Abqaiq ... subjected to co2 injection

Abqaiq ... subjected to co2 injection

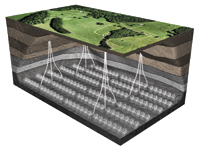

SAUDI ARAMCO has raised the recovery rate at its Abqaiq oil field, one of the kingdom’s oldest fields, to 68 per cent and plans to start applying a carbon dioxide (CO2) injection programme soon that will help boost oil recovery rates to 70 per cent across the kingdom, a senior oil source says.

Abqaiq, discovered before Saudi Aramco took over stewardship of the kingdom’s oil industry from the company’s US ancestors, is currently producing 300,000-400,000 bpd of crude oil even though the US company that was then known as the Arabian American Oil Company or Aramco had predicted that the field would have run out of oil by now.

Saudi Aramco expects that with CO2 injection and its knowledge of reservoirs it will be able to raise recovery rates to 70 per cent versus a global average of 50 per cent, the source says.

Asked why Aramco had cut its proven reserve estimates in its latest annual report to under 260 billion barrels, the source says this was because most of the state-owned company’s expenditures were now going into gas rather than oil because of the kingdom’s need to step up gas exploration and production.

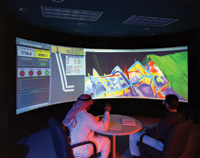

However, there was no need to worry about reserves since Aramco is adopting a long-term view and is relying on its upstream technology to maximise its output, replace and even boost its reserve base, he says.

The kingdom’s reserves of oil originally in place are estimated at 760 billion barrels, of which 100 billion have been produced already, based on a 50 per cent recovery factor.

Saudi Arabia’s recoverable reserve figure of around 260 billion barrels is also based on a recovery factor of 50 per cent and will rise as recovery rates are boosted, the source says, giving Abqaiq as an example.

This might explain why Saudi Arabia has says repeatedly that while it could easily raise its total production capacity to 15 mbpd from 12.5 mbpd currently, it sees no immediate need to do so at this time.

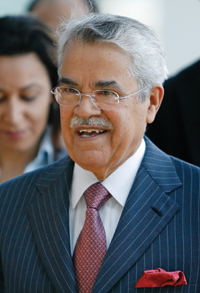

Saudi Arabian Oil Minister Ali Al Naimi says that it had not been proved that there was any need for his country to invest in additional crude production facilities.

“I believe that demand in the future will peak before supply so whether Saudi Arabia needs more than 12.5 million bpd capacity is yet to be demonstrated,” Al Naimi says.

“I think it will take some time to see what is going to happen to demand. But obviously with what is happening in the oil and gas field and also the quick technological development of renewables, I question whether Saudi Arabia will need, at least now, to think about future production capacity,” he says.

Al Naimi and Saudi Aramco CEO Khalid Al Falih have both said there is no immediate plan to raise the kingdom’s production capacity beyond 12.5 mbpd though Saudi Aramco has identified the fields that could be developed to boost capacity to 15 mbpd if needed.

Saudi Arabia is, however, investing heavily in research and plans to raise its spending significantly from around $350 million per year now to $1.8 billion annually to 2020, the source says.

One particular area that Saudi Arabia is focusing on is solar power and it is hoping to develop a home-grown industry that will eventually allow the kingdom to become an electricity exporter within the next 10 years.

The kingdom is seeking investors for a $109 billion plan to create a solar industry that generates a third of the nation’s electricity by 2032, according to officials at the agency developing the plan.

.jpg)