ORC planning expansions

ORC planning expansions

Oman Refinery Company (ORC) said it had signed a $140 million syndicated loan with a consortium of local and foreign banks to partly fund its expansion projects.

"Oman Refinery will use the fund for partly financing its expansion, which include an isomarisation (plant), Muscat-Sohar pipeline, a terminal facility and a power co-generation plant", said ORC chief executive officer Adel Abdulaziz Al Kindy.

"The capital expenditure of these projects is estimated at $320 million," he added.

One bank official said the tenure of the syndicated loan was seven years, but he declined to divulge the interest rate saying that it is linked with the London Inter-Bank Offer Rate (Libor).

Led by Gulf International Bank, the participating banks were Oman International Bank, Arab Bank, