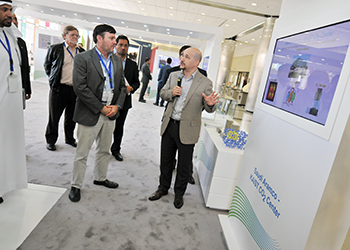

Aramco ... aiming to further boost the supply of gas in the kingdom

Aramco ... aiming to further boost the supply of gas in the kingdom

The Saudi Vision 2030 would see state oil giant Saudi Aramco assume full authority over its 12 million barrels per day of production capacity, but would seemingly free it of any obligation to balance oil markets

Oil giant Saudi Aramco is planning to boost its gas production and oil refining capacity over the coming year as Saudi Arabia seeks ways to further develop its downstream sector and generate more revenues to make up for the declining value of crude.

Aramco’s chief executive Amin Nasser says that over the coming 10 years the goal is to increase production almost twofold from its current level of 12 billion cubic feet (340 million cubic metres) per day. "This figure is expected to double to around 23 billion cubic feet during the coming decade," says Nasser.

Boosting the supply of gas in the kingdom has been set as a major priority for Aramco, which is looking to provide more feedstock for downstream industries, as well as keep up with local power generation demand growing at 4 per cent-5 per cent annually. Nasser stresses the importance of growing the downstream sector and producing speciality chemicals. "Saudi’s share of the global petrochemical market is 6 per cent and this can grow even more," he says.

On the refining side, Aramco is targeting boosting its refining capacity from the current level of 5.4 million barrels per day (mbpd) to 8 mbpd-10 mbpd, Nasser says, without providing a time frame for the expansion. The new refineries in Jazan and Yasref are expected to add a combined 1.2 mbpd of processing capacity once they are completed, he adds.

According to industry sources, Aramco is currently looking at investing in a refinery in India and in other Asian countries. The company already owns a stake in a refinery in China’s southeastern Fujian province alongside Sinopec and ExxonMobil, and is still discussing its participation in China National Petroleum Corp’s (CNPC) under-construction Kunming plant, as well as investment in CNPC downstream assets more broadly.

Nasser says Aramco is maintaining its strategy "to achieve a better balance between the total exploration and production capacity ... and its refining capacity."

Saudi Arabia’s current production capacity stands at 12 mbpd of crude oil. Despite low oil prices, the kingdom is for the time being sticking with its policy of defending market share by keeping its output at around 10 mbpd.

Meanwhile, Saudi Arabia’s Vision 2030 programme for reducing the kingdom’s dependence on oil revenues will have huge but as yet still unclear repercussions for Saudi Aramco. As reflected in its plans for floating a 5 per cent stake in the state oil giant on at least one overseas bourse, Riyadh is looking to foster a more commercial and more international outlook, and in 10 or 20 years’ time, Aramco could be a very different company, with a very different set of assets and strategic priorities from those it has today.

In the future, Saudi decisions on oil policy should "only contribute to the benefit of Aramco and the profitability of the company," says the plan’s architect, and the kingdom’s emerging driver of oil policy, Deputy Crown Prince Mohammed bin Salman.

|

Falih ... it pays to have the spare capacity |

The impact of the transformation programme, which aims to empower the private sector to fuel economic growth and meet the employment aspirations of the 10 million Saudis currently under age 25, is already visible in oil policy. Prince Mohammed indicated last year that Aramco would be run independently from the oil ministry, which has historically headed oil policy and set production targets.

Meanwhile, Saudi Aramco flexed its integrated muscles in its 2015 annual review, posting all-time highs in crude oil and natural gas production as well as a big jump in refined products exports.

The display of strong growth in the giant’s upstream and downstream divisions, despite collapsing oil prices, comes as the company prepares to offer up to 5 per cent of its business in an initial public offering (IPO).

"This was a year where the value of being a long-term company with a long-term strategy was clearer than ever before," says Nasser.

Aramco reported that crude oil production rose by more than 7 per cent year-to-year to 10.2 mbpd in 2015, while gas output climbed roughly 3 per cent to 11.6 billion cubic feet per day. Reserves of crude oil and condensate held steady at 261.1 billion barrels compared to 2014, even as oil prices sank to multiyear lows around $30 per barrel by the end of 2015.

