Sabic ... spreading its wings

Sabic ... spreading its wings

SAUDI Basic Industries Corporation (Sabic), one of the world’s largest petrochemicals groups and the Gulf’s largest listed company, is studying potential mega projects in Saudi Arabia, North America and China, including those involving shale gas in North America.

“We are talking with a number of potential partners in the US for investment in shale gas as the cost of shale gas is reasonable compared to oil or alternative materials like coal or solar power,” says Sabic CEO Mohamed Al Mady.

Sabic also has several domestic projects under construction, including a synthetic rubber plant at its Kemya joint venture that would come on line in two to three years. Al Mady says the company is finding it difficult to grow within Saudi Arabia because of a shortage of natural gas.

“The shortage of gas and many sectors competing for it have made internal expansion very hard,” Al Mady says.

Sabic, which makes petrochemicals, metals and fertilisers, relies heavily on natural gas as a raw material for its chemical business, and is facing increased competition from the US where a shale gas boom has made new and cheap supplies available.

Sabic had announced earlier this year that it has approached several US firms to invest in the US shale gas industry. The company is also considering building a single-phase oil-to-chemicals complex in Yanbu, Saudi Arabia at an estimated cost of $30 billion.

Meanwhile, Sabic’s third-quarter net profit fell 4.5 per cent, missing most analysts” forecasts, as sales of petrochemical products slowed.

The company reported net income for the three months ended September 30 of SR6.18 billion ($1.65 billion), down from SR6.47 billion a year earlier. Riyadh-based NCB Capital had expected Sabic to post a net profit of SR6.58 billion, while analysts at Cairo-based EFG-Hermes had pencilled in a SR6.75 billion result.

The petrochemicals giant, which is 70 per cent state-owned, attributed the decline in profit to “lower quantities sold.”

Al Mady linked the drop in profit to a slowing global economy, noting that Europe is still in recovery mode, while China is underperforming slightly. “Considering all these circumstances, the company’s results are good,” he says.

Sabic’s disappointing quarter comes after Germany’s BASF, the world’s largest chemicals company, lowered its outlook for 2015 and reported a 4.8 per cent decline in third-quarter profit.

Sabic’s revenue for the third quarter declined slightly to SR48.071 billion from SR48.8 billion for the same quarter last year, Sabic’s chief financial officer Mutlaq H Almorished says.

|

Al Mady ... new strategies in place |

“Sabic is growing its business in China, looking for investment in China and Chinese companies. We just have to compete like everybody else,” Al Mady says. “We cannot take the China market for granted. We have to build our capability and strength in that market.”

However, the recent drop in the global oil prices would pick up soon and the increasing global population would increase the demand for oil, he says.

He says Sabic’s investments were not affected by the decline in oil prices since they have been planned for a set period of 20 years. “We always do a feasibility study before embarking on major investment projects,” he says, adding that its investments in China will bring the company good returns.

“We are currently looking for more investment opportunities in Chinese companies,” he notes.

“The impact of the declining oil prices on the petrochemical industry is not quite clear. In general it will reduce the prices of the naphtha and LPG, which are used as raw materials for the petrochemical industry.

“It will have a beneficial effect on the competition among users of naphtha and propane gas,” he says, pointing out that it will not have beneficial effect on countries and companies that use fixed gas prices.

Al Mady says, a national taskforce empowered to unite private and public sector initiatives is needed to drive further downstream diversification of the Saudi economy.

He says there needs to be a step change in the country’s approach to downstream based on the Royal Commission model that drove the development of the petrochemical industry. He points to the need for many initiatives required to drive further downstream development, including improved infrastructure, free-trade zones to support investment inflows and government investment in early training of employees.

“These imperatives cannot be achieved if every company, every industry, every ministry, is following its own agenda, no matter how well-meaning the agenda may be,” says Al Mady. “Downstream diversification extends beyond the interests of a single industry. It requires a coordinated and consolidated approach from business, from government, from the ministries and from entrepreneurial enterprise. The wisdom of past experience can better equip us for the future.”

Al Mady observes that past experience in downstream diversification provides a model for the future. He pointed to the growth of the petrochemical industry in just four decades from a standing start to a world-class pillar of the economy worth $354 billion as evidence for the success of the model.

Sabic was established in 1976 as part of the first phase of Saudi Arabia’s economic diversification into primary downstream industries including petrochemicals, fertilisers and steel. The vision of taking the natural gas that was the waste product of the oil industry and turning it into commercially viable products drove the foundation of the Royal Commission and the establishment of the industrial cities in Jubail and Yanbu. This in turn led to the Royal Decree that founded Sabic and drove its growth over the next four decades.

Growth in the petrochemical industry continues to outstrip the economy as a whole, averaging 9-10 per cent over past years against GDP growth of 4-5 per cent. The industry has also been the catalyst for growth in other areas of the economy, including banking, construction and insurance.

