The United Nations has recently approved the first methodology under Article 6.4 of the Paris Agreement, representing an advancement in the realm of global carbon markets.

This initiative marks

the beginning of a new phase in international carbon trading, allowing

countries and companies to offset emissions under a unified global standard,

reported Carbon Credits.

Key Features of

Article 6.4

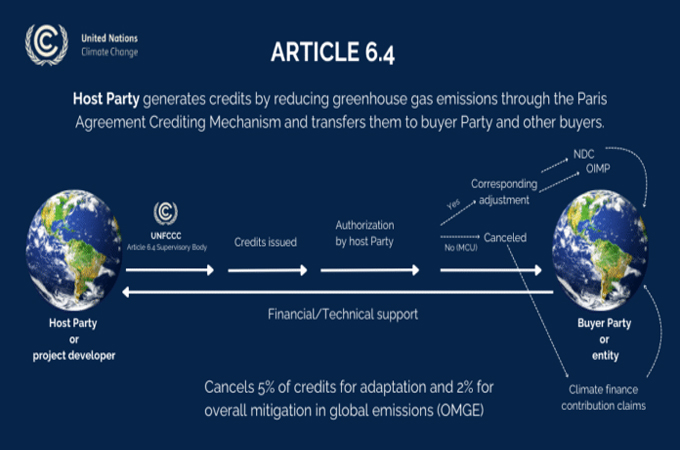

- Global Market Creation: Article 6.4, also known as the Paris

Agreement Crediting Mechanism (PACM), establishes a platform where

countries can trade verified emission reductions. This mechanism aims to

ensure that carbon credits are derived from real and measurable emission

cuts, enhancing the credibility of carbon trading.

- Replacement of the CDM: The new methodology replaces the Clean

Development Mechanism (CDM) from the Kyoto Protocol, which registered over

7,800 projects from 2006 to 2020. This transition aims to improve the

quality and transparency of carbon credits in the marketplace.

- Support for Renewable Energy: The first approved method specifically

supports renewable energy projects, with a focus on small wind and solar

developments in developing countries. These projects are pivotal in

reducing greenhouse gas emissions and expanding access to clean energy.

Financial

Implications

- Climate Finance Goals: At COP29 in Baku, world governments

committed to increasing climate finance for developing countries to at

least $1.3 trillion annually by 2035. This funding will come from both

public and private sources, with developed nations pledging to mobilise

$300 billion each year.

- Impact on Emissions: The World Bank estimates that

cooperation under NDCs could potentially reduce emissions by up to 5

billion tonnes annually by 2030, providing a clear pathway for countries

to meet their climate targets.

- Market Growth Potential: Experts predict that global demand for

carbon credits could reach 2 billion tonnes by 2030 and surge to as much

as 13 billion tonnes by 2050, signaling robust growth in carbon trading

markets.

Integrity and

Transparency

Article 6.4 aims to

address previous criticisms of carbon markets, particularly concerning weak

integrity and unclear reporting standards. Key measures include:

- Independent Audits: All projects must pass rigorous checks

by independent auditors before earning credits, ensuring that only

verified emission cuts are recognised.

- Digital Tracking: Each carbon credit will come with a

digital record, allowing buyers to trace its origin and impact, thereby

enhancing accountability and transparency.

- Strict Monitoring Framework: The Supervisory Body’s framework will

set clear baselines for emissions, measure reductions over time, and

monitor performance using standardised tools.

Business and Market

Response

The approval of the

first methodology is expected to attract significant interest from the energy

and finance sectors:

- Market Value Growth: The voluntary carbon market was valued

at about $2 billion in 2023 and is projected to grow to over $100 billion

by 2030 as Article 6.4 trading gains momentum.

- Pressure on Companies: The new system will encourage companies

to purchase only verified and transparent credits, reducing the risk of

"greenwashing" and enhancing corporate social responsibility.

- Regional Exchanges Preparation: Carbon exchanges in Asia, Europe, and

Latin America are preparing to include Article 6.4 credits in their

offerings, which will help stabilise global carbon prices.

Social and

Environmental Impact

The new UN system

aligns with Environmental, Social, and Governance (ESG) goals and promotes

sustainable development:

- Job Creation: Renewable energy projects, such as solar

and wind farms in Africa and Asia, are expected to create millions of jobs

while improving air quality and energy access.

- Alignment with SDGs: The initiatives support the UN

Sustainable Development Goals (SDGs) for clean energy and climate action,

emphasising the interconnectedness of environmental and social benefits.

Future Outlook

While the approval of

the methodology is a significant milestone, challenges remain before the system

can reach its full potential:

- Additional Methodologies: The Supervisory Body will need to

approve more methodologies for complex sectors like forestry, agriculture,

and industry, ensuring accurate representation of emission reductions.

- Negotiations and Concerns: Ongoing negotiations between countries

will address concerns about potential delays in domestic emission cuts due

to reliance on carbon trading. However, proponents argue that this system

will open new funding avenues for clean energy and climate adaptation

projects.

- Funding Needs: Developing countries are estimated to

require about $4.3 trillion annually by 2030 to meet their climate and

energy goals, highlighting the critical role that Article 6.4 could play

in bridging this funding gap.

As the Supervisory

Body prepares for its next meeting before COP30 in Belém, Brazil, the focus

will be on expanding the system and ensuring it delivers real benefits for

people and the planet.