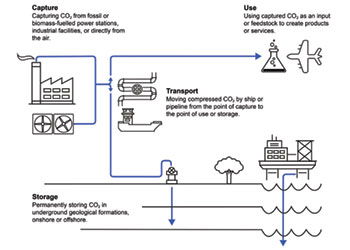

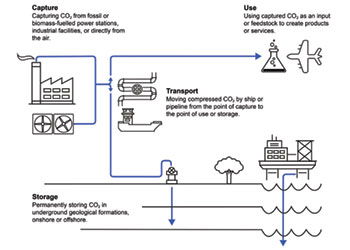

Figure 1 ... how CCUS works

Figure 1 ... how CCUS works

The industry has expanded drastically over the past 50 years, however, deployment and current capture rates have been behind expectations and insufficient to achieve net-zero emissions, writes Candice Gao from DBRS Morningstar

After carbon dioxide (CO2) emissions reached a record high in 2022, carbon capture, utilisation, and storage (CCUS)–which can play a role toward the goal of net-zero carbon emissions–is gaining significant attention, both positive and negative, across the globe.

CCUS refers to the technologies that attempt to process these emissions and decarbonise power generation or industrial processes by capturing emitted carbon (at the emission point) and then transporting and storing it underground (Figure 1).

According to the International Energy Agency (IEA), there are currently 40 facilities globally deploying CCUS on a commercial scale, capturing and storing 45 million tons per year.

'We expect this number to continue growing, given the urgency to reduce greenhouse gas emissions and combat global warming. However, several challenges and barriers must be addressed in order for this technology to scale up,' Candice Gao, Senior Analyst at DBRS Morningstar said.

CCUS DEPLOYMENT BEHIND EXPECTATIONS

The CCUS industry has evolved and expanded drastically over the past 50 years. After decades of development, this technology has reached a mature stage, where it has been deployed in an array of sectors, including natural gas, ethanol, and ammonia.

Bloomberg New Energy Finance (BNEF) forecasts that the market will continue to grow at a compound annual growth rate of 20 per cent.

However, CCUS’ deployment and current capture rates have been behind expectations and insufficient to achieve net-zero emissions. Investment, government funding, and policy incentives must ramp up in order to increase its effectiveness.

MAJOR BARRIERS & POTENTIAL SOLUTIONS

• High capital costs: From a financial perspective, the capital-intensive nature of this technology limits its deployment to a certain degree, as CCUS is often an added overhead for companies.

Capture costs vary depending on the industries, systems, and concentration of CO2 in the emission sources.

|

Annual CO2 emissions worldwide from 1940 to 2022 (in billion metric tons) |

The cost of capture per ton of CO2 for low-concentration industrial sources with 5 per cent to 15 per cent CO2 concentration, including cement, hydrogen, and steel, ranges between $67 and $85, excluding transportation and storage fees.

High-concentration emission streams where CO2 makes up 50 per cent to 90 per cent of the emissions, such as ethanol and ammonia, are typically cheaper to capture.

For example, BNEF estimates that carbon capture from ethanol processing, which is the most expensive of the three primary high-concentration sources of carbon capture, costs almost $38.60 per ton of captured CO2 based on a reference average-size 50 million gallon (MGal) ethanol plant in the US.

Capital expenditures (capex), which are for retrofitting facilities, constitute nearly half of this ongoing cost and correspond to almost $27 million in upfront costs.

The second-highest cost comes from fixed operating expenses (opex), which represent approximately 30 per cent.

The cost composition suggests that higher capture and utilisation rates can reduce costs per ton of CO2 substantially and enhance its economic viability by achieving economics of scale.

• Lack of transport/storage infrastructure and emergence of CCUS hubs: Carbon storage facilities and pipelines to transport CO2 are essential infrastructure for CCUS, and are also expensive and risky to develop.

For some small-scale carbon capture plants, lack of access to transport and storage infrastructure poses another challenge.

One solution is CCUS hubs (also known as CCUS networks), where companies cluster together and share the equipment and pipelines needed to move CO2 to storage sites from capture plants.

CCUS hubs are on the rise and projected to make up one third of global capture capacity by 2030 because of the benefits they provide.

Firstly, such hubs will likely reduce the levelised costs of pipeline transport when the network becomes more efficient. Secondly, on top of reducing costs, hubs can achieve better outcomes, including higher utilisation rates, and are more accessible to government funding.

Lastly, they should enable low-capacity plants to access the shared transport and storage infrastructure with greater ease.

Although there are no CCUS hubs in operations yet as of today, a number of projects have reached the final investment decision stage, and we expect more on the way in Europe and North America given the upsides of hubs.

For instance, ExxonMobil, along with 13 other companies, has proposed to facilitate the Houston Ship Channel carbon capture and storage infrastructure project.

Once completed, this hub can effectively capture and store up to 100 million metric tons of CO2 per year by 2040, according to ExxonMobil.

• Low capture rate and evolving technology: Another concerning issue that hinders the development of CCUS is the subpar capture rate. While the CO2 capture rates vary among recent CCUS projects, some implemented projects achieved only 45 per cent—far below the typical 90 per cent baseline target—because of technical challenges and operational difficulties. It’s overly expensive for CCUS efficiency to exceed 95 per cent.

However, ongoing research and efforts put into boosting efficiency, evolving technology such as new systems and designs can likely improve the performance of CCUS at a reasonable and affordable price.

UNTESTED TECHNOLOGY HEIGHTENS CREDIT RISK

With rising demand to develop CCUS, more investments are expected in the private sector and more financing activities of such projects.

According to Gao, CCUS projects can fall under the Global Methodology for Rating Project Finance.

'We generally view long-term contracts with creditworthy offtakers enabling stable revenue streams as credit positive. However, given the technology is relatively new and untested without an established track record or proven reliability, we find the technology risk is currently high and, if not mitigated through means such as technology supplier underwriting, potentially credit negative.'

Furthermore, government subsidies and regulatory policies may or may not remain supportive in the long run, bringing additional uncertainty.

Notwithstanding, CCUS cost and operational efficiencies enabled through CCUS hubs will help to mitigate and share the major risks in project development and potentially reduce costs to a point where projects become financeable.

FAVOURABLE POLICY INCENTIVES

With new Environmental Protection Agency (EPA) rules set forth to regulate greenhouse gas emissions from the power sector, BNEF estimates there will be added capacity in CCUS of around 1.05 billion metric tons of CO2.

Many government policies are also concurrently driving CCUS’ future development as a way to decarbonise.

For instance, the US Inflation Reduction Act includes an enhanced tax credit under Section 45Q of the Internal Revenue Code, which can provide an extra revenue stream as opposed to an added cost.

The UK government has also committed GBP1 billion ($1.21 billion) government funding in support of CCUS hubs. Overall, government funding and the regulatory frameworks encourage investment in CCUS and facilitate its long-term growth.

Overall, we believe that CCUS could help reduce CO2 emissions despite limited examples of CCUS projects at present.

However, renewable power generation facilities, including solar and wind, will continue to be the mainstream method to decarbonisation, with CCUS serving as a supplement.

Accordingly, CCUS is expected to have minimal credit impacts on the renewables portfolio currently rated.