Takahashi ... supporting customers use big data analytics

Takahashi ... supporting customers use big data analytics

Full industrial automation is not only an imperative shift simply waiting to happen, it's in harmony with the ongoing development of digital technologies and the customer readiness to adopt them, say Yokogawa's Muraleedharan Nellikkayil and Hirofumi Takahashi

Last year, Yokogawa commissioned a global survey, the findings of which revealed an increase in interest and investment in industrial autonomy (IA) over the next three years in key process industries, including oil and gas, pharmaceuticals, chemicals, petrochemicals, and power generation.

Abdulaziz Khattak of OGN sat down with two senior company executives — Muraleedharan Nellikkayil, Senior Executive Vice-President, Industrial Automation and Process Solutions Business; and Hirofumi Takahashi, General Manager, Process Solutions Business, Digital Enterprise Business Division — to learn in-depth how industries are adopting automation and what awaits in the realm of IA.

|

Nellikkayil ... industrial autonomy builds on automation |

Can you explain the difference between industrial autonomy and automation? And which of the two is Yokogawa striving for?

Nellikkayil: The difference is the way it is expressed. Industrial autonomy is the endgame, where everything is connected: machines, process, and people, and where it can encompass and collect all information that helps in the final decision making. But automation is the baseline, and unless you have a good automation system, you cannot build the layers on top. This is currently where the industrial world stands right now. But that’s not enough. You cannot just be an isolated production plant; you need a well-connected supply chain mechanism, better safety, and operational excellence to drive towards a better society. And this is where autonomous solutions come in.

Automation is Yokogawa’s key strength. It is us, who coined the term: IA2IA (Industrial Automation to Industrial Autonomy), and we are now moving towards industrial autonomy. It is also where the world is moving towards. And furthermore, we see the technologies enabling that as well.

Takahashi: The automation layer was established in the 1970s when we developed the Distributed Control System (DCS). With time that expanded to include the automation of certain manual jobs done by operators. An example is the Modular Procedural Automation (MPA). However, the linking of these automated procedures still requires human knowledge and intervention. In the autonomous world, human intervention for decision making can partly be replaced with technologies such as Artificial Intelligence (AI) and Machine Learning (ML).

Despite the large number of companies aiming for full autonomous operations by 2030 (64 per cent according to the survey), is the industry really ready?

Nellikkayil: It is a journey that must happen. Different industries respond in different ways, depending on their objectives, and with some better equipped than the others. In the Middle East, for example, the oil and gas industry wants to become autonomous for several reasons: workers’ safety, not exposing workers to harsh environments in offshore locations, optimizing the number of people in operations, getting machines to do repetitive jobs, etc.

The survey shows that 30 per cent of companies today have some form of semi-autonomous operations. But 64 per cent say they would have full autonomous operations (Level 5) by 2030. Whether that happens is yet to be seen. But everyone is moving in that direction.

Takahashi: From a technology standpoint, not only are digitalisation technologies continuously being developed, there is customer readiness to utilise these as well. However, there are two perspectives to this readiness: Greenfield projects customers have a good opportunity from the onset to design their projects as digitalisation-ready and have the liberty to consider all options. But brownfield projects customers need to be selective about the choice of technologies they need to apply into their existing sites, or they could also enhance the digitalisation technologies to be adopted into such an existing facility.

How receptive is the region’s oil and gas industry to automation and/or IA?

Nellikkayil: Since Yokogawa is more in tune with the oil and gas industry, we can see major companies making efforts to do that transition, including the leading oil companies.

One of the major oil companies in this region, for example, has multiple assets — from oil production to refinery and gas plants — and it has the ability to get information across these assets to help in better decision making.

Separately, another company approached us to prepare a blueprint for achieving full autonomy for a decades-old oil field. And while a target was to reduce workforce at the field by 50 per cent, a key objective was to optimise many internal processes to run the plant remotely and improve overall plant efficiency.

Similarly, another company in the region has ambitions for industrial autonomy. Yokogawa is already underway with a project, which includes building a command centre in their headquarters connecting to all their assets across the country (around 100 of them). The objective is to seat all experts in one central location to monitor and control those assets rather than having people placed in each of these locations.

In the refinery segment too, many recently built refineries have adopted technology. This will enable them to move into the autonomous stage, which is already in the first design stage.

How will you allay concerns related to cybersecurity and other safety issues in facilities?

Nellikkayil: In 2012, a major hacking incident affected more than 30,000 computers on the corporate network of a national oil company and caused a panic, raising questions of what could happen if such an incident occurred again. This pushed the need for tighter cybersecurity since until that time companies hadn’t thought much about it. Our survey found 51 per cent companies planning significant investment in cybersecurity over the next three years.

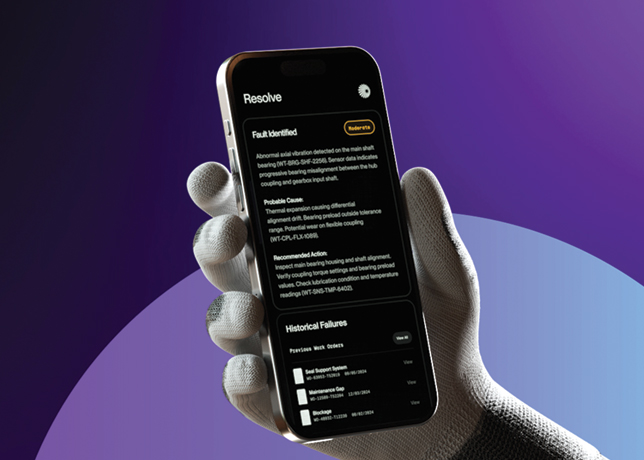

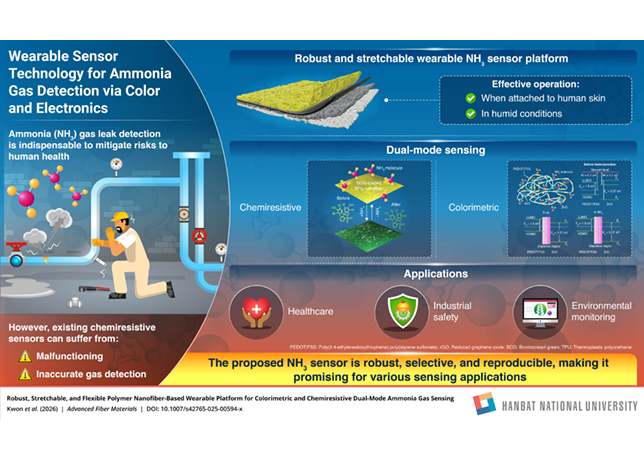

Takahashi: When it comes to safety, our customers have implemented the safety instrumentation system, which allows the plant to be shut down in a safe manner in case something goes wrong. Additionally, we are working on building in the safety logic into the MPA to allow computers to detect problems. Furthermore, there is the use of AI. Plants are now producing a lot of data, which is difficult for humans to analyse, and AI technology analyses this data to predict critical equipment failure.

What was the most alarming as well as promising finding in the survey?

Takahashi: The alarming finding for me was only 22 per cent companies saying optimising staffing levels was one of their top four priorities. It seems very few customers are seeing the importance of investing in humans. And even though companies are transforming from automated to (semi) autonomous, human supervision would still be required because they are still far away from full autonomous operations. And so, I feel more investment needs to be made in human resource.

Nellikkayil: A perplexing finding for me was Europe’s reluctance to invest in new technologies and the push to industrial autonomy. Some 56 per cent companies in Western Europe felt they would attain full autonomous operations in 10 years' time, much lesser than 71 per cent of companies in the Asia-Pacific region. This is surprising since IR4.0 is the brainchild of Germany.

Takahashi: What was very promising in the report was companies wanting to improve the working environment for workers; around 34 per cent said they would invest in worker safety.

Nellikkayil: It is also promising from a Yokogawa point of view to find many Middle East customers have priorities like safety, remote operation, cybersecurity, digital twin technology, because these are some of Yokogawa’s key strengths and thus allows us to be part of the customer's growth journey.

The survey shows Covid-19 to accelerate investment in IA. What is your perspective on this?

Nellikkayil: Covid-19 has acted as a catalyst and has compelled customers to think more about adopting technologies for IA. When the pandemic initially struck, everyone thought it would soon pass; however, it’s still here. So, everyone was forced to rethink their lifestyle and thus ensued social distancing, remote working, etc. We too think plants should become more autonomous. This will help make people’s lives safer by not exposing them to harsh environments.

Takahashi: The Covid-19 situation has not only changed our lives, but also the way people work in the plants. For example, some customers said pre Covid-19 the shift supervisor, who usually works in the control room, could also go out to the field to see the actual situation. However, now neither is he allowed to go out nor is the field operator allowed to come into the control room. So the day to day information exchange, which happened before is not happening anymore. Such situations can be addressed through remote monitoring using smart helmets, with cameras on them. And we are seeing new demands based on the new driver.

What are some of Yokogawa’s recent technologies for the oil and gas industry?

