Damien Duhamel

Damien Duhamel

Transformation is in motion as Vision 2030, electrification, and industrial expansion redefine the Kingdom’s 515-million-litre lubricant industry, Damien Duhamel tells OGN

Saudi Arabia’s lubricant sector is entering one of the most dynamic phases in its history. Once centred on automotive consumption, it is now being reshaped by Vision 2030’s diversification agenda, the electrification of transport, and the emergence of new industrial and manufacturing clusters.

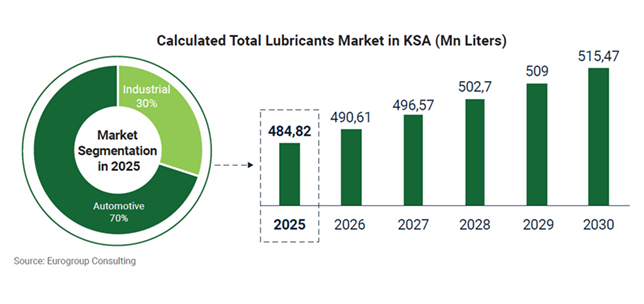

According to Eurogroup Consulting’s report ‘Changing Patterns in the KSA Lubricant Market’, national consumption already exceeds 515 million litres annually, making it the largest lubricant market in the GCC.

Yet behind this scale lies a rapidly changing composition of demand and a growing emphasis on performance, sustainability, and local production.

VISION 2030: DRIVING STRUCTURAL CHANGE

Vision 2030’s ambition to expand non-oil industries, tourism, and logistics is forcing lubricant producers to rethink their portfolios.

Investments in giga-projects such as NEOM and Qiddiya are creating demand for specialised industrial, hydraulic, and marine fluids, while the expansion of public transport and ride-hailing services is altering the automotive mix.

"Vision 2030 has created a fundamental shift in how lubricant producers operate in the Kingdom," Damien Duhamel, Managing Partner of Eurogroup Consulting Middle East and Asia, tells OGN energy magazine.

"We see both global and local players repositioning their portfolios to align with emerging sectors such as public transport, tourism fleets, and manufacturing."

Beyond the increase in volume, demand is shifting toward higher-quality lubricants, with customers increasingly seeking premium and synthetic formulations that deliver extended service intervals and withstand the Kingdom’s high-temperature conditions.

Synthetic and semi-synthetic lubricants are also gaining popularity among construction and fleet operators due to their durability and efficiency.

As diversification accelerates, the balance between automotive and industrial demand is evolving.

THE EV ERA: FROM ENGINE OILS TO THERMAL FLUIDS

|

KSA’s growing EV infrastructure reflects its shift toward sustainable mobility and next-generation lubricants under Vision 2030 |

Electric and hybrid mobility is still nascent but gaining momentum. Government policies and public-private partnerships are encouraging EV infrastructure and domestic vehicle assembly, opening a new chapter for lubricant innovation.

"Forward-looking producers are investing in R&D to develop fluids that ensure heat dissipation and long-term performance, particularly under Saudi Arabia’s extreme temperatures," Duhamel notes.

These include e-transmission lubricants, battery-cooling fluids, and other specialty formulations that compensate for declining demand in traditional engine oils.

Fleet operators and rental companies, another fast-growing segment, now prefer lubricants that extend service intervals and improve fuel economy — both essential for cost and sustainability goals.

BASE OIL UPGRADES & LOCALISATION MOMENTUM

A significant structural shift is underway in the supply chain; refiners and blenders are moving from Group I to Group II and III base oils, enabling lower emissions and higher oxidation stability.

This transition also advances the Kingdom’s localisation agenda by attracting new blending and refining investments.

|

Local manufacturing and blending are key pillars of KSA’s lubricant-localisation strategy |

"Localisation is not only about producing within the Kingdom," says Duhamel. "It is about transferring technology, ensuring quality consistency, and building a resilient industrial base that supports Saudi Arabia’s broader diversification goals."

Local players are scaling capacity while international brands form joint ventures to secure market access.

Pricing and raw-material sourcing remain challenges, but long-term competitiveness increasingly depends on efficiency and supply-chain integration.

