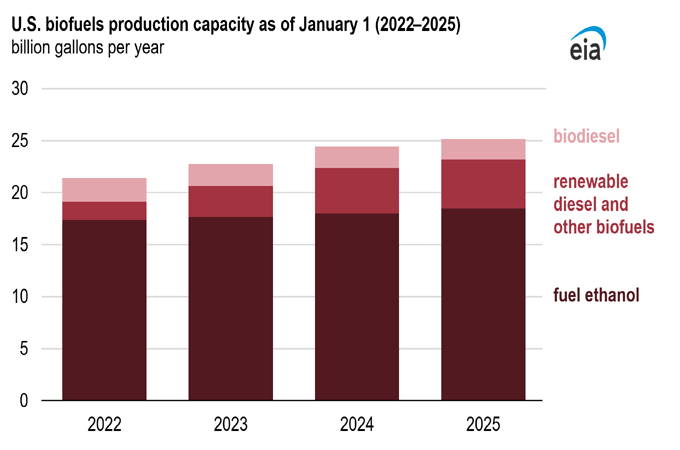

The pace of capacity additions for US biofuel production slowed in 2024, with production capacity increasing by a modest 3 per cent from the start of 2024 to the start of 2025, according to US Energy Information Administration (EIA) latest biofuels production capacity reports.

A deceleration in

production capacity in EIA’s category renewable diesel and other biofuels accounted

for most of the slowdown in growth.

Sustainable aviation

fuel (SAF), renewable naphtha, and renewable propane make up virtually all of

the other biofuels.

Renewable diesel

and other biofuels

Renewable diesel and other

biofuels production capacity increased just 391 million gallons per year

(gal/y) in 2024, less than one-third of the growth observed in 2022 and 2023.

In 2024, only two capacity additions came

online, both in California: Phillips 66’s conversion of its Rodeo refinery to

exclusively produce biofuels and the new Renewable Fuels plant in Bakersfield.

With the completed

conversion, the Rodeo plant has a capacity of 767 million gal/y, up from 180

million gal/y in last year’s report.

This increase makes it the second-largest

renewable diesel plant in the US, behind Diamond Green Diesel’s

982-million-gal/y plant in Norco, Louisiana.

US capacity growth

from the Rodeo expansion and the 138-million-gal/y Bakersfield plant was

partially offset by the loss of capacity at four facilities.

Monroe Energy and

Chevron stopped co-processing renewable diesel at their Trainer, Pennsylvania,

and El Segundo, California, refineries, respectively. Vertex Energy and Jaxon

Energy closed plants in Mobile, Alabama, and Jackson, Mississippi, respectively.

The loss of renewable

diesel capacity at four facilities reflects changes to biofuel margins and

petroleum refining margins since 2020.

Low refinery margins and rising

biofuel credit values in 2020 and 2021 prompted a wave of renewable

diesel capacity announcements.

As more of those plants started operations,

biofuel production began exceeding target volumes, and biofuel credit

values and margins decreased in 2023.

At the same time,

petroleum refinery margins were much stronger than their 2020 lows, resulting

in a slowdown in investments to expand renewable diesel capacity for the

upcoming years.

A notable shift in

2024 was the increased focus on SAF.

SAF is an alternative

to petroleum jet fuel that capture in other biofuels category.

Other biofuels

includes SAF, renewable heating oil, renewable naphtha, renewable propane,

renewable gasoline, and other emerging biofuels.

EIA combine other

biofuels with renewable diesel capacity because other biofuels are mostly

produced at renewable diesel plants as byproducts or, often in the case of SAF,

in place of renewable diesel.

Following the

completion of conversion projects in 2024, Phillips 66’s Rodeo plant can

shift about 150 million gal/y of its renewable diesel production

capacity to SAF, and Diamond Green Diesel can shift about 235 million

gal/y to SAF.

Biodiesel

In addition to slower growth in renewable diesel production capacity, biodiesel

production capacity decreased slightly.

In 2024, eight

biodiesel plants closed due to poor margins, resulting in a loss of about

100 million gal/y of production capacity.

Fuel ethanol

Unlike renewable diesel and biodiesel, US fuel ethanol production capacity

increased more in 2024 than in previous years.

Fuel ethanol accounts

for 73 per cent of all biofuels production capacity, with a total of almost

18.5 billion gallons of capacity per year.

Most of this

production is concentrated in Midwest states, where corn is produced for

feedstock.

Because US fuel

ethanol consumption has been somewhat flat in recent years, the increased

capacity is mostly contributing to growing exports of ethanol. -OGN/TradeArabia News Service