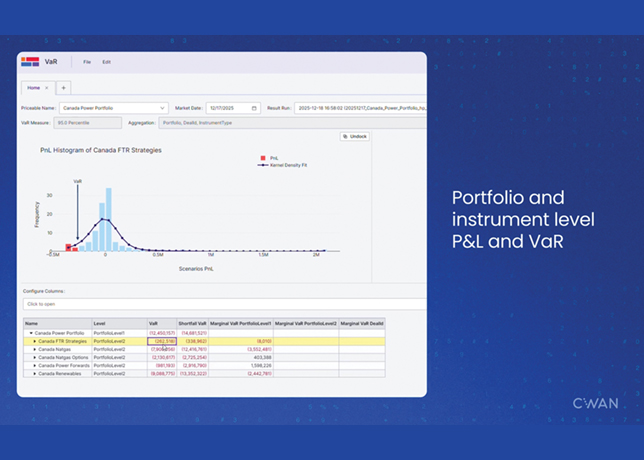

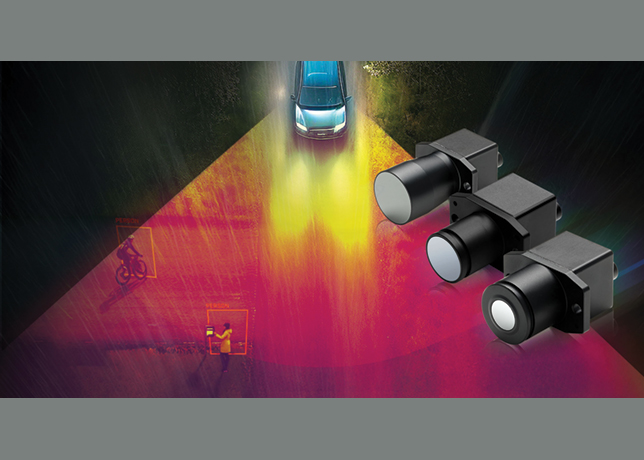

Takahashi: From a technology point of view, we are supporting customers use big data analytics together with AI and machine learning; robotics for operation in harsh environment; and IIoT sensors for field data collection.

Additionally, our Plant Resource Manager (PRM) is a key information source to collect data from the field. Meanwhile MPA captures senior operators’ knowledge into the digitalised standard operating procedures (SOPs) so that the younger generation can learn and execute certain procedures in a safe and effective manner.

Nellikkayil: Takahashi’s point of capturing the knowledge trapped in the heads of the older people is very important from the localisation perspective. Countries want more local engineers into the mainstream, while these young men and women need the knowledge in a form they can easily understand. The MPA allows them to learn through simulation technology using actual field scenarios. Yokogawa is working very closely with these countries to get more local engineers.

What IA targets have you set in the region?

Nellikkayil: Service opportunity and solution provider are two key targets we have in terms of growth. Yokogawa has traditionally been an automation company offering cutting edge innovative solutions. But today we need to add more value and work with customers to achieve bigger objectives such as operational excellence, workers’ safety, reducing emissions, etc.

Our target now is switching from a products seller to a service-based business model where we see a big opportunity. We can help customers through their transformation journey and stay with them throughout the plants’ entire lifecycle.

Takahashi: To support these two objectives, Yokogawa has been working to enrich its solutions portfolio. Previously, it was mainly for industrial automation systems focusing on the control layer. However, to support digital transformation, we are enriching the portfolio from Level 2 to Level 4, including the systems integration across this vertical.

To obtain such technologies and capabilities, we have been aggressively collaborating with existing companies. One of the achievements in this regard is the acquisition of KBC Advanced Technologies. This company has the consultation knowledge and key technologies for energy optimisation as well as process simulation, which could be utilised for digital twins thus helping customers’ transformation.

Brief us on Yokogawa’s three goals for achieving sustainability: achieve net-zero emissions; ensure well-being; and make transition to a circular economy.

Nellikkayil: The corporate philosophy of Yokogawa is to contribute to a sustainable society. Three years back, we outlined a strategic plan called TF 2020 taking these three goals based on the United Nations’ Sustainable Development Goals (SDGs).

These goals are measured at Yokogawa’s global headquarters in Tokyo. We continuously monitor them against the performance of the previous year. There is a dedicated person focusing on our SDGs initiative.

To help customers reduce emissions, Yokogawa offers several technologies. Our analytical technologies are called continuous emission monitoring system (CEMS). Meanwhile the Tunable Diode Laser Spectrometers (TDLS) technology can measure CO2 very close to the furnace. This reduces the amount of carbon going into the stack and flaring up. With our optimisation plan, we recapture and reuse the carbon within the process itself.

Yokogawa helps local engineers get inducted into the mainstream, with women empowerment being a key area of focus. In Saudi Arabia, we have more than 50 female engineers today in our office.

Takahashi: Adding to Nellikkayil’s comment, we recently got the license for an energy saving company (ESCO) in Saudi Arabia. This allows us to offer consultation to our customers on energy consumption as well implementing Digital Energy Management Solutions (D-EMS) using our existing technologies and, therefore, contribute to our customers heading towards net zero emissions.

In other countries, we are working with customers for energy optimisation, furnace optimisation, etc.

To ensure wellbeing, we can support to move humans from harsh and hazardous environments to safer work locations by adopting the robotics technologies.

And in terms of circular economy, our products and solutions are contributing to our customers reducing waste in terms of energy and water. In other countries, our system is helping convert wastewater into industrial water.