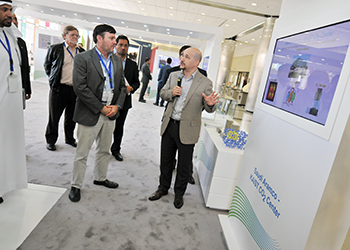

Abouraya ... increasing operational efficiencies

Abouraya ... increasing operational efficiencies

Zamil’s new Dammam shipyard was commissioned in April 2015 and by the addition of this brand new yard, the company’s new subsidiary, Zamil Shipyards, now manages and operates three shipyards – two in Dammam and one in Jeddah

Zamil Offshore, the largest offshore and marine services provider in the Middle East, is expanding in the region besides going through a process of comprehensive restructuring, spinning off its business units into three subsidiaries – Zamil Marine, Zamil Offshore Construction and Zamil Shipyards.

During the second quarter of 2016, Zamil Offshore, opened a new affiliated company in Abu Dhabi, UAE – Al Zamil Offshore Services LLC – to work mainly in chartering out some of its offshore vessels in the UAE and at the same time market its very specialised shipbuilding, ship and rig repair services regionally, says Hassan Abouraya, consultant engineer and Business Development/International Marketing & Risk Management Executive.

Abouraya says despite the current low market conditions, Zamil Offshore, a closed joint stock company wholly owned by Zamil Group HoldinAg and founded in 1977 as a 100 per cent Saudi firm, is focusing on increasing the operational efficiencies of its vessels and shipyards to cut costs, rather than crimping investment. This is keeping in mind that Saudi Arabia’s national oil company Saudi Aramco will not cut funding to its key oil and gas production capacity projects, despite the current market conditions, he says.

Zamil Offshore’s scope of work covers offshore marine services, ship chartering, ship chandelling, offshore and on-shore engineering & construction services including hook-up business, shipbuilding, ship & rig repair and sea ports operation and management.

One of the spun-off subsidiaries, Zamil Marine manages 73 offshore support vessels (OSVs). Zamil owns 68 of them while five are brokered. Zamil Offshore’s fleet includes diesel electric and Rolls Royce UT 733-2 anchor handling tug/supply/safety vessels, DP-2 multi-role diving/ROV support vessels, supply boats, work boats, utility boats, crew boats and three jack-up self-propelled lift boats. The average age of Zamil vessels is about seven years while the utilisation rate peaks to 98.3 per cent, he says.

The majority of the vessels in Zamil’s fleet are on long-term charter with Saudi Aramco.

Zamil Marine Operations owns and operates vessels including 29 anchor handling/supply/safety tugs, six DP-2 multi-role dive support vessels, 11 workboats, one supply vessel, six dive support vessels, six utility vessels, eight crew boats and three jack-up self-propelled lift boats.

The company’s fleet continued to grow, points out Abouraya. The 2015 additions included two-dive support shallow draft vessels Zamil 601 and Zamil 602 built at Zamil’s own new Dammam shipyard and two multi-purpose fast crew boats Zamil 105 and Zamil 106 acquired from Hong Kong. The 36 m crew boats have a deck space of 94 sq m and passenger seating capacity of 70. They are designed to carry 50 tonnes of cargo, he says.

"The sagging international price of crude oil has affected our operations especially in the offshore vessels chartering segment. Many world players especially from South East Asia have come to our region to compete against us in the Aramco long-term chartering tenders.

"Average OSV chartering rates globally have dropped significantly since last year and the big players in the Middle East – Saudi Arabia, UAE and Qatar – succeeded in damping the region’s day rates. Aramco as well as the other regional oil producing companies started re-negotiating most of the existing offshore vessel chartering contracts," says Abouraya.

He says, however, demand in the Middle East OSV market is expected to remain positive, driven by Saudi Arabia, UAE and Qatar requirements, although the global market remains prone to excessive tonnage.

Nobody can predict when the oil global oil prices will stabilise especially with the return of Iran and maybe Iraq and Libya to the oil export market.

COMPETITION

Abouraya says: "We are currently facing competition from a number of offshore companies deploying their vessels in our region including Tidewater, Swire, Topaz, Halul and Posh. We have already lost some chartering opportunities to them and are struggling to keep all our vessels employed."

On competition in offshore construction, he says: "We are slightly affected, but in general, we are still in good situation, especially since the award of Aramco contract to us for the management and operation of their West Pier ship repair facility, which includes floating docks, piers and the west pier marine workshops. This new contract covers repair, refit, modification, conversion and complete overhauls to the Saudi Aramco marine fleet, repair of vessels navigation equipment and repair of Aramco pollution equipment."

SHIPBUILDING, SHIP & RIG REPAIR

Zamil’s new Dammam shipyard was commissioned in April 2015 and by the addition of this brand new yard, the company’s new subsidiary, Zamil Shipyards now manages and operates three shipyards – two in Dammam for shipbuilding and ship repair and one in Jeddah for ship repair, he explains.

Generally, Zamil Shipyards focuses on building offshore and harbour service vessels. So far, 50 diversified offshore vessels, harbour tugs, port service units, navy tugs and coast guard surveillance vessels have been built and delivered. Of them, 25 joined the Zamil fleet under long-term charter contracts to Saudi Aramco.

Zamil shipyards’ standard building programme includes offshore support vessels, anchor handling tug/safety vessels diesel electric and Rolls Royce UT designs; maintenance/workboats, utility boats, multi-purpose vessels, platform supply vessels and diving support vessels. As to harbour service, it has built and delivered harbour tugs 35, 45 and 70 TBP, and harbour miscellaneous services units including a buoy handling vessel, mooring and pilot boats.

The two Dammam shipyards together offer 18 slots for building and repair of all kinds of vessels up to 7,300 tonnes in weight and 102 m in length. Dammam Shipyards has a total 0f 1.3 kilometre of repair / outfitting quay with 6 to 8 metres water depth.

The Jeddah yard offers two floating docks which enables it to offer docking for all types of merchant and naval vessels up to 215 m.

In response to competition in the segment, the company has started implementing a diversification strategy. It has built and delivered a series of vessels for the defense and security for local and regional customers, three tugs for the Saudi Royal Navy and four surveillance/logistics vessels for export to the Kuwaiti Coast Guard. "Currently, we do not have any new building orders. Our eastern shipyards are concentrating on rig repairs and ship repair.

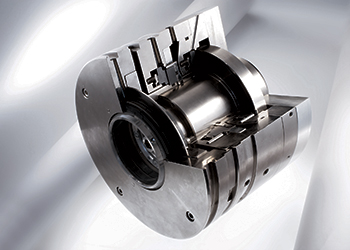

"To increase the competitive advantage of our shipyards we have started establishing a Saudi Maritime Cluster for in-house licensed repair centres at our Dammam and Jeddah shipyards. We have some agreements in place with MTU and Sparrow, and others are under negotiation," Abouraya adds.