Adwea … integrated operational network

Adwea … integrated operational network

ABU Dhabi Water and Electricity Authority (Adwea) is a government authority that monitors and manage the electricity and water infrastructure in Abu Dhabi, UAE. The authority is responsible for ensuring supply of electricity and water to the people in its operating region. Adwea maintains a strong position in the UAE electricity and water market and is supported by its network of subsidiaries. Strong growth prospects in the domestic electricity and water market could further help the authority to improve its electricity and water infrastructure to meet the rising demand, says GlobalData in a SWOT analysis of the company.

STRENGTHS

Operational structure: Adwea operates through several subsidiaries that carry out power and water production, transmission and distribution. It operates through a network of subsidiaries and each subsidiary supports Adwea’s operations. Its main operating companies include Al Mirfa Power Authority (AMPC); Abu Dhabi Water & Electricity Company (Adwec); Abu Dhabi Transmission and Dispatch Authority (Transco); Abu Dhabi Distribution Authority (ADDC); and Al Ain Distribution Authority (AADC). AMPC, a public joint stock company, operates two plants, Al Mirfa Power & Distillation Plant and Madinat Zayed Power Plant. Such integrated operational network enables the authority to streamline its operations.

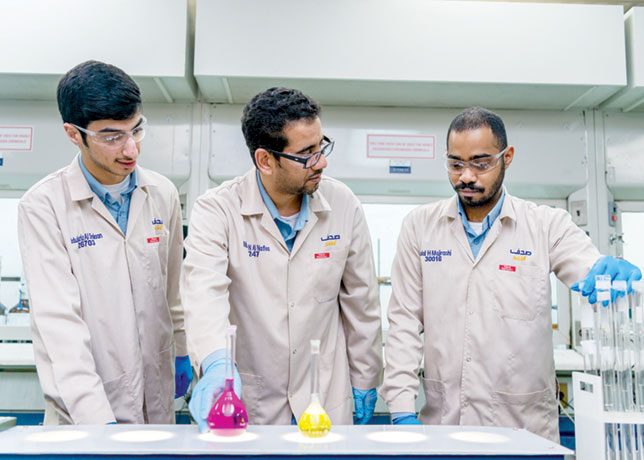

Research and Development (R&D) focus: Adwea undertakes several research and development activities. The authority operates through the National Water and Energy Research Centre (NWERC), which conducts several research activities related to electricity and water sectors and develops innovative technologies. Such focus on R&D activities enables Adwea to improve and enhance infrastructure, efficiency and enhance its revenue.

Strong market position: Adwea is one of the largest providers of desalinated water and electricity in the UAE. As of October 2012, the authority owned 51 per cent share in the Abu Dhabi National Energy Authority (Taqa) that provides more than 95 per cent of electricity and water in Abu Dhabi Emirate. Besides, its subsidiary Adwec is the single purchaser and seller of electricity and water in the Emirate of Abu Dhabi. According to in house research, Adwea has a share of 47.6 per cent in the country’s total installed capacity. Such leading position and strong customer base enable the authority to generate higher revenue.

WEAKNESSES

Lack of fuel diversity: Adwea utilises thermal sources as the major source of its electricity generation, particularly natural gas. The authority generates a substantial portion of power from natural gas as primary fuel. Thermal fuel sources such as coal, natural gas and oil are costlier than non-conventional sources of energy such as nuclear, wind, solar and hydro. Delay in the supply of the fuel could impact the power generation capacity of the authority. It could focus on clean fuel sources for power generation so that dependence on gas can be minimised. The authority should focus on reducing its dependence on a single fuel source and develop projects that use clean fuel sources for power generation so that dependence on natural gas could be minimised.

OPPORTUNITIES

Growth in water and power projects investment: According to the authority’s sources, The Middle East and North Africa (Mena) is expected to witness strong investments in the power and water sector. The power sector including generation, transmission and distribution across the region is expected to be worth $283 billion by 2018. In the GCC, power generating capacity is expected to rise by an estimated 64,000 MW to 176,500 MW by 2020 with an investment of $40-45 billion. The authority could benefit from the positive outlook in the sector.

Positive outlook for renewable sources: According to the International Renewable Energy Agency (Irena), regional investment surpassed $2.9 billion in 2012, reflecting an increase of 40 per cent from 2011 and 650 per cent from 2004. With over 100 projects under development, the region could witness a 450 per cent increase in non-hydro renewable energy generating capacity in the next few years. The authority could look to diversify its fuel sources in light of positive outlook of the renewable energy sector.

THREATS

Operational issues: Adwea operates numerous power generation, transmission and distribution assets, including power plants, transmission lines, substations and others. The operations of the authority are subject to interruptions due to breakdown or failure of equipment, transmission lines, substations, major accidents or damage caused by severe weather conditions or natural disasters. With the ageing of power assets, the authority would require huge capital expenditure to maintain them. Any breakdown or failure of such operating facilities could prevent the authority from fulfilling its power sales agreements on time.

Volatility in electricity prices: The prices of electricity are subject to huge fluctuations in the utility industry. Further, adequacy of generating reserve margins, scheduled and unscheduled outages of generating facilities, availability of stream flows for water desalination, price and availability of fuel for generating plants, and disruption of constraints on transmission facilities are some of the reasons for price volatility. The fluctuations in the electricity prices could increase the cost of operation, thereby affecting the authority’s financial performance.

Political unrest in the Middle East: The recent political unrest in various Middle Eastern countries could affect the business operations of the company. Due to the tense political situation in the region, some government projects could be delayed; however, other projects are moving forward with adequate financing.