Zamil Offshore ... increasing its competitive edge

Zamil Offshore ... increasing its competitive edge

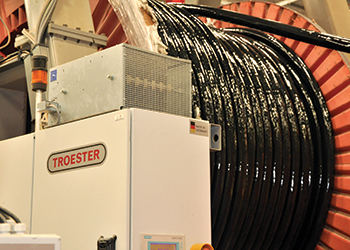

The company is also considering venturing into new offshore services by investing in cable lay/pipe lay vessels and is looking for alternative uses for its offshore vessels in offshore towage, marine salvage and rescue and environmental protection

Zamil Offshore, the largest offshore and marine services provider in the Middle East, is focusing on increasing the efficiency and reducing the operational costs of its vessels without compromising on the quality of its services, at a time when the offshore supply vessel (OSV) sector in reeling under the onslaught of lower oil prices.

The company is also considering venturing into new offshore services by investing in cable lay/pipe lay vessels and is looking for alternative uses for its offshore vessels in offshore towage, marine salvage and rescue and coastal and sea environmental protection services.

"The sagging international price of crude oil has affected our operations especially in the offshore vessels chartering segment. Many world players especially from South East Asia have come to our region to compete with us in the Aramco long-term chartering tenders," says Hassan Abouraya, Zamil Offshore’s consultant engineer, Business Development/International Marketing & Risk Management Executive.

Average OSV chartering rates globally have dropped significantly since last year and the big players in the Middle East – Saudi Arabia, UAE and Qatar – succeeded in damping the region’s day rates. Aramco as well as the other regional oil producing companies are continuously re-negotiating all of the existing offshore vessel chartering contracts.

However, demand in the Middle East OSV market is expected to remain positive, driven by Saudi Arabia, UAE and Qatar, although the sector remains prone to excessive tonnage, he says.

Abouraya points out that despite the bleak scenario optimism has returned to the market with the Middle East emerging as a potential growth area for OSV work driven by Aramco and Adnoc requirements. The total OSVs working in the Arabian Gulf has slightly increased. Sanctions against Iran have been eased and owners are looking to move their older tonnage into that market, he says.

Anticipating market change is crucial, nobody could predict when the global oil prices will stabilise especially with the return of Iran, Iraq and Libya to the oil export market, says Abouraya.

"We are currently facing fierce competition from a number of international offshore companies deploying their vessels in our region we have already lost some chartering opportunities to some of them and are struggling to keep all our vessels employed," he explains.

ZAMIL SHIPYARDS

Referring to Zamil’s shipbuilding and ship and rig repair business, Abouraya says in response to competition in the segment, the company has started implementing a diversification strategy. It has started preparing its new facility for life cycle support of defence and security vessels for local and regional customers. "Our new Dammam shipyard is reasonably loaded with diversified repair jobs," he says.

|

Abouraya ... focus on efficiency |

"Currently, we do not have any new building orders. Our eastern shipyards are concentrating on rig repairs and ship repair and to increase the competitive advantage of our shipyards we are capitalising on building the Saudi Maritime Cluster for onsite licensed repair centres at our Dammam and Jeddah shipyards. We now have agreements in place with MTU and Sparrow, and others are under negotiation. As to the newly launched business unit in cooperation with MTU announced last year it resulted in a sudden increase in the revenue to almost $3.4 million," he says.

As to rig repairs, Zamil Shipyards now is considered the repairer of choice for Rowan rigs. The company’s Dammam shipyard has completed significate repairs for Rowan rigs including Middle town, Bob Keller, Hank Boswell and Scooter Year-gain.

Currently, Rig Scooter-Year-gain is still in the shipyard and Rig Hi Island IV has just arrived; most of the jobs onboard Hi Island IV are blasting and painting work and piping systems modification and renovation.

Since the Red Sea offshore developments are on hold at present due to the oil price, Zamil’s Jeddah shipyard is concentrating on providing services for merchant vessels at the Red sea. It is currently loaded with merchant vessels’ repair, the average number of vessels repaired during 2015 and 2016 was 56 vessels per year using the yard’s two floating docks and along its two jetties. As to the first half of 2017, the total number of repaired vessels so far accounts for 35 vessels, mostly for local owners.

ZAMIL MARINE

The OSV chartering market is still struggling under the heavy oversupply of vessels. OSV’s chartering rates are still at rock-bottom, the day rates in the region still tend to be low with no signs of market firming, says Abouraya.

"Being the largest Saudi private sector company in the offshore business we are committed to serving Saudi Aramco’s requirements and at the same time we started implementing regional diversification. At present we have one vessel operating in the spot market in Sharjah, UAE.

Like most of the OSV big players we have a few laid up OSVs; they are kept fit for upturn and currently our Zamil Marine is negotiating the chartering of all its laid up vessels to a big Italian Offshore company working in the GCC region in one go, at the same time we have acquired 6 OSVs with high specs under chartering/re-chartering contracts for some jobs for Aramco," he continues.

Both Saudi Aramco and Adnoc have announced significant capital investment plans recently. Presumably, this is good news both for the new construction and repair business. Aramco issued a $1-billion EPCI tender for the 6th phase redevelopment of Safaniya, which is considered the world’s largest offshore oilfield with reserves estimated at 37 billion barrels.

ZAMIL OFFSHORE CONSTRUCTION

"Our Zamil Offshore Construction subsidiary has recently acquired a brand new, self-propelled – self elevated lift boat (Design: SE-200LB) Zamil LB2 which was under construction and ready for delivery at the Chinese Guangxin Shipbuilding & Heavy Industries Co Ltd. Now we are planning to load it onboard a heavy lift vessel to transport it to Dammam Port during the second half of August.

The new lift boat has four 91.5 m cylindrical legs, accommodation for 150 men, heli-deck, 200-tonne main crane and 20-tonne auxiliary crane. Its length overall is 84.6 m including the helideck with a beam of 38.0 m, 3.05 m draft and its speed is 6 knots. ABS Class Notation *A1, Self-Elevating Unit*AMS-NP CRC".

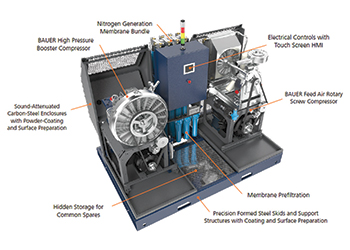

Abouraya admits that Zamil is concerned about more capacity being created by the new joint venture mega integrated maritime yard to be built by Saudi Aramco, Bahri, HHI and Lamprell. The mega yard will be constructed inside the new industrial port of Ras Al-Khair on the Arabian Gulf and will be the largest in the region in terms of production capacity and scale.

The new mega yard will cost around $5.2 billion to build, of which roughly $3.5 billion will be funded by the Saudi government. The rest will be funded by the joint venture members. The mega yard will enable building of three to four offshore rigs and 40 vessels of different sizes, including a few super-tankers per year. It will also provide maintenance services for rigs and vessels. The first phase will be in operation by 2019.

.jpg)