Dr Sameer Akbar

Dr Sameer Akbar

NATIVE to Oman there is a small, yellow and rather unique little bird. Known locally as Nassaj, derived from the Arabic verb ‘Nasajah’ – to tailor or weave – the bird has a distinctive nest. For one real estate developer in Dammam, this unprepossessing little bird is inspiring its nascent business.

“We see the bird as our model. The idea that it works sincerely and diligently to create a comfortable, loving home environment draws parallels with our own mission and vision,” says Dr Sameer Akbar, chief executive of Nesaj, a market entrant about a year ago.

It has been a rapid rise for subsidiary of Al Fozan Group, one of Saudi Arabia’s most successful conglomerates which started as a building materials supplier in the 1950s, and has since branched out into countless commercial and industrial sectors, from banks to petrochemicals. The move into real estate, and in particular affordable housing, has all the hallmarks of being another strategic masterstroke.

“We owe our strong start to Al Fozan and its vision and commitment to our strategic plans. Currently, we target middle income Saudi families with quality affordable housing, bridging the large affordability gap in the market,” Dr Akbar explains.

The pace of the company’s market entry is impressive. Its first project, Sakanat al Nada, was completed within 10 months and, says Dr Akbar, will be a useful market barometer ahead of the end-2013 completion of its second project, Sakanat al Safa, which will be double the size.

“A project normally takes between one and two years (to complete),” Dr Akbar points out, noting the unique social and demographic contexts in Saudi Arabia.

“The Saudi residential real estate market is unique and is changing rapidly,” he says. The 2009 global economic downturn, coupled with an increase in construction and land costs in Saudi Arabia triggered by speculation, has led to a more pragmatic view of family housing. Also, Dr Akbar adds, the fact more women are now working, and therefore may have fewer children, will see demand for smaller residential units rise.

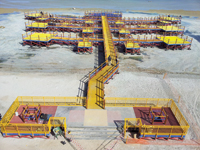

|

Nesaj’s Sakanat Alsafa Project |

He believes much of the stock in the market is currently overpriced. “A small villa or duplex in a good neighbourhood costs in the region of SR1.3 million ($346,000), which is beyond the reach of most middle income families,” he says. Building houses that are both affordable but also aesthetically pleasing and finished well is a challenge.

“We mitigate high build costs by working with smaller contractors who tend to have lower overheads,” the chief executive explains. He says Nesaj conducts its own project management functions in-house rather than being outsourced, and quality, yet cost efficient finishes are sourced from China.

Despite the clear potential for the affordable housing market, Dr Akbar believes moves to reform the home loan system in Saudi Arabia are too slow.

“As a Saudi I can get an SR500,000 loan from the real estate investment fund which would buy me a 240 sq m apartment at about SR2,000 per sq m.

“But there is no way a developer will sell you an apartment at SR2,000 – in today’s market it would be more like SR2,500. The fund ceiling must be raised.”

Dr Akbar is cautiously optimistic that the kingdom’s new mortgage law will stimulate demand for residential property. “The market is a moving target, and it is hard to speculate on what will happen.

But I believe the new mortgage law is positive, especially if it means the government can better control land speculation, which would boost real estate and construction markets, trickling down to the economy and job market,” he continues.

Going forward, the chief executive says Nesaj is working on a three-year financial plan to develop an entire project package, from design to infrastructure development to construction, with GCC investors, not just middle income Saudis, in mind.