KPC ... momentous changes taking place

KPC ... momentous changes taking place

Significant investment has also gone into expanding Kuwait’s downstream operations. This includes the upgrade and expansion of the country’s two existing refineries, Mina Al Ahmadi and Mina Abdullah, as part of the $13 billion Clean Fuels Project

As Kuwait continues to invest heavily in both upstream and downstream production, there are reports that the Kuwait Petroleum Corporation (KPC), the country’s national oil company, was reassessing its capital investment plans, announced in 2018 and worth an estimated $500 billion over the years up to 2040.

The plans called for $114 billion in capital expenditure in the first five years, with an additional $394 billion up to 2040, which would have helped the country meet some of its ambitious long-term targets.

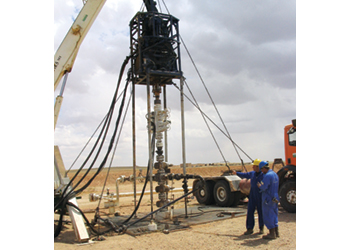

Among other things, Kuwait has been targeting the production of 85,000 bpd of heavy oil by 2021, and is investing in developing its reservoirs of dense crude. KPC has long had plans to develop the northern oil fields, Rutga and Umm Nigha, which produce heavy oil as well as condensate.

Major investments by Kuwait, both upstream and downstream, will continue, however. The country also remains committed to expanding its foothold in overseas production and refining.

|

Al-Fadhel ... focus on gas |

Meanwhile, it was also reported that KPC and its subsidiaries may undergo a restructuring that will see the companies amalgamate under three divisions – upstream, downstream and marketing.

Both international and domestic upstream entities will operate under Kuwait Oil Co (KOC), all of the downstream entities will join Kuwait National Petroleum Co (KNPC), and marketing will operate under a third arm, sources say.

KPC has numerous subsidiaries including Kuwait Petroleum International (KPI), KPC’s international downstream arm; Kuwait Oil Tanker Co.; Kuwait Gulf Oil Co.; Kuwait Foreign Petroleum Exploration Co. (Kufpec); Kuwait Aviation Fueling Co.; and Kuwait Petroleum Europe.

The process is awaiting approval from KPC’s board and the country’s top oil and gas decision-making body, the Supreme Petroleum Council, which will likely take until the end of the year, one source says. The restructuring process is very likely to be approved, another industry source commented.

KPC has been deliberating certain restructuring strategies for some time, but plans had cooled down by the end of last year.

Since then, however, there have been several shake-ups in Kuwait’s oil sector, which has seen the oil minister replaced and several new executives resign and new ones appointed, including for the position of CEO at KPC. That post is now headed by Hashem Sayyed Hashem, who in the past held the position of CEO at KOC.

Additionally, Emad Sultan has taken over from Jamal Jaafar as CEO of KOC. In another move, Waleed Al-Badr, former head of KPC Marketing, was appointed as head of Kuwaiti downstream behemoth KNPC.

Minister of Oil and Minister of Electricity and Water Khaled Al-Fadhel says that Kuwait will reach its highest rate of natural gas production in 2031/2032, estimated at 3.5 billion standard cubic feet per day day (bscfd).

The remarks were made by CEO of Kuwait Petroleum Corporation (KPC) Hashim Al-Hashim, on behalf of minister Al-Fadhel, during the 27th Annual Conference of the Gas Processing Association-GCC Chapter held in Kuwait.

He added that the future outlook for the rich gas development will be exposed to a great expansion in the near future when north Kuwait Jurassic fields will be fully operational by the year of 2023/2024, bringing Kuwait’s rich gas production up to 3 bscfd.

Meanwhile, KPC executed measures to facilitate expansion in production and achieving sustainable developments, including launching its promising 2040 strategy for the upstream exploration and downstream refining sector, Al-Hashim says.

|

Al-Hashim ... LNG will be the major source of fuel |

He notes that natural gas has always been a major factor of Kuwait’s economy as Kuwait has a long history of natural gas exploration and processing that goes back to the year of 1979 where Kuwait’s first gas processing complex was commissioned at Mina Al-Ahmadi refinery-KNPC. In line with KPC strategic plan to meet the long-term fuel requirements for Kuwait’s growing energy demand, liquefied natural gas (LNG) import will predominantly be the major source of fuel in Kuwait where Kuwait’s giant LNG terminal project is coming in the year of 2022 at Al-Zour, he says.

The $2.9 billion project will consist of eight full containment tanks with a net capacity of 225,000 cu m and a max send out rate of 3,000 bbtu per day, he adds.

LNG is "energy and environment in harmony", and for that reason, it was chosen to be Kuwait’s major domestic fuel source for its economic feasibility as well as environmental friendly impact, says the CEO.

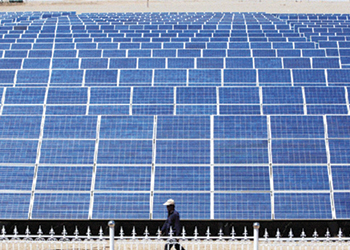

Kuwait expects to meet 15 per cent of its local energy needs through renewable sources by 2030.