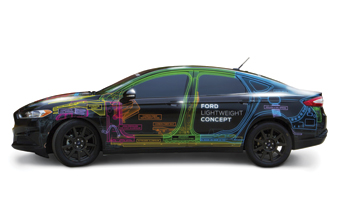

Al Mady highlights that Sabic continues to play a role as a key enabler in the next, more complex phase of downstream diversification. Sabic participated with Saudi Aramco and the Public Investment Fund to begin the establishment of the Industrial Investment Company to attract resources into the maritime, automotive, power, water and electrical equipment sectors.

|

Sabic’s technology centre |

Sabic has also expanded its own operations into performance chemicals and engineering thermoplastics and made significant additions to its global innovation network, including the opening of the Sabic Plastic Applications Development Centre in Riyadh’s Techno Valley at the end of last year.

These initiatives are specifically focused on building downstream opportunities in key industries including automotive, construction, consumer electronics and packaging.

This year will see construction commence on Sabic’s Home of Innovation, a focal point for customer collaboration and a showcase to help attract downstream technology partners. Sabic will also continue its investment in training and development and support of its SME customers.

“Business and government are each doing their part. But I do not believe we can go much further within the limits of the current structure,” says Al Mady. “Now is the time for a bold initiative to drive us toward the success we all believe is possible.”

Sabic’s strategic initiatives and increasing demand for petrochemicals could provide opportunities growth opportunities. However, increasing competition may hamper its performance if it fails to maintain product quality and consumer loyalty.

Sabic has a wide range of businesses, which helps the company cater to the diverse needs of its consumer base and generate higher revenue. Sabic is one of the world’s market leaders in the production of polyethylene, polypropylene and advanced thermoplastics, glycols, methanol, and fertilisers. It is also one of the largest producers of steel in the Middle East.

The company divides its products into four categories namely, chemicals, fertilisers, metals and plastics. The company manufactures and sells basic chemicals, intermediates, polymers and speciality chemicals.

These products are used in pharmaceuticals, cosmetics, clothing, paints and packaging, and textile industries. It also manufactures polyvinylchloride (PVC) and polyester used in a wide variety of consumer, commercial and industrial products. Its fertiliser products include prilled and granular urea, ammonia and phosphate.

Sabic is one of the largest manufacturers of steel in the Middle East and Africa. It manufactures flat steel and long steel products. It also manufactures high-quality metals used in construction industries. Thus, a broad portfolio helps the company diversify the business risks associated with a particular market.

The company’s Technology and Innovation (T&I) division works with strategic business units to improve the manufacturing processes and develop new technologies. The company has T&I facilities across the world. Sabic focuses on the development of new patents and certifications. It has a total of 17 Technology & Innovation facilities in Saudi Arabia, the US, the Netherlands, Spain, Japan, China, India and South Korea, backed by more than 8,000 patents.

Sabic, in collaboration with universities, international research centers and other partners from public and private sectors, works together to develop its research capacities to launch new products using advanced technology.

Sabic currently has research relationships with some of the leading universities such as Cambridge University in the UK, the Dalian Institute of Chemical Physics in China, ETH Zurich in Switzerland, the National Research Council in Italy and the Fraunhofer-Gesellschaft in Germany.

In Asia, Sabic has three Technology and Innovation facilities and recently, the company opened new state-of-the-art technology and innovation facilities in China and India.

Sabic’s business operations are well diversified across different geographical markets. The company managed to minimise the risks arising out of operating in a specific geographical region by spreading its business across the world.

The company’s global network comprises sales offices, storage and distribution facilities. Sabic markets its products in over 45 countries and operates 60 world-class manufacturing and compounding facilities, with 22 in the Middle East, 9 in Asia, 12 in Europe and 17 in the Americas. Its regional operations help in the coordination of the company’s global activities.

The company is headquartered in Riyadh and its key facilities are in Saudi Arabia. Sabic’s network of offices and companies is spread throughout the Middle East and Africa, which includes the United Arab Emirates, Egypt, Lebanon and Turkey.

Its offices in Asia are in Indonesia, Singapore, the Philippines, Vietnam, China, Hong Kong, Taiwan, South Korea and Japan. The company’s Innovative Plastic division operates across 35 countries worldwide. It operates six technology centers in Riyadh, Bangalore, Baroda, Jubail, Houston, and Geleen, and one for engineering thermoplastics. The wide geographical presence allows the company to serve various growing global markets.

The company could capitalise on its operational presence in major markets. The increasing demand for steel and steel products will enable the company to record substantial growth. The growth in demand for steel follows the high demand forecast in developing economies. The World Steel Association (WSA) expects the outcome of government stimulation packages, stabilisation in the financial systems and return of some consumer confidence to have a positive impact on demand for steel.

According to industry estimates, the world stainless steel market is expected to reach 35 million tonnes (mt) by 2014 and 45 mt by 2020. China is expected to be the major player in the market, followed by Europe, India, the US, and Japan. In China, flat product and long product markets are expected to reach 8.5 mt and 2.5 mt respectively in 2014.