Holt (left) and Lightbody ... metering allows exact monitoring of oil and gas wells

Holt (left) and Lightbody ... metering allows exact monitoring of oil and gas wells

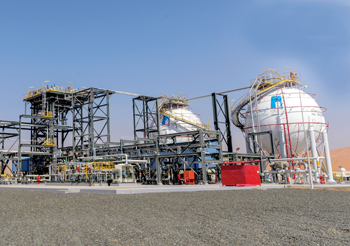

James Holt, GM, and Colin Lightbody, Technology Manager, Proserv Measurement reveal that ageing, unreliable kit can hit revenues and a metering system essentially equates to a “cash register”

No matter what area a business operates in, improving the bottom line is the one guaranteed way of enabling it to flourish.

In oil and gas, with its dependency on economic predictions and the day-to-day pricing of hydrocarbons, running a tight operation and maximising profitability is essential.

Nothing encompasses that more than fiscal metering, as James Holt, GM, Proserv Measurement explains: “Metering effectively allows operators to monitor exactly how much oil or gas they are producing from their wells 24/7. In a custody transfer, or financial transaction, both buyer and seller need to know the exact quantities agreed to are being delivered.”

Holt adds that a metering system essentially equates to a “cash register” and any slippage in the accuracy of the readings could see a seller either oversupplying the customer, thus giving away millions of dollars of oil for free, or even short-changing the client, risking subsequent legal action and reputational implications.

Colin Lightbody, Technology Manager, Proserv Measurement suggests the simplest way for an operator to ensure their fiscal metering equipment remains accurate is to prioritise its maintenance:

“Whatever the fiscal flow meter reading indicates, that’s what a customer will get billed on. So, the reliability of that piece of kit is vital to safeguarding the integrity of all transfers.”

Proserv is headquartered in the UK but it has an extensive network of facilities across the Middle East, including in the UAE and Saudi Arabia. Lightbody has seen that across the Arabian Peninsula, like elsewhere in the world, ageing measurement equipment, and the risks attached to it becoming obsolete, is a growing problem.

When key components fail, operators are left with a significant issue. “After a time, flow meters will inevitably become obsolete and they are crucial pieces of equipment. If the manufacturer can no longer support them, or provide spare parts, the operator’s metering capability and visibility will just collapse once a meter finally breaks down.”

James Holt implies outmoded flow-metering equipment could even be a differentiator in agreeing a deal. “Customers want to know that their supplier has traceable, certified metering equipment that is fully maintained. In other words, they have the best available kit, maintained to the best available standards. That provides the trust required.”

Holt believes operators should turn to specialists, like Proserv, who not only install metering solutions but can also manage “the whole lifecycle of the system” for the client, including phasing in new upgrades. This would create the reassurance needed to prevent equipment from becoming obsolete.

Colin Lightbody compares trusting in obsolete metering equipment to maintaining an ageing car: “Regular maintenance might help to keep that car on the road for several extra years but the older it gets, the harder it will be to source and repair a vital part when it finally breaks.

“If an operator’s obsolete flow meters break down on a large field in the Middle East with its multiple partners, there is a contractual obligation to maintain production. The operator cannot just stop pumping for several weeks to find a new metering solution, as the extended supply chain is expecting that oil or gas.”

Lightbody reveals an operator would have little choice but to trust in the measurements of third parties, including its customers. “In a time of increased efficiencies and maximised returns, this represents a disaster. The operator would simply not know how much oil or gas it is producing or how much is being transferred from A to B.

“Millions of dollars of revenue could be lost due to a lack of regular maintenance and an effective strategy.”