KNPC CEO Waleed Al-Bader says that the fifth Gas train is expected to be commissioned at the end of 2019 that will boost KNPC’s Gas processing nameplate capacity to 3.1 bscfd (billion standard cubic feet per day).

At his speech during the opening of the 27th Annual Conference of the Gas Processing Association-GCC, Al-Bader says, the aim of Ethane Recovery plant in 2008 is to supply the downstream petrochemical industry with the required ethane feed.

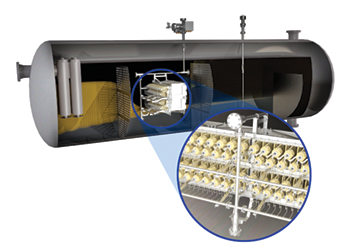

KNPC has commissioned its fourth top of the art Cryogenic gas processing complex in 2015 with a capacity of 805 mmscfd of gas, he added.

KNPC has a bright long history in the development of gas industry in Kuwait, which started in 1979. KNPC has been and continues to be the sole Gas Processing sector in the nation of Kuwait under the umbrella of Kuwait Petroleum Corporation (KPC), Al-Bader indicates.

Development of Kuwait Gas processing industry has continued in KNPC over the years by synchronisation with the upstream gas exploration works, to bring to light many significant and strategic gas treatment and processing facilities such as Acid Gas removal unit in the year of 2000 to treat Kuwait sour Gas.

"Our outlook for rich gas processing based on KPC 2040 strategy where KNPC plays a significant role in its development representing the downstream sector," he says.

KNPC’s vision through the downstream 2040 strategy is to be a world-class refiner through superior operating performance by adding value to Kuwait’s hydrocarbon and meeting domestic as well as international market demand with the highest products quality possible.

The domestic refining 2040 strategy objectives are to enabling higher gas production. KNPC is continuously developing and investing in its gas processing complex to meet the expected increase in Kuwait Gas production till 2040, which will require additional gas processing and treatment facilities to be built in the future such as a new LPG train and AGRP revamp project and operating KNPC Facilities to the highest operational standards.

In August 2018, Kuwait Foreign Petroleum Exploration Company (Kufpec), which is part of KPC, borrowed $1.1 billion to invest in oil and natural gas projects, specifically targeting shale operations. Kufpec aims to produce 150,000 bpd by 2020, up from 100,000 in 2018, with operations currently in Australia, Norway and Canada.

In November it was reported that state-owned Kuwait Oil Company had placed orders worth $1.3 billion for drilling rigs, the largest order in the company’s history. Kuwait is also looking to increase its natural gas output to about 100 million cubic metres a day over the next decade and a half, up from 54 million cubic metres today.

One issue that could strongly affect overall oil production is the neutral zone, where Kuwait and Saudi Arabia have joint control over the onshore Wafra and offshore Khafji fields. Production was halted at the Khafji field in October 2014, while Wafra was shut down under instructions from Saudi Arabia in May 2015. Combined, the fields have a capacity of 500,000 bpd. Talks about restarting operations have been on and off since production was first halted, and in October 2018 Saudi Arabia’s crown prince, Mohammed Bin Salman, said the two parties were getting close to striking a deal.

Analysts, however, believe that a renewal of production in the neutral zone is not imminent. Significant investment in recent years has also gone into expanding Kuwait’s downstream operations. This includes the upgrade and expansion of the country’s two existing refineries, Mina Al Ahmadi and Mina Abdullah, as part of the $13 billion Clean Fuels Project, which was launched in 2014 and is nearing completion. The two refineries are being integrated into a single complex, with a strong focus on higher value products such as diesel.

Meanwhile, the Al-Zour oil refinery, which will be among the world’s largest, is more than 80 per cent complete and expected to be operational by 2021. Combined, these projects will increase Kuwait’s total refining capacity to 1.4 mbpd.

In November 2018 Kuwait National Petroleum Company (KNPC) unveiled plans to invest $25 billion in new downstream projects over the next 20 years, which would ultimately bring Kuwait’s total refining capacity to 2 mbpd by 2035, with KNPC currently undergoing a feasibility study for the construction of a new refining complex.

Kuwait’s $27 billion (KWD8.2 billion) Al-Zour crude complex’s oil refinery is divided into three projects, a refinery, liquefied natural gas (LNG) processing facilities, and a petrochemicals complex, according to a statement by Kuwait Integrated Petroleum Industries Co (Kipic), a subsidiary of Kuwait Petroleum Corporation.

The $16 billion (KWD4.8 billion) oil refinery is expected to deliver 615,000 barrels per day. Construction listings website ProTenders cites Canadian contractor SNC-Lavalin as Al-Zour oil refinery’s testing and commissioning consultant, whilst Van Oord and Saud Abdulaziz Alrashed & Brothers Company are named dredging contractors for the project.

The FDH joint venture that includes America’s Fluor, and South Korea’s Daewoo Engineering and Construction and Hyundai Heavy Industries, is Kipic’s engineering, procurement, and construction contractor for the oil refinery’s Packages 2 and 3. In a project listing on its website, Fluor says it is delivering work on lump-sum basis for the oil refinery.

Fluor booked its $2.6 billion portion of the contract in Q3 2015.