New lateral re-entry technology has been applied to a Saudi Aramco well with highly successful results. OGN looks at the project, which involved drilling two short-radius horizontal sections off the main vertical wellbore Saudi Aramco has upgraded its capability to enhance crude oil production from existing wells, installing the world's first system to allow selective multiple reentries to horizontal wells drilled from vertical wells.

The installation of new lateral reentry system - self locating (LRS-SL) technology took place in a well in the Ghawar field, the largest in the world.

The application of LRS-SL technology enables the company to speed up remedial well production tasks without using expensive rigs, according to Wafik H Turki, acting general manager, Drilling and Workover.

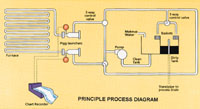

The project involved drilling two short-radius horizontal sections off the main vertical wellbore nine metres apart in two different directions within the well's targeted production zone, he said. They were drilled at depths of more than two kilometres.

Short-radius horizontal sections have drilling trajectories which turn from vertical to lateral in less than 30m.

They are drilled to expose more of a production zone to a wellbore, allowing the company to tap oil which cannot be fully accessed by a vertical well.

LRS-SL technology allows an operator to enter a dual lateral horizontal well selectively and easily to carry out remedial jobs such as well stimulation or zonal isolation in a very cost effective manner, Turki explained.

Installation of LRS-SL across the start of each lateral section enables oil to be produced from all three wellbores - the vertical and the two laterals - simultaneously.

This maximises the production potential of the well as a whole or from any of the wellbores, as desired.

The technology was supplied by contractors Sperry Sun Drilling Services and Dresser Oil Tools, divisions of the Texas-based Halliburton Energy Services.

Saudi Aramco has drilled numerous lateral sections from existing wells to capture the maximum amount of crude oil in the reservoirs it manages.

Along with Ghawar, the fields in which this technology is particularly appropriate include Qatif and offshore Berri, Marjan and Safaniya.

Saudi Arabia contains more than 80 oil and gas fields, many undeveloped.

Of the developed fields, 12 provide the bulk of Saudi Aramco's oil and gas production and contain most of the Kingdom's hydrocarbon reserves.

From the world's largest oilfield at Ghawar, to the world's largest offshore field at Safaniya and the Shaybah development, Saudi Aramco is the world upstream leader. There are less than 1,430 wells producing oil and gas. Remarkably, this is the lowest number in the world relative to the size of the Kingdom's production.

Saudi Arabia produces a range of crude oil grades, from heavy to super light. The lightest grades are produced onshore, while the medium and heavy grades come mainly from offshore. In general, Saudi Arabia has pursued a strategy in recent years of reducing medium and heavy oil production in favour of lighter crudes.

In order to maximise its oil revenues Saudi Arabia has increased Extra Light and Arab Super Light production at the expense of Arab Heavy and Arab Medium crude oil.

Although some capacity has been shut in, field rotations are being used to minimise reservoir pressure damage and preserve the option of bringing the capacity back online within a few months, if needed. Most of Saudi Arabia's spare production capacity is medium crude.

Some of the principal fields include:

Ghawar

The Ghawar field is the main producer in Saudi Arabia with around 4.6 million barrels per day (bpd) of 34 deg API Arabian Light crude.

Berri

Discovered in 1964 by Mobil, Berri is an onshore and offshore giant. It has 11 billion barrels of proven reserves of 32-34-39 deg. API oil recoverable at relatively low cost.

The field produces from several formations of the Upper and Middle Jurassic age, lying mostly at a depth of 8,300 feet.

The capacity has been expanded from less than 700,000 bpd in 1990 to 1.15 million bpd. Berri crudes are blended with lighter grades mostly produced from Abqaiq and partly from Qatif. The export blend is known as Arabian Extra Light, 38 deg. API with about one per cent sulphur.

Abqaiq

A super-giant field discovered in 1940, Abqaiq has 17 billion barrels of proven oil reserves recoverable at relatively low cost.

The oils are reservoired in Upper and Middle Jurassic formations, as in the case of Berri, but at a depth of 6,690 feet in most cases.

The field was expanded in 1994 to produce 850,000 bpd of 35-37 deg. API oils with 1.32 to 2.28 per cent sulphur. This has added 165,000 bpd to the stream producing Arabian Extra Light.

Abqaiq's crudes and those of Berri are mixed at blending facilities built at Abqaiq to produce the Arabian Extra Light grade.

Hawtah

Since 1994, the Hawtah Trend (also called the Najd fields), which includes the Hawtah field and smaller satellites (Nuayyim and Hazmiyah) south of Riyadh, has been producing around 200,000 bpd of 45 deg to 50 deg API, 0.06 per cent sulphur, Arab Super Light.

Overall, the Najd fields are estimated to contain 30 billion barrels of liquids and major natural gas reserves.

Khurais

Khurais is about 70 km long with a structure trending north and northwest.

It has three Upper/Middle Jurassic oil zones already tapped. The field's capacity now is 100,000 bpd.

The total oil reserves in place at Khurais is believed to exceed 20 billion barrels, though only about seven billion barrels would be recoverable.

Offshore fields

Offshore production includes Arab Medium crude from the Zuluf (more than 500,000 bpd capacity) and Marjan (270,000 bpd capacity) fields and Arab Heavy crude from the Safaniya field.

As of the middle of last year, Saudi Arabia was producing around 57 per cent Arab Light, 15 per cent Arab Medium, 12 per cent Arab Heavy, and 11 per cent Arab Extra Light.

The Saudi-Kuwaiti Neutral Zone contains about five billion barrels of proven oil reserves.

Within the Neutral Zone, Japan's Arabian Oil Company (AOC) operates two offshore fields (Khafji and Hout), with crude production of about 300,000 bpd.

Texaco, meanwhile, operates three onshore fields (Wafra, South Fawaris and South Umm Gudair), with current crude oil production of more than 200,000 bpd.