An ADNOC Drilling hybrid rig

An ADNOC Drilling hybrid rig

With AI revolutionising drilling operations, predictive maintenance, and oilfield services, ADNOC Drilling is well-positioned to integrate new technologies and expand its global footprint

ADNOC Drilling is accelerating its expansion with a strong focus on artificial intelligence (AI) and digital transformation, positioning itself as a leader in energy services.

With record-breaking financial performance in 2024 and a commitment to further growth, the company is leveraging AI-driven efficiency, expanding its fleet, and targeting strategic acquisitions across key global markets.

In 2024, ADNOC Drilling achieved record revenue of $4.034 billion, a 32 per cent increase year-on-year, while EBITDA surged 36 per cent to $2.01 billion. Its net profit doubled since its 2021 listing, reaching $1.30 billion in 2024.

Abdulrahman Abdulla Al Seiari, CEO ADNOC Drilling, attributed this success to the company’s strategic investments and its embrace of AI-powered drilling technology.

"Our targeted expansion across the region, AI-powered rigs and cutting-edge oilfield services position us for even greater success. As we accelerate innovation through Enersol and unlock Abu Dhabi’s unconventional energy potential through Turnwell, ADNOC Drilling remains at the forefront of the industry – driving efficiency, sustainability and long-term progressive returns for our shareholders."

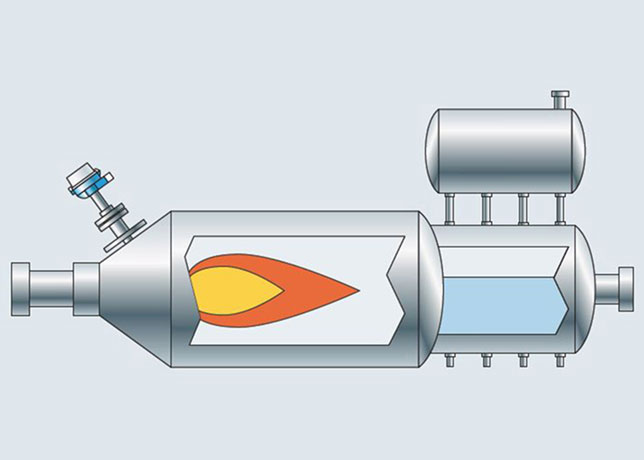

AI has become a critical tool in ADNOC Drilling’s expansion strategy, enhancing drilling efficiency, predictive maintenance, and automation.

The company has integrated AI into its rigs, optimising performance and reducing operational costs while maintaining high safety and sustainability standards.

The integration of AI across ADNOC Drilling’s operations is expected to drive predictive maintenance, reducing downtime and improving rig efficiency; automation of drilling processes, lowering costs and enhancing safety; and advanced data analytics, optimising oilfield services and well completion.

Beyond the region, ADNOC Drilling is targeting the US and European markets, where AI-driven solutions are transforming energy services.

The company has earmarked $1 billion in investments for 2025, with $700 million allocated to AI-centric acquisitions in the US and Europe.

In an interview with AGBI, Youssef Salem, ADNOC Drilling’s Chief Financial Officer, highlighted the strategic importance of these investments. He said: "We are focusing on technologies related to the completion side after the well has been drilled. This will allow the execution of oilfield services from start to finish without third parties."

ADNOC Drilling’s Enersol joint venture with Alpha Dhabi is leading the charge in AI-powered acquisitions.

Two of Enersol’s recent acquisitions, Gordon and Deep Well Services, are US-based companies that have seen an uptick in activity following energy policy shifts under President Donald Trump’s administration.

With AI revolutionising drilling operations, predictive maintenance, and oilfield services, ADNOC Drilling is well-positioned to integrate new technologies and expand its global footprint.

Through Turnwell, ADNOC Drilling’s joint venture with SLB and Patterson-UTI, the company has already completed 30 unconventional wells and is leveraging AI-driven techniques to maximise Abu Dhabi’s untapped energy potential.

Salem also underscored the shift in revenue sources, with global investments expected to contribute 7 per cent of net income by 2026.

REGIONAL PRESENCE

ADNOC Drilling has expressed commitment to Saudi Arabia, highlighting its collaboration with Saudi Aramco and its subsidiaries operating in the Kingdom, including EV (smart camera technology for 3D visualisation) and NTS (a manufacturing business producing drilling equipment).

"For us, Saudi Arabia continues to be very strategic for our actual underlying operation, and we continue to find ways to build even deeper relationships," Salem told Arab News.

With operations in Jordan and Saudi Arabia, ADNOC Drilling is expanding into Oman and Kuwait, capitalising on growing energy demands. The company’s prequalification with major operators in these countries is expected to lead to new contracts.

ADNOC Drilling plans to expand its fleet to 151 rigs by 2028, up from 142 at the end of 2024, reinforcing its position as the largest drilling operator in the Middle East and North Africa.

For 2025, ADNOC Drilling expects revenue between $4.6 billion and $4.8 billion and a net profit from $1.35 billion to $1.45 billion, with a 28 per cent to 30 per cent margin.

The capital expenditure for 2025 is estimated to be between $350 million and $550 million.