KPC has signalled that it will review its outstanding contracts

KPC has signalled that it will review its outstanding contracts

KPC’s five-year, $115 billion investment programme unveiled earlier last year is a massive expansion of its five-year, $50 billion spending plans unveiled in 2014, reflects the vast additional sums Kuwait aims to spend in the downstream moving forward

Kuwait Petroleum Corp (KPC) believes a brighter future is here. With some tangible progress finally being made on its awards of enhanced technical-service agreements (ETSAs), and the state oil giant simultaneously embarking on an ambitious downstream expansion program abroad, Kuwait is poised to reposition itself in the global oil landscape.

KPC’s five-year, $115 billion investment programme unveiled earlier last year, a massive expansion of its five-year, $50 billion spending plans unveiled in 2014, reflects the vast additional sums Kuwait aims to spend in the downstream moving forward.

The monster budget has pushed Kuwait to rely on commercial debt, project financing and borrowings from export credit agencies to a far greater degree than it has in the past, rather than potentially overstretch its own coffers should oil prices soften.

Kuwait’s upstream ambitions sound straightforward – increase oil production capacity from around 3.1 million barrels per day currently to 4 mbpd by 2020 – but execution is another matter. The country’s 4 mbpd target has been in place for years, yet little progress has been made to make it a reality, and time is running out.

Encouragingly, Kuwait officially awarded long-awaited ETSAs to Royal Dutch Shell and BP last year, with France’s Total and Russia’s Lukoil waiting in the wings. But the restart of Kuwait’s Neutral Zone fields shared with Saudi Arabia is also critical. A political spat has shut in the area’s roughly 500,000 bpd of output for the past three years.

Some contract work has been awarded to fix pipelines and related infrastructure, but there is no official indication that the Gulf neighbours have resolved their differences, sources close to the matter say.

The 10-year ETSAs inked with Shell and BP are integral to raising oil output from the Ratqa and Burgan oil fields, although it is unclear how much of these additions will go toward offsetting declines elsewhere versus adding new capacity. It also remains to be seen if Kuwait can attract additional IOC investments.

The country has been trying to court foreign capital under its new ETSA model since 2009, with little effect, and lengthy negotiations with Total and Lukoil have not yet materialized into project awards. KPC has signalled that it will review its outstanding contracts with a view of making them more attractive, but it is unclear what changes are possible given the difficult political tightrope to manoeuvre, with foreign operatorship and reserves booking off-limits.

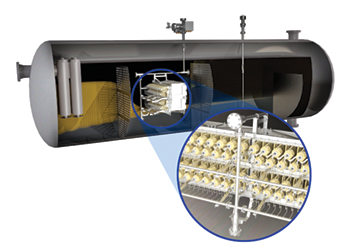

The country’s downstream plans are less politically fraught but no less ambitious. KPC subsidiary Kuwait Petroleum International (KPI) aims to expand its global refining capacity from 300,000 bpd to 1.3 mbpd by 2040 while integrating petrochemicals into many of its plans.

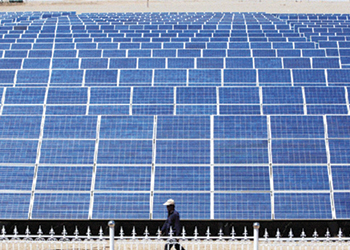

Although stopping short of admitting that peak oil demand could pose a problem for major producers like Kuwait, the company has conceded that continued growth in renewables and electric vehicles requires it to actively build out a market for its crude and diversify its revenue stream. "[P]eople will always need petrochemicals," KPI CEO Nabil Bourisli says.

"All of life will be based on petchem products, especially after 2035." Kuwait is not alone in taking this view, with Saudi Arabia and Abu Dhabi also stretching their downstream reach abroad, particularly in Asia.

But Kuwait is more advanced, with several projects already in the pipeline. KPI holds a 35.1 per cent stake in the recently constructed 200,000 bpd Nghi Son refinery in Vietnam and plans to double the unit’s capacity over the next four years. The downstream unit is also in talks with an Indian firm to develop a 300,000 bpd refinery in the oil-hungry nation and is hunting for a third partner, preferably an IOC. Its 50-50 Duqm refining scheme shared with Oman Oil is running into delays, however, with the pair struggling to line up another partner as well as the $6 billion in project financing.