Shaybah ... production capacity boosted

Shaybah ... production capacity boosted

Aramco remains focused on maximising long-term value creation from the kingdom’s hydrocarbon resources while making tactical adjustments to meet the challenges of the market downturn, aiming to lower costs and improve performance

Saudi Aramco creates maximum value from the kingdom’s resources by reinforcing the company’s pre-eminent position in exploration and production, replacing produced oil, increasing gas reserves, and growing oil and gas production while optimising costs. In 2016, Aramco achieved a new record for crude oil production, averaging 10.5 million barrels per day (mbpd). Its current output stands at 9.8 mbpd. Aramco also produced a record level of sales gas, averaging 8.3 billion standard cubic feet per day (bscfd).

On their own, the kingdom’s hydrocarbon reserves represent potential energy. The transformation of potential into opportunity requires the best people, practices, and technology — attributes that underlie the company’s aim to become the world’s leading integrated energy and chemicals company, says the company in its Annual Review 2016.

For more than eight decades, Aramco has prudently managed Saudi Arabia’s oil and gas reserves to maximise their long-term value, and to enable the growth of economies around the world. Petroleum is the original wellspring of Saudi Arabia’s prosperity, and the foundation of its continued growth. The company’s drive to create more value from the resource base is powered by the expertise and ingenuity of the company’s people, the company’s relentless focus on best-in-class practices, operational efficiency, the use of innovative technologies, and research into the sustainable use of hydrocarbons.

Together, these capabilities further diversify the economy and launch new business opportunities for oil field service providers, suppliers, manufacturers, and technology developers.

At year-end 2016, the company’s recoverable crude oil and condensate reserves stood at 260.8 billion barrels. Gas reserves grew to 298.7 trillion standard cubic feet (tscf). In 2016, Aramco discovered two new oil fields, Jubah, 300 kilometres (km) north of Dammam, and Sahaban, 280 km south of Dammam, and one new gas field, Hadidah, 470 km south of Dammam. At year-end, the company’s total number of fields was regrouped to 130 fields. This number reflects the grouping of some areas as subdivisions of larger fields, where these areas are parts of continuous geological structures.

Aramco continued progress in the company’s unconventional gas programme. It completed wells in northern Saudi Arabia to help meet the company’s commitment to deliver 55 mmscfd of gas by year-end 2017 to industrial and electrical power facilities in the Wa’ad Al Shamal industrial city project. In addition, Aramco completed wells in South Ghawar and the Jafurah Basin.

The company’s ongoing success in adding gas reserves — especially nonassociated gas — provides the domestic economy with additional and cleaner potential energy, and supplies of fuel and feedstock that can be harnessed for greater opportunity.

OIL PRODUCTION

The company’s investments in upstream, from exploration to production and processing, are designed to maintain its supply flexibility and world leading production capacity, enabling its role in stabilising oil supplies in the future. Aramco maintained its spare oil production capacity by optimising the mix of crude oil grades from a balanced portfolio of mature and young reservoirs.

In 2016, Aramco successfully executed a demanding drilling and workover schedule and made significant progress on the following major projects:

|

Khurais ... more wells being drilled |

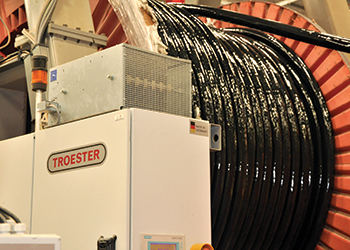

• The company’s second 250,000 bpd expansion project at Shaybah, located in the Rub’ Al Khali or Empty Quarter, came onstream, raising its overall production capacity to 1 mbpd of Arabian Extra Light crude oil — double the facility’s original capacity; and

• Aramco continued drilling wells to increase the production capacity of its Khurais field, located 150 km southeast of Riyadh, by 300,000 bpd to raise current capacity from 1.2 mbpd to 1.5 mbpd by mid-2018.

Aramco continuously optimises its crude oil mix, guided by its outlook and assessment of future performance. To maximise long-term value, optimise costs, and advance recovery rates, Aramco completed technical assessments for producing fields, integrating subsurface computational models with surface facility networks to identify and exploit beneficial synergies.

GAS PROCESSING

Growing supplies of cleaner burning natural gas helps reduce domestic reliance on liquid fuels for power generation, enabling increased liquids exports, and provides feedstock to petrochemical industries, spurring regional development, job creation, and demand. In 2016, Aramco achieved an all-time high for total raw gas processing of 12 bscfd. Other highlights from 2016 include:

• The facilities for the company’s grassroots Midyan Gas Plant in the Tabuk region of northwestern Saudi Arabia reached 97 per cent completion;

• Aramco started up a second NGL processing train at Shaybah;

• The company’s Wasit Gas Plant, located north of Jubail Industrial City, reached its full operational feed capacity of 2.5 bscfd;

• To feed Wasit, Aramco brought gas production onstream from the big bore nonassociated gas wells in its offshore Arabiyah and Hasbah fields, situated approximately 150 km northeast of Jubail Industrial City in the Arabian Gulf. The Hasbah field features some of the world’s most prolific gas production platforms. With the startup of production from these two fields, more than 40 per cent of its nonassociated gas now comes from offshore fields. The plant will supply nonassociated gas and condensate to the Saudi Electricity Company’s new power plant in Duba in the kingdom’s northwest, generating opportunities for economic growth in the region; and

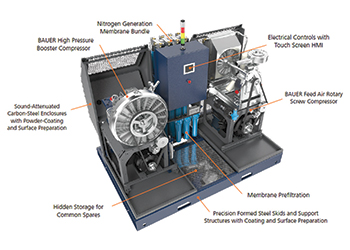

• Aramco commenced construction of its grassroots Fadhili Gas Plant, located 30 km west of Jubail Industrial City, in late 2016. The facility is emblematic of its broader impact on not only increasing supplies of gas, but also driving economic growth, developing the Saudi workforce, and reducing emissions.

Designed to process 2.5 bscfd and deliver 1.7 bscfd of sales gas to the Master Gas System, Fadhili will be its first plant to treat nonassociated gas from both onshore and offshore fields. In another first, the plant was designed from inception to use the Tail Gas Treatment process to reach the maximum sulphur recovery rate of 99.9 per cent, helping protect air quality. The project’s value extends well beyond the resources it will process. The development of Fadhili will add billions of dollars to the local economy, with an expectation that 40 per cent of the plant’s materials and services to be sourced and manufactured in Saudi Arabia. It will be the first to have the capability to use low Btu gas to fuel an independent power plant, yet switch to sales gas as needed. This flexibility enables it to generate electricity from lower value gas and maximise supplies into the Master Gas System.

Aramco’s significant investments in new gas processing capacity help meet Saudi Arabia’s demand for energy, reduce the use of liquids for electricity generation, and enable opportunities in energy consuming industries such as steel, aluminium, and other downstream value-added sectors.

OPTIMISING PERFORMANCE

Aramco made substantial achievements in drilling through a number of programmes and initiatives. They include cost optimisation initiatives which saw the oil major negotiating lower costs for rigs, materials, and services. Aramco also introduced a programme to recondition equipment and materials.

.jpg)