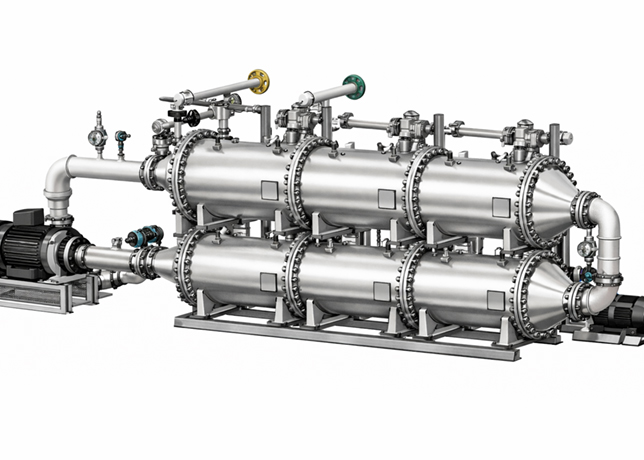

Sadara’s Aromatics plant

Sadara’s Aromatics plant

Sadara, the multi-billion-dollar joint venture of Saudi Aramco and DowDupont, is primarily focused on the growth markets of Africa and Asia. However, its unique location allows it to tap into the established markets in Europe and the Americas, Sadara CEO Dr FAISAL AL-FAQEER tells K S SREEKUMAR

Sadara is well positioned to capture the upside value in the growing speciality market, but this value can also be maximised at the GDP level if it is integrated with downstream manufacturing that will ensure that finished products are produced locally by a well-trained national workforce, says its CEO Dr Faisal Al-Faqeer.

"Sadara knows that our competition never rests. However, we firmly believe that the chemical industry has plenty of room for growth, and we plan to be a significant part of that growth," Dr Al-Faqeer tells OGN in an exclusive interview.

Sadara’s competitive advantage starts with two global leaders in their respective industries as shareholders, Saudi Aramco and DowDupont, who bring globally leading energy and chemistry technologies together, he explains.

"In addition to the strength of Sadara’s shareholders, we enjoy a secure supply of domestically sourced feedstock, state-of-the-art technologies and a workforce that was trained in shareholder facilities around the world. Additionally, our central location in the heart of the Mena region – which itself is growing at a healthy GDP rate with a growing middle class – is one of our most notable success factors. Last but not least are our people.

"Sadara is a team of can-do industry experts from around the world that have built this company from an idea to a fully functioning, world-class enterprise in five years, and that strong company culture will see us succeed as we move from the project phase to operations," says Dr Al-Faqeer, who has to his credit years of experience in the oil and gas industry, having led different functions within Saudi Aramco including engineering consulting services, research and development and refining. He was most recently the general manager for Saudi Aramco’s Ras Tanura refinery, the largest refinery in the Middle East.

Excerpts from the interview:

After assuming charge as the CEO of a fully-operational Sadara Chemical Company, what are the key challenges that lie before you?

The dream that was Sadara became a reality in September of 2017, when our 26th and final manufacturing facility was brought on line and produced commercial quantities of toluene di isocyanate (TDI).

|

Dr Al-Faqeer ... Sadara is a team of ‘can-do’ industry experts from around the world |

However, this was just the beginning for us as a company! We remain focused on ensuring that our facilities are run safely and at optimum levels, producing commercial products that are sold in Saudi Arabia and indeed all over the world. For this reason, we are also now focusing more of our efforts on the Sales & Marketing aspect of our business, building strong relationships with our customers throughout the Middle East Zone.

Additionally, given Sadara’s adoption of cutting-edge technologies, our need for specialised skill sets remains a key focus. We began to address this need with the launch in 2013 of one of the most aggressive, technology-based on-the-job training (OJT) programmes by any Saudi corporation. Our Human Capital Development team has continued to develop new development programmes, following the success of the OJT programme, by exploring new options for ensuring our most important resource – our employees – receive the necessary training and development opportunities to grow themselves professionally and serve Sadara in the best possible way.

What are some of the over 3 million metric tonnes of performance-focused products that will add new value chains to the kingdom’s vast petroleum reserves?

Sadara has 26 world-scale manufacturing facilities, of which 14 are producing chemicals never before produced in Saudi Arabia. This is achieved by using best-in-class technologies to crack not only gas feedstock – ethane – but also liquid feedstock – naphtha – to create a differentiated slate of high-value added plastics and chemical products.

