Khadir (left )and Gamble

Khadir (left )and Gamble

Downstream companies are more likely to have seen taxable supplies outweigh purchases, resulting in a payment position. However, the zero-rating provisions will obviously limit the total output tax payable

Having possibly already been through the process in the UAE and Saudi Arabia, most readers lodged their first Bahrain VAT returns on or before April 30, 2019 and are now recovering from what was presumably a stressful and frantic few days leading to the lodgement.

Oil and gas companies with taxable operations in Bahrain, like their counterparts in other industries and other GCC countries, will have found themselves in either a payment or a refund position, depending on their location in the supply chain, write two experts from Keypoint, one of the GCC’s most comprehensive professional business services providers.

Upstream companies in the exploration or drilling stages with significant taxable supplies in Bahrain are unlikely to have reported any transactions in the sales side of the VAT return but could have had numerous acquisitions (with many subject to VAT) to report, resulting in a refund payable by Bahrain’s tax authority, the National Bureau for Revenue (NBR), say Mubeen Khadir and Mark Gamble. Khadir is the head of Keypoint’s tax practice and Gamble is a senior manager in the tax practice.

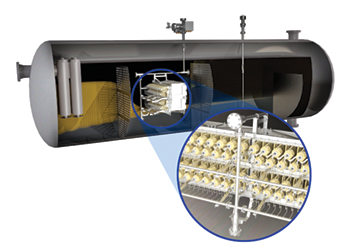

Downstream companies are more likely to have seen taxable supplies outweigh purchases, resulting in a payment position, however, the zero-rating provisions will obviously limit the total output tax payable.

Given this was the first ever return for both the NBR and many Bahrain-based oil and gas businesses, it is also expected that many Bahrain purchases were made before VAT was implemented on January 1, 2019 (therefore with no VAT) and that it may take a few months for the input tax to filter through to the return.

WHAT NOW?

What you do now depends on your liability. Where a taxpayer is required to pay the NBR, generally the risk rating is low but there are steps taxpayers can take to solidify their position. Where money is owed by the NBR, taxpayers should expect that the revenue authority may want to conduct a review before paying out.

IN A PAYABLE POSITION

If you are in a payable position and paid your liability by April 30, congratulations! Although VAT is going to have an impact on your business (including cash flow), you have (at least in theory) successfully cleared the most immediate hurdle.

You can gain comfort that you are likely to be at the lower end of the spectrum for audit risk. However, just being in a payable position does not guarantee that you have calculated your VAT liability correctly and the NBR is well within their rights to review your VAT return (and to do so at any time over the next five years).

It could therefore be strategically advantageous to review the VAT return preparation process to ensure compliance. Conducting a review now means that any errors identified that results in a tax shortfall of less than BD5,000 can be corrected in the next return. Moving forward, organisations should also start to focus on VAT optimisation, moving from simply seeing VAT as a drag on ‘business as usual’ to a potential source of competitive advantage.

IN A REFUND POSITION

If you are in a refund position, you have two options: roll over the refund or request payment of the refund. Rolling over the refund means the amount stays in your NBR account and will be applied against any future VAT liabilities. Obviously, if your business will generally be in a refund position, it makes sense to request a refund (noting the chance of audit).

It would be surprising to learn that, as at the time of publication of this article, Bahrain-based oil and gas companies have received refunds from the NBR. If the Saudi experience is anything to go by, it may take up to nine months to see the first refunds paid.

Technically, the NBR is required to respond to a refund request within 60 days, but this timeframe can be restarted by the NBR requesting additional information. Once a refund is approved, the NBR is required to process the refund within 30 days. Given this was the first return, taxpayers requesting a refund should expect the NBR to want to see some documentation before paying, which will likely draw out the process. If you are requesting a refund, be prepared for the cash flow impact caused by the time delay and the chance of audit.

WHAT’S A VAT AUDIT?

We can only guess what an audit will comprise, however, we expect the NBR to adopt a similar approach to those taken in other VAT jurisdictions. An audit generally starts from a high-level moving to the more granular:

* Request sample supporting documentation (such as work papers, tax invoices and customs declarations (bayan));

* Request detailed documentation (such as full transaction listings, tax coding, evidence of VAT treatment, all tax invoices and customs declarations);

* Interrogate documentation and VAT return;

* Discuss systems and processes in a formal interview, with targeted questions based on the interrogation process (step 3); and

* Issue a formal letter outlining audit findings and imposing penalties (if any).

An audit can be finalised at any stage providing the revenue authority is satisfied with the taxpayer’s VAT position. An audit changes according to a taxpayer’s features, as industries have different VAT risk areas. A key risk area for oil and gas companies is the zero-rating rules, so taxpayers should expect this to be a focus in an audit, along with documentary requirements. Finance functions of businesses that have operations in more than one GCC country should also be very aware that there are significant differences in the zero-rating rules applied by the UAE, Saudi Arabia and Bahrain.

Audits can be time consuming and disruptive and should be managed as quickly and efficiently as possible. Errors are a fact of life and – if found - penalties may apply. The best way to manage an audit is to have strong systems and procedures for VAT compliance in place before the audit even commences. This means documenting VAT return preparation procedures, having processes in place to ensure all tax invoices are valid, maintaining work papers and putting sufficient internal controls in place to manage VAT risks.

Penalties for late payment of liability (which would occur if you identify an error greater than BD5,000) range from 5 per cent to 25 per cent of the amount due and publication of the offence. Penalties for non-compliance can range up to BD5,000 for each offence.

WHAT CAN YOU DO NOW?

Thoroughly review the VAT return preparation process. Having just prepared and lodged a return, you should be asking yourself: What worked well? What needs improvement? Did we have enough time to prepare? The first return in an entirely new tax system is never going to go 100 per cent smoothly, so this is the optimal time to learn and re-adjust ahead of the next return.

The ability to make corrections in the next return makes this process even more worthwhile, but remember if you identify any errors that cannot be corrected in the next return, you only have 30 business days from identifying the error to lodge an amended return. It would be prudent to review tax codes in light of any additional guidance released by the NBR, especially once its oil and gas guidance has been released.

Taxpayers can start to implement internal procedures for VAT compliance, including agreeing on an internal review process for the VAT return (who prepares, who reviews, who signs off) and documenting this process. Agree a process for escalating complex VAT queries, which could be directed to a dedicated in-house member or an external adviser (a relationship with an external adviser is highly recommended at this early stage as it is the best way to stay abreast of any VAT updates and changes).

NBR will expect stakeholders responsible for VAT compliance to have a strong understanding of the VAT law. Taxpayers should invest in staff education, not only for the return preparers but for the wider accounts team. Most staff now should have some idea of what VAT is and what a VAT return requires. Industry-specific training sessions are more likely to see a reasonable return on any investment (whether in terms of time, effort or cash).

MOVING ON

Having now implemented VAT and lodged a first VAT return, Bahrain’s oil and gas companies are maturing into VAT-compliant entities. Now is the optimal time to consolidate VAT processes and review and adjust internal systems (including tax coding) to ensure the next VAT return is a streamlined and stress-free exercise.

If you have requested a VAT refund, be prepared to wait before receiving it and be prepared to support your position. VAT is a self-assessing tax, so tax authorities (including GAZT, the FTA and the NBR) expect taxpayers to have processes to ensure compliance. Strong VAT processes give tax authorities confidence that you take your VAT compliance obligations seriously and therefore assist greatly in the event of an audit.