LNG supplies will boost Bahrain’s economy

LNG supplies will boost Bahrain’s economy

The project is being developed to supplement local gas production in Bahrain and ensure capacity to meet peak seasonal gas demand and industrial growth

Bahrain LNG WLL, the developer and owner of the first LNG receiving and regasification terminal in the Middle East developed on a PPP basis, has completed limited recourse financing for the project. Bahrain LNG WLL is jointly owned by the Oil and Gas Holding Company (nogaholding) and a consortium consisting of Teekay LNG Partners L.P. (Teekay LNG), Gulf Investment Corporation (GIC) and Samsung C&T (Samsung). Financing a project of this size and complexity is a landmark in the regional financial markets.

The project was awarded to the Teekay LNG-GIC-Samsung consortium in December 2015 by the National Oil & Gas Authority (Noga) of Bahrain following an international competitive tendering process. The project is being developed to supplement local gas production in Bahrain and ensure capacity to meet peak seasonal gas demand and industrial growth. It will also enable Bahrain to procure internationally-traded LNG on a competitive basis.

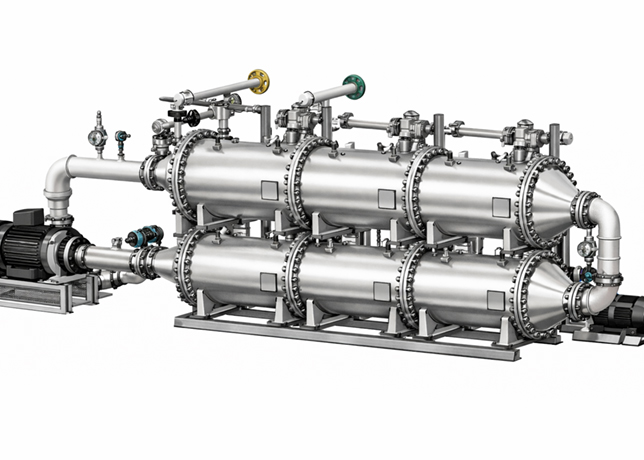

The project will have a capacity of 800 million standard cubic feet per day and will be owned and, once completed in early 2019, operated under a twenty-year agreement. It will comprise a Floating Storage Unit (FSU), an offshore LNG receiving jetty and breakwater, an adjacent regasification platform, subsea gas pipelines from the platform to shore, an onshore gas receiving facility, and an onshore nitrogen production facility.

The EPC contract was awarded to GS Engineering & Construction. Teekay LNG will supply the FSU which will be modified specifically for this project, through a twenty (20) year time-charter agreement.

A syndicate of nine international and regional banks is participating in the USD 741 million loan which has a tenor of 20 years, Korea Trade Insurance Corporation (K-SURE) provided commercial and political risk cover for approximately 80 per cent of the financing. Standard Chartered Bank, Arab Petroleum Investments Corporation (APICORP), and the Korea Development Bank acted as pathfinder banks.

The banking syndicate includes APICORP, Standard Chartered Bank DIFC, Korea Development Bank, Ahli United Bank B.S.C., Banco Santander S.A., Crédit Agricole Corporate and Investment Bank, ING Bank, Natixis, and Société Générale.

His Excellency Shaikh Mohamed bin Khalifa Al-Khalifa, Minister of Oil, commented: "The Bahrain LNG Import Terminal is a key component of our plans for the further expansion of the energy and related sectors of the Kingdom of Bahrain.

The achievement of financial close is a critical milestone in the continued development of the Bahrain LNG Import Terminal Project and we congratulate the sponsors, their supporting lenders and K-SURE on their achievement after many months of sustained effort."

Dr Dafer Al Jalahma, Chief Executive of nogaholding commented: "It is encouraging to see the successful closing of the financing for the project, and for the strong support shown by lenders and K-SURE that resulted in the attractive terms achieved. I commend the nogaholding team for its sustained effort to achieve this result."

Mark Kremin, President and CEO of Teekay LNG Group commented: "Achieving financial close is an important milestone for the project and we congratulate the project teams on this great achievement."