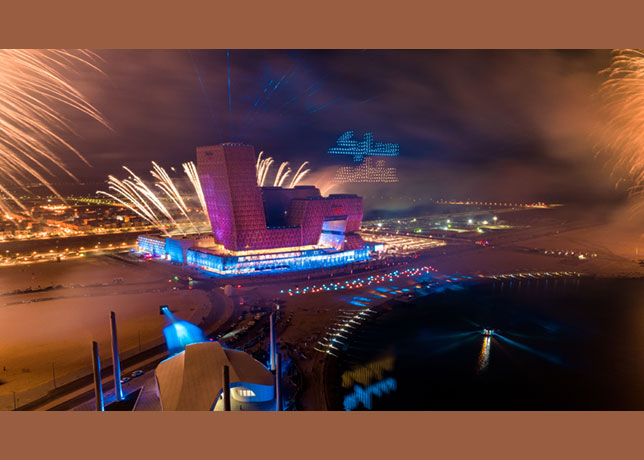

SABIC's Home of Innovation Center in Riyadh

SABIC's Home of Innovation Center in Riyadh

The chemicals major's commitment to sustainability and innovation drives its resilience, enabling the company to navigate market challenges effectively while achieving significant milestones in safety and operational efficiency in 2024

In early August, SABIC, a leading global chemicals manufacturer, announced a significant rebound in its financial performance for Q2 2024, reporting a net profit of SR2.18 billion ($580 million).

This figure marks an 85 per cent increase from the SR250 million ($70 million) recorded in Q1 of the year, underscoring the company's resilience in a challenging market environment.

Abdulrahman Al-Fageeh, the CEO, attributed this impressive growth to improved product margins, increased sales volumes, and effective management of supply chain disruptions that have affected many sectors globally.

'Our results reflect our resilience, innovation, and ability to adapt to challenging circumstances,' he stated. 'We are committed to meeting the demands of our customers worldwide.'

In line with its solid performance, SABIC declared a cash dividend of $1.36 billion for H1 2024, signalling its robust financial health and dedication to returning value to shareholders.

Notably, SABIC has realised cumulative benefits exceeding $2 billion through synergies with Saudi Aramco, highlighting the strength of this strategic partnership. These synergies have been instrumental in streamlining operations and enhancing overall competitiveness.

In addition to its financial achievements, SABIC has made significant strides in its environmental, health, safety, and security (EHSS) initiatives.

Al-Fageeh reported a substantial improvement in safety performance, with a Safety and Health Event Rate (SHER) of 0.18 for Q2 2024, a remarkable 62 per cent decrease from 0.47 in the same quarter of the previous year.

This commitment to safety is vital for SABIC, especially as it expands its operations globally.

In May 2024, SABIC successfully completed the divestment of its stake in the Saudi Iron and Steel Company (Hadeed) to the Public Investment Fund (PIF).

This strategic move allows SABIC to concentrate on its core portfolio of chemicals and polymers, aligning with Saudi Arabia’s Vision 2030 goals aimed at economic diversification and industrial development.

Al-Fageeh emphasised that this decision not only streamlines operations but also positions both SABIC and Hadeed for new growth phases.

BRAND VALUE & INNOVATION LEADERSHIP

SABIC’s brand value has also seen a commendable increase, rising to $4.89 billion in 2024, marking a 3.7 per cent growth.

This achievement underscores the company’s increasingly favourable perception among its target audiences and its status as the second most valuable brand in the global chemicals sector for the second consecutive year.

Al-Fageeh comments: 'The strength of our global brand is a clear reflection of our collaborative business approach and dedication to nurturing enduring relationships with our customers. We remain steadfast in providing market-leading solutions while ensuring that sustainability remains integral to our economic value creation and growth strategy.'

The recognition received by SABIC for its innovative solutions winning multiple Edison Awards reinforces its commitment to excellence in research and development.

These accolades demonstrate the company’s leadership in providing solutions that not only meet but exceed customer expectations.