These new value chains include products that will enable local manufacturers in Saudi Arabia to manufacture what is only currently available through import. In the polyethylene envelope, for example, Sadara is able to bring to the market speciality grades of linear low-density polyethylene (LLDPE) and Solution Elastomers, enabling a wide range of speciality end-use plastic films, containers, artificial turf and fabrics. Additionally, in the liquid chemicals envelope, Sadara is able to produce such new products as amines, propylene glycol, butyl glycol ethers, TDI, PMDI and polyols, which will enable the paints and coatings, personal care products, foam and moldings industries, among others, to flourish in kingdom.

As many of the products in the Sadara portfolio have never been produced in the kingdom before, their local introduction will not only reduce the country’s reliance on imports, but will also establish a competitive platform to enable the development of a strong downstream manufacturing industry within Saudi Arabia.

What are the success factors that make Sadara a ‘game changer’ in the chemical industry?

Sadara’s competitive advantage starts with two global leaders in their respective industries as shareholders, Saudi Aramco and DowDupont, who bring globally leading energy and chemistry technologies together. In addition to the strength of Sadara’s shareholders, we enjoy a secure supply of domestically sourced feedstock, state-of-the-art technologies and a workforce that was trained in shareholder facilities around the world. Additionally, our central location in the heart of the Mena region – which itself is growing at a healthy GDP rate with a growing middle class – is one of our most notable success factors. Last but not least are our people. Sadara is a team of can-do industry experts from around the world that have built this company from an idea to a fully functioning, world-class enterprise in five years, and that strong company culture will see us succeed as we move from the project phase to operations.

|

Sadara has 26 world-scale manufacturing facilities |

Which will be the target markets for Sadara’s products? How much annual revenue is the fully-operational Sadara expected to make?

Sadara is primarily focused on the growth markets of Africa and Asia. However, our unique location allows us to tap into the established markets in Europe and the Americas.

With that said, we are also very focused on growing the local downstream manufacturing market. To realise the most benefit from the new value chains Sadara is introducing, we have been collaborating with the Royal Commission for Jubail and Yanbu (RCJY) to attract local, regional and international investors to PlasChem Park, a unique initiative that will help accelerate the drive to create more value downstream.

We have come a long way in creating one of the most attractive industrial parks for small and medium sized enterprises (SME’s). To promote downstream business manufacturing investment, we continue to collaborate with many government and industrial organisations such as the Ministry of Energy Industry and Mineral Resources, Saudi Industrial Development Fund (SIDF), SME Authority and RCJY among others. We believe that there is untapped potential in downstream manufacturing for SME’s in Saudi Arabia within a multitude of different industries. These opportunities include oil and gas, chemicals, construction materials, home and personal care products among others. Further developing these industries will help create additional value along the value chain, and will help create GDP multipliers for the Saudi economy.

With the region currently contributing only 2.5 per cent of the $4 trillion global chemicals market and less than 2 per cent of the $1.16 trillion speciality chemicals market, do you see more sophisticated petrochemical ventures coming up here? How will that affect Sadara?

Less than 1 per cent of the chemicals produced in the GCC region are considered speciality chemicals, with the remainder falling into the commodities category. Furthermore, most of the products that have a growing demand in the region – due to steady growth of the region’s middle class – are products based on speciality chemicals. This means that Sadara is well positioned to capture the upside value in the growing speciality market, but this value can also be maximised at the GDP level if it is integrated with downstream manufacturing that will ensure that finished products are produced locally by a well-trained national workforce. Sadara knows that our competition never rests. However, we firmly believe that the chemical industry has plenty of room for growth, and we plan to be a significant part of that growth.

|

Sadara’s Mixed Feed Cracker |

What are the strategies that would help the region create more enduring wealth for chemicals?

The current global environment is forcing consolidation within the chemicals industry, driving more integration and collaboration among the players in areas that are not competitive by nature. This will subsequently allow more value to be captured by all participants. Sadara has already adopted this mentality and is working with a variety of partners to realise better value for all involved, including Wa’ed, a wholly owned Saudi Aramco subsidiary focused on the promotion of entrepreneurship in kingdom; Dhahran Techno-Valley, a major undertaking by King Fahd University of Petroleum and Minerals to drive the development of a knowledge-based economy in Saudi Arabia; and Sanabil Investments, a Saudi Government-owned direct investment fund aimed at developing industrial-focused projects in the kingdom.

Petrochemical has been identified by both the National Transformation Program (NTP) 2020 and Vision 2030 as one of the sectors to lead the push away from fossil fuel reliance. What role does Sadara have to play to achieve the goal?