Global brands are leveraging advanced formulations and long-standing customer trust to retain market share, while local blenders compete on agility, cost efficiency, and localisation incentives under Vision 2030.

New industrial and manufacturing zones being developed across Saudi Arabia are expected to attract additional lubricant-blending and refining capacity over the next few years.

These initiatives form part of Vision 2030’s broader objective to enhance downstream integration and strengthen local content across the energy and industrial value chains.

Ongoing government programmes supporting manufacturing localisation and export-oriented production are also helping position Saudi Arabia as a future hub for high-performance lubricants serving regional markets.

DIGITALISATION & MARKET EVOLUTION

Digital tools are redefining customer engagement, with e-commerce platforms and predictive-maintenance systems now complementing traditional distributors, helping workshops manage inventory and performance data more efficiently.

Producers that combine online access with technical support are building stronger brand loyalty and reducing grey-market exposure.

Market observations show that lubricant e-commerce sales, though still modest, are expanding rapidly.

The trend is driven by younger consumers who prefer digital channels, and by fleet operators, who rely on automated procurement.

Distributors and workshops are adopting CRM systems, digital diagnostics, and data-sharing platforms to improve responsiveness and customer retention.

At the same time, data from connected fleets is allowing formulators to tailor lubricants to specific duty cycles, a sign of how analytics and field data are reshaping product development.

FROM COMPLIANCE TO COMPETITIVE ADVANTAGE

|

KSA’s lubricants market will reach 515 million litres by 2030 |

Sustainability has moved from corporate messaging to a measurable business imperative.

Regulations by the Saudi Standards, Metrology and Quality Organization (SASO) promote low-sulphur, biodegradable, and re-refined oils, while major producers invest in cleaner processes and recyclable packaging.

"Balancing cost and performance remains challenging, but sustainability is no longer optional; it is a source of differentiation and competitive strength," Duhamel emphasises.

The shift aligns directly with Vision 2030’s environmental pillars, positioning sustainability as a growth driver rather than a constraint.

Efforts to collect and re-refine used oils are also expanding, particularly in industrial zones where large-scale consumption occurs.

The introduction of circular-economy practices, such as lubricant recovery and base-oil reprocessing, reflects growing awareness of long-term environmental responsibility across the sector.

INDUSTRIAL LUBRICANTS: POWERING THE KINGDOM’S GIGA-PROJECTS

Heavy equipment for NEOM, the Red Sea Development, and Qiddiya requires durable hydraulic fluids, greases, and gear oils that can withstand demanding conditions. Industrial volumes are, therefore, gaining share against automotive consumption.

Large contractors are also adopting condition-monitoring systems to track lubricant degradation and performance in real time. This approach improves operational efficiency, reduces downtime, and increases safety, factors that are becoming essential for mega-project execution.

The trend is supporting greater use of high-performance synthetic greases and extended-life hydraulic fluids designed for extreme environments.

This expansion also boosts local manufacturing and after-sales services, reinforcing lubricants’ role as an enabler of industrial productivity.

SAFEGUARDING QUALITY & BRAND INTEGRITY

While counterfeiting and grey imports continue to challenge legitimate suppliers, manufacturers are countering with QR-code authentication, tamper-proof packaging, and stronger regulatory cooperation. These measures, combined with digital traceability, help preserve product performance and consumer confidence, critical to sustaining trust in a growing market.

Improved enforcement and consumer awareness are also helping reduce counterfeit risks.

Public campaigns are encouraging end-users to purchase from verified distributors, while digital product-registration tools allow customers to authenticate products instantly through mobile applications.

A MARKET READY FOR REINVENTION

Saudi Arabia’s lubricant industry is at a strategic crossroads, where economic diversification, digitalisation, and sustainability pressures are reshaping every link of the value chain.

Companies that adapt their portfolios, localise operations, and integrate environmental leadership will capture the next wave of growth.

With Vision 2030 as its compass, the sector is evolving from a volume-driven business into a knowledge- and technology-driven industry, poised to support a cleaner, smarter, and more connected Saudi economy.

By Abdulaziz Khattak