THE UAE is marching ahead with ambitious plans to boost its production capacity.

The country’s oil production is set to climb to a record 2.5 million barrels per day (bpd) within two years as the country pushes ahead with major projects to expand output capacity amid growing world demand.

Western analysts believe the UAE has the potential to go beyond 2.5 million bpd, given its massive proven crude reserves and the heavy capital it is pumping into projects to develop and maintain its main onshore and offshore oilfields.

Oil industry sources say the UAE, which controls nearly 10 per cent of the world’s total recoverable oil deposits, pumped close to 2.5 million bpd in 2003.

According to forecasts by the London-based Centre for Global Energy Studies (CGES) and Business Monitor International (BMI), production next year could rise slightly to around 2.35 million bpd and swell to a record 2.5 million bpd in 2006.

The Abu Dhabi National Oil Company (Adnoc) has been playing a key role in the future plans and projects in the UAE.

Adnoc announced that the group and its other companies were planning mega projects to increase oil and gas output in the near future.

The UAE also plans to develop its energy capacity by setting up one of the world’s largest gas-production plants.

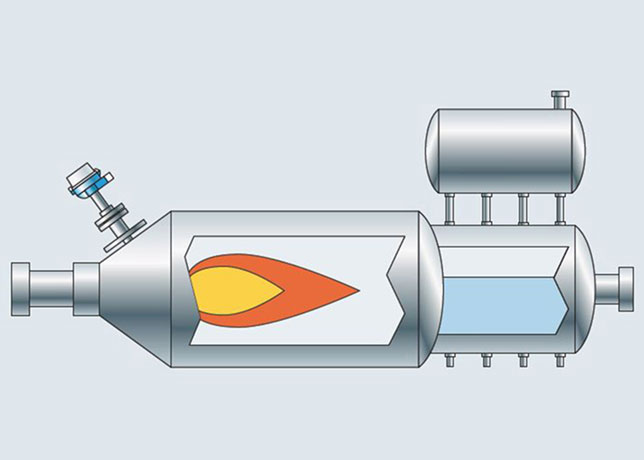

Adnoc will increase its gas production to 4.5 million metres per day by 2007, once phase three of its onshore gas development project, the Habshan Gas Complex, delivers further capacity of 1.2 million metres per day, an Adnoc report says.

The gas will be used for reinjection into crude oilfields and as a feedstock for petrochemicals.

Separately, Adnoc subsidiary, the Abu Dhabi Company for Onshore Oil Operations, has engaged in expansion projects to increase crude oil production from one million to 1.4 million barrels per day (bpd) by 2006.

The UAE also wants to further develop Upper Zakum as part of Adnoc’s overall plans to raise Abu Dhabi’s sustainable capacity to around three million bpd by the end of this decade.

Upper Zakum’s current production capacity is around 550,000 bpd and the field is programmed for expansion to approximately 750,000 bpd, reports say.

The oilfield is operated by the Zakum Development Company (Zadco), in which the Abu Dhabi National Oil Company (Adnoc) has an 88 per cent share and Japan Offshore Development Company (Jodco) holds the remaining 12 per cent.

The death of UAE President Shaikh Zayed bin Sultan Al Nahyan did not affect the oil policy.

Veteran oilman Mohammed Al Hamili was tapped as the new energy minister to replace Obaid bin Saif Al Nasseri, appointed in 1997, and run an expanded portfolio that combines oil, electricity and water.

The government plans to raise production capacity to 3.6 million bpd by 2005 and four million bpd in 2010, including gas injection projects at the onshore Bu Hasa and Bab fields and the further development of the Upper Zakum oilfield.

In LNG, the UAE is the second producer in the Arab world after Qatar as its main LNG venture, the Abu Dhabi Gas Liquefaction Co (Adgas), produces close to 10 million tonnes per year mostly for its Japanese client Tepco.

The downstream sector in the UAE will see significant growth by 2005.

The Abu Dhabi Oil Refining Company (Takreer) is moving ahead with its estimated $70 million fifth package under phase 3 of the onshore gas development (OGD-3) and phase 2 of the Asab gas development (AGD-2) programme.

Package 5 covers the construction of facilities for storage and handling of the incremental condensate supply at Ruwais. The project will include building pipeline receiver stations, three floating roof condensate storage tanks with mixers, condensate feeds and transfer pumps, distribution manifolds and all necessary utilities and ancillaries.

Takreer says that the front end engineering and design, FEED, for its Inter-Refinery Pipeline project has been completed and the EPC contract for the project is expected to be awarded in the first quarter of 2005.

Meanwhile, the Abu Dhabi Polymers Co Ltd (Borouge) has scheduled to shut down its cracker and downstream units in the first quarter next year for two to four weeks, a company source said.

The shutdown will be for maintenance and debottlecking work, the source added. The producer plans to add 100,000 tonnes per year (tpy) of new polyethylene capacity, to bring its downstream output in line with its upstream side.

Borouge has long been running its 480,000 tonnes per year petrochemical plant above its name plate capacity.

Construction of the phase-II development of Borouge is progressing steadily.

Borouge, a 60:40 joint venture between Adnoc and European petrochemicals giant Borealis, is investing $40 million in the project, which is to expand its capacity by 30 per cent.

The UAE exported 485,500 bpd of refined products in 2002 and increased its refining capacity by around 491,300 bpd in the same year said a report.

But in 2003, economic conditions for the UAE’s refiners were difficult as high oil prices made feedstock expensive, according to a recent study.

