SAUDI ARABIA’S role as “swing producer” and emergency cushion capable of raising its output has been an important factor in not letting prices spiral out of control, particularly when oil markets have faced significant challenges and possible disruptions as a result of the Arab uprisings, with reduced crude supplies to the global markets particularly from Libya, Yemen and South Sudan.

Additional strains have been put on the markets due to Iran’s threats to close the Strait of Hormuz in case of a Western attack against its nuclear programme.

This has further served to underscore the importance of Saudi Arabia to the energy market, with Saudi officials repeatedly stating they are able to offset potential crude outages and counter oil price spikes.

This situation has led Asian economies to import even more oil from Saudi Arabia, with the kingdom then raising production levels.

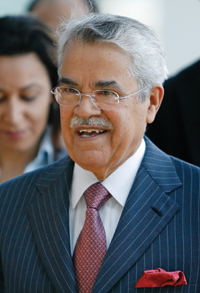

According to Ali Al Naimi, the Minister of Oil and chairman of Saudi Aramco, it is the company’s “spare capacity that has been tapped to compensate for production disruptions and declining supply from other major suppliers, and is a cornerstone of the kingdom’s forward-looking energy policy”.

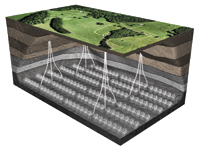

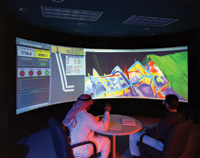

By 2020, Aramco has set ambitious benchmarks for the country and the company: the company aims to develop unconventional gas resources, become a leading global chemicals and refining company, promoting an energy-efficient Saudi economy.

Saudi Aramco has increased its crude oil output significantly to 9.1 million barrels per day (mbpd) in 2011, from 7.9 mbpd in 2010, according to the company’s 2011 Annual Review. Crude exports jumped to 6.63 mbpd in 2011, from 5.5 mbpd the year before. With regards to gas, the company states that its production averaged 9.9 billion cubic feet per day (bcfd) in 2011 from 9.4 bcfd in 2010.

As Opec’s largest oil producer and exporter, Saudi Aramco has exceeded its exploration and export capacities over the last year amid remarkable political and economic challenges in the region.

.jpg)