Saudi Arabia’s long-term economic prosperity depends on industrial and commercial diversification, particularly the move downstream from hydrocarbon raw materials toward intermediate and final products that can be marketed throughout the kingdom and exported to emerging and other markets around the world.

The move downstream comes in the context of Saudi Arabia’s Vision 2030 and its National Transformation Plan, which promote the long-term diversification of the Saudi economy beyond oil. As Khalid Al-Falih, Saudi Minister of Energy, Industry and Mineral Resources, told an international audience in July 2016, "The economic transformation as well as the diversification of economic activities are two things of utmost importance for the success of nations in the future, especially those that rely on limited resources in their economy."

This is where Sadara comes into the picture. Sadara uses new feedstock and brings new technologies and other first-time processes to the region in a highly integrated manufacturing complex that is the largest ever built in the world in a single phase. It will produce a differentiated slate of plastics and chemical products. Leveraging on the unparalleled strengths of its two parents.

The result? Sadara is uniquely positioned to contribute to the move downstream by Saudi Arabia and its economic diversification. It will create brand-new value chains downstream and help transform the industrial landscape of the kingdom and the wider Gulf region.

The next decade is expected to see a large increase in global petrochemical capacity. The shale gas boom has given cheap and abundant feedstock supply to US producers, whilst China has developed technology which utilises coal in its petrochemical supply chain. How do you plan to deal with the increased competition from US and China?

Sadara is located in the heart of the Mena region in the middle of at least 400 million people with economies growing between 3 per cent to 4 per cent annually. Sadara is well positioned to serve these markets with the products that are in high demand by the growing middle class in these economies. This location advantage can only be positive to Sadara despite the global market challenges.

Sadara has made its initial foray into the Middle Eastern isocyanates market, with cargoes of polymeric methylene di phenyl di isocyanate (PMDI). Besides China and the local market which other markets will you be targeting?

In addition to the Middle East Zone, which Sadara markets to directly, Sadara is seeing strong demand for its products in Asia and Europe, which are marketed by DowDupont.

Sadara remains committed to growing the kingdom’s downstream manufacturing capabilities, to support the continued growth of the local GDP, as well as the Middle East’s manufacturing capabilities, helping to turn them into export, rather than import, economies.

Will the foray into the local market be substantial so as to aid in import substitution and bring down its prices?

As the local downstream manufacturing industry develops, the kingdom will see a definite benefit, as its reliance on imports will be reduced. We firmly believe that Sadara’s logistics advantage will vastly improve security of supply to our customers and will be accretive to their bottom line. PlasChem Park is a testament to this view.

It is developed over a 12-square kilometre piece of land, two times the size of the Sadara Chemical Complex, with a platform for major investments and small projects. Thus far, a number of deals have been executed for investments with a capital of around $500 million, with some other deals valued in the $30 million range. These projects, and many others, are driven by the kingdom’s drive to attract high value manufacturing projects which will contribute positively to GDP growth with skilled employment opportunities and import substitution.

Sadara is reported to have sent out some sample cargoes of toluene di-isocyanate (TDI) to customers in Saudi Arabia for testing. When will you start the full commercial sales of TDI?

In addition to samples, commercial sales of TDI have already occurred. Sadara is targeting 2018 as the year when the market will be able to enjoy the full Sadara product offering.

What is your target for investments in the PlasChem Park?

PlasChem Park is a collaborative effort between Sadara and the Royal Commission. It is located on a 12-square kilometre parcel of land that is being developed to host a multitude of different investments, in different sectors, that will be selected based on the value they bring to Sadara and the kingdom.

There is no specific target in terms of number of projects or project value, as that will be determined by local and regional demand. Sadara’s vision is to bring the best investors with the highest value creation to our economy. Thus far, we have two opportunities in downstream applications that are up and running and at least three of our investors in the pipeline will break ground in PlasChem by the third or fourth quarter next year.

Thus far, we have executed long term deals with Halliburton and Surfactant Detergent Company (SDC) and are in the processes of concluding other EO and PO deals. We have also recently signed a supply agreement with a local Saudi company to utilise some of our value chains to manufacture a wide range of final, market-ready products, such as hydrocarbon resin, isoprene, aromatic solvents and more.

Additionally, we have signed a Memorandum of Understanding with a Bahrain-based chemical recycling company to build a facility that will focus on upgrading some of our low value by-products to higher value molecules, which will add additional value to the kingdom and enhance Sadara’s environmental footprint.