SUSTAINABILITY COMMITMENT

Throughout the first half of 2024, SABIC made significant strides in its sustainability initiatives.

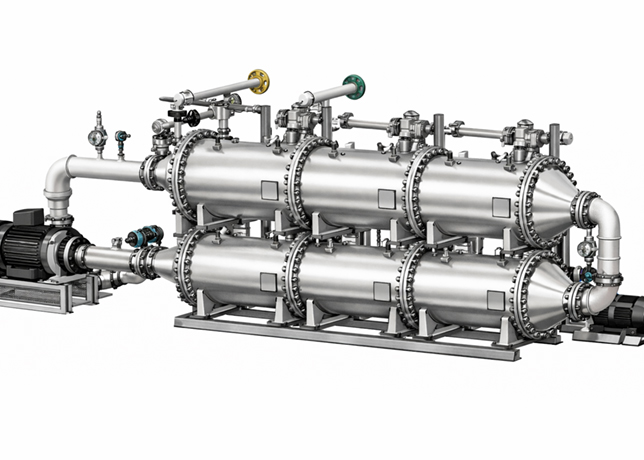

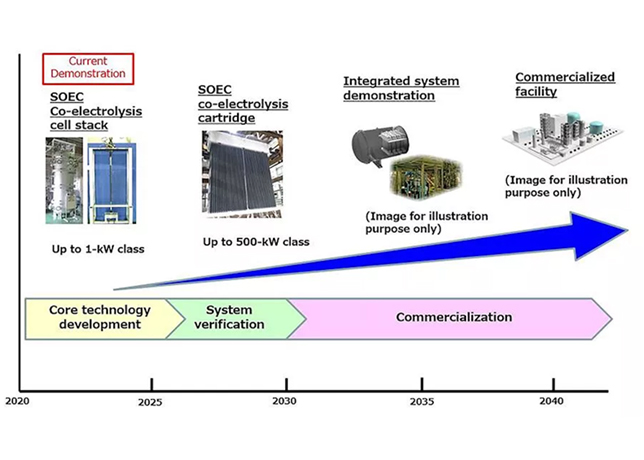

The company inaugurated the world’s first large-scale electrically heated steam olefin cracking furnace in the Netherlands, which is expected to reduce carbon emissions substantially compared to traditional methods.

This project aligns with SABIC’s commitment to achieving carbon neutrality by 2050 and illustrates the firm’s proactive stance on addressing climate change challenges.

Moreover, SABIC has begun construction on its Fujian Petrochemical Complex in China, a $6.4-billion joint venture that promises to enhance the company’s product offerings and production capabilities significantly.

The complex is poised to leverage leading technologies and is expected to commence operations in 2026, further solidifying SABIC’s presence in the crucial Asian market.

In addition to its international projects, SABIC is also prioritising localised manufacturing to bolster its competitive edge.

The company is undertaking a strategic project to manufacture catalysts in Saudi Arabia, which aims to transform the country into a manufacturing hub for specialized materials.

This initiative aligns with the Shareek programme, which seeks to enhance the competitiveness of the energy sector and increase local content in industrial production.

FUTURE OUTLOOK

Looking ahead, SABIC remains focused on leveraging its strengths to navigate ongoing market challenges while continuing to deliver value to stakeholders.

With a robust balance sheet and a commitment to innovative solutions, the company is well-positioned for sustainable growth in the evolving chemical landscape.

As SABIC continues to align with Vision 2030, its efforts to enhance operational efficiency, invest in cutting-edge technologies, and expand its global footprint will be critical to maintaining its leadership in the chemical industry.

The company’s unwavering commitment to sustainability, safety, and innovation will undoubtedly play a pivotal role in shaping the future of the global chemicals sector.

With its strategic initiatives and a clear focus on growth, SABIC is poised to not only weather economic fluctuations but also emerge stronger in the years to come.

By Abdulaziz Khattak