Meanwhile, exports of petroleum products surged by 38 per cent year-to-year to more than 635,000 bpd, primarily to Asian markets. Exports to India jumped by 18 per cent from the previous year, while China, South Korea and Japan grew by 4.5 per cent, 3.5 per cent and 2.8 per cent, respectively.

Aramco says its exports to the US stayed at about 1 mbpd in 2015, despite increasing competition from the country’s unconventional oil production.

"Despite the low oil price environment, in 2015 Saudi Aramco delivered another record year of crude oil and gas production, as well as making significant rapid progress in its continued domestic and international downstream expansion," says Khalid Al Falih, Aramco chairman and Saudi Arabia’s energy minister.

"These results, delivered through focused operational efficiency and fiscal discipline, have consolidated the Kingdom of Saudi Arabia’s position in international energy markets," Falih says.

Saudi Aramco is considering upstream investments outside of the kingdom, as part of plans to become the world’s largest integrated energy company and ahead of its initial public offering (IPO) by 2018 that could be the biggest ever.

"Post-IPO, and even as we prepare for the IPO, you will find Aramco quite interested into going into international upstream," Falih says.

"International gas is the most attractive, notionally speaking, today and we are very much interested to look at it."

|

Nasser ... growing downstream is vital |

Listing Aramco is one of the cornerstones of Saudi Arabia’s Vision 2030 to diversify its economy, with the funds raised to be invested in other sectors. The current plan is to list up to 5 per cent of the firm on national and international stock markets by 2018, followed by a potential listing of a bundle of its downstream assets. Prince Mohammed, who has been pushing the IPO as part of a transformative economic vision for the kingdom, has says the company is worth $2 trillion-$3 trillion.

Aramco already boasts the world’s largest upstream portfolio, and an expansion into the international exploration and production market will add a new wrinkle to its value offering to future shareholders. Unlike many national oil companies, Aramco has not ventured into the upstream outside the kingdom, where it boasts the world’s largest oil reserves of 261 billion barrels. Falih gives no indication of where it might invest.

There are no plans, however, to reopen the kingdom’s upstream to foreign firms, which was last tried in the early 2000s, but failed to bring any resources to market. "Typically you bring investors if you have a lack of capital, if you have a lack of technology or if you have a lack of project management expertise," Falih says.

"So in the case of Saudi Arabia we obviously have the capital, we also have the technology," he adds.

Saudi Arabia’s policy is to keep idle capacity of at least 1.5 2 mbpd to respond to sudden global outages, and Falih says there are no plans to change that after the IPO, even if international investors might question the commercial value.

"I think we can demonstrate to investors that it actually pays over time to have that spare capacity, and the second thing is they are going to have to accept it. It is part of the package," he says. "You are buying into the lowest-cost producer, the most capable producer of oil and gas, and of course you are buying into the best relationship between a government and an oil company."

Asked if the kingdom was looking expand its production capacity beyond the current 12.5 mbpd, Falih does not rule out the possibility. "I think we are comfortable, given the levels of inventory and the spare capacity available for Saudi Arabia, I do not see a need for us to make that call any time soon," he says.

A few issues with the Saudi government on taxation still need to be worked out prior to the IPO. "I do not call these restructuring, but it requires extensive rewiring of our financials and relationship with the government to allow the IPO to take place," he says.

Other issues include limiting Aramco’s involvement in non-oil projects, such as construction of infrastructure, that at times were not profit-driven and rather carried out for social development. Aramco was called upon to build universities and stadiums in the past, as the most efficient project manager in the kingdom.

Projects of that nature "need to be more clearly delineated, and the company will do them for profit, if the government ever needs Aramco to do it," Falih says.

In his message in the Annual Review Falih says seen from a long-range perspective, challenging times are also times of opportunity. Continued economic development and rising standards of living will propel worldwide growth in energy demand, but declining investments by energy producers raise concerns about another cycle of supply constraints and therefore more market volatility. Saudi Arabia, under the leadership of King Salman, is committed to sustaining its investments in hydrocarbon-based energy.