Shale ... Aramco prospecting for the new resource

Shale ... Aramco prospecting for the new resource

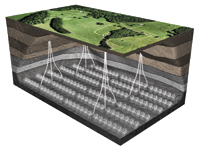

SAUDI ARAMCO is seeking to begin producing natural gas from shale rock in the country before the end of the decade as domestic power demand climbs.

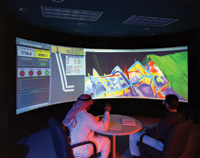

“If we can get it by 2020, that will be good,” general manager of Exploration Ibraheem Assaadan says. “We are in the reconnaissance phase, shooting regional seismic programmes and drilling all over the country.”

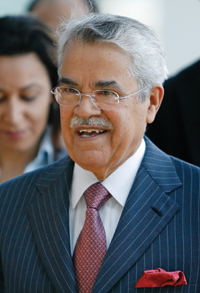

Saudi Arabia is exploring for gas to meet rising electricity demand. The kingdom currently uses oil to fuel many of its power plants, reducing the amount of crude available for export. Saudi Aramco is searching for so-called unconventional gas, including shale and tight fuel, in the nation’s northwest, president and CEO Khalid Al Falih says.

At least three to five rigs are being used to evaluate the resources, Assaadan says. Saudi Aramco, the world’s largest crude exporter, had about 100 rigs in operation last year and will employ a similar number in 2012, he says, adding that low gas prices remain a “major issue” in developing the prospects.

Saudi Arabia sells gas locally at a subsidised price of 75 cents a million British thermal unit, a third of international market rates. The country needs to examine the way it regulates tariffs to make unconventional gas extraction attractive, Assaadan says.

Saudi Aramco has conceptual estimates of its tight and shale gas reserves but has not yet booked recoverable reserves until it completes an assessment of its unconventional gas resources, Al Falih says.

“We have numbers that geologists present to us, but they are still conceptual estimates. We really do not have booked recoverable reserves in terms of unconventional resources, because until you can know with certainty the resource base and drill enough wells to know the reservoir characteristics, and whether it is homogeneous or heterogeneous, and more importantly until you prove that it can be produced commercially, you cannot book them,” Al Falih says.

“So what we have now are conceptual resource estimates. We know the resource base is there, but how much it is and when will we be able to put it down as a commercially recoverable reserves, we have some more work to do. I have mentioned before that our resource base is in the hundreds of tcfs. Hundreds can become smaller if you go with P90, the 90 per cent probability. On the other hand, it will be much larger if you used P10 figures, and something in the range of 200 to 300 tcf range if you are looking at the mean estimate,” he adds.

“But at this stage, I would just caution it is still estimates of resources, conceptual in nature, and it will take a couple of years of intensive exploration and perhaps piloted production of this type of resources before we tell with certainty how much reserves we have and when we will be able to bring it to market,” Al Falih says.

Asked whether Aramco planned to carry out the work on its own or whether it might bring a foreign partner, Al Falih replies: “We are the largest company in upstream. We have financial, technical and project management capability to undertake projects of any type in the upstream. Certainly within the geology of Saudi Arabia, we are more knowledgeable than anybody else. So as of now, we are not going to bring anybody. Of course, ultimately there are sovereign decisions which the government can take, but this has not been even considered. Saudi Aramco is in the process of undertaking this exploration work on our own.”

Saudi Arabia has the world’s fourth largest reserves of natural gas.

.jpg)