According to a report, the growth in 2002 was due to the expansion of Takreer’s Ruwais refinery, which has a full production capacity of 420,000 bpd and Emirates National Oil Company’s (Enoc) 120,000 bpd condensate - processing plant at Jebel Ali Free Zone.

Takreer operates the emirate’s two refineries at Ruwais and Umm Al-Nar, which have capacities of 420,000 bpd and 88,500 bpd respectively.

Light products produced at Ruwais are mainly exported to Japan and India, while fuel oil produced there is sold locally for domestic power generation.

The Ruwais facility has also installed a low-sulphur gas oil (LSGO) plant and expanded its hydrocracker.

Meanwhile, Dolphin Energy Ltd has clinched a deal to supply the UAE’s northern emirate of Ras Al Khaimah (RAK) with natural gas from March 2005.

UAE-based Dolphin agreed to sell the RAK Gas Commission about 40 million cubic feet per day of gas for a period of two years and five months through the end of July 2007.

Dolphin’s $3.5 billion inter-Gulf gas project aims to pump an initial two billion cubic feet per day of natural gas from Qatar’s giant North field to the UAE by 2006.

Dolphin has also started the geophysical, geotechnical and environmental surveys for construction of a sub-sea gas pipeline between Qatar and Abu Dhabi.

Adnoc subsidiary Gasco has tendered for two major gas projects worth $1.9 billion, including the development of Phase III of the onshore gas development programme at the Thamama F field and a gas treatment centre for the Thamama F and Asab C projects.

The tenders are expected to be finalised by end-2005.

The Abu Dhabi Company for Onshore Operations (Adco), a subsidiary of Adnoc, is also upbeat about the future growth and will continue to be one of the top crude oil producers in the UAE.

Adco is developing its sixth oilfield at Al Dabb’iya to raise production by 200,000 barrels per day (bpd) by mid-2006.

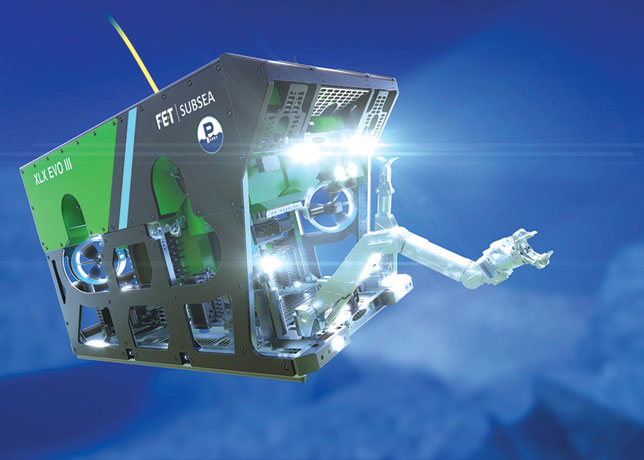

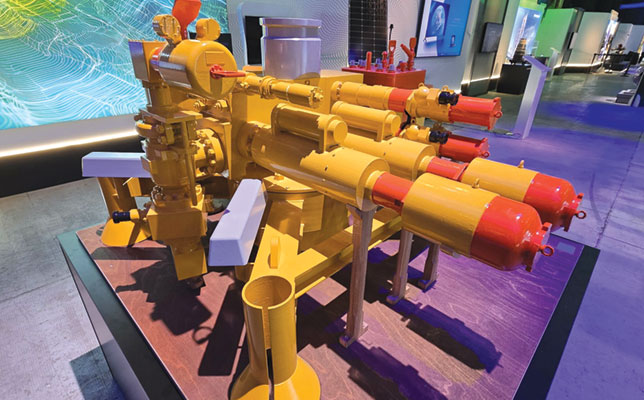

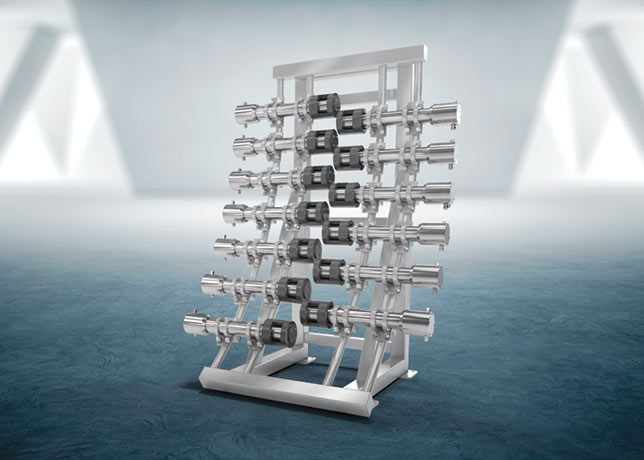

Adipec 2004, the 11th edition of the Abu Dhabi International Petroleum Exhibition & Conference, also had record-breaking success. The event broke all previous records with 38,563 trade professionals visiting, over the four days of the event.

Meanwhile, the Emirates General Petroleum Corporation (Emarat) has signed two separate agreements to export lubricants and other oil products to Libya and Iraq.

Emarat deputy director general for Sales and Marketing Affairs, Adel Khalifa, said that UAE’s maximum production of lubricants was about half a million tonnes per year. This, he said, meets the local demand with surplus for export.

Local consumption of the product ranges between 100,000 to 120,000 tonnes of the total output, which is shared equally between Abu Dhabi and the northern emirates. He expressed the hope that similar agreement would be signed soon with Syria, Turkey and India.

Emarat’s distribution network currently include Lebanon, Jordan, Egypt, Bahrain, Oman, Yemen, Afghanistan, Pakistan, Ukraine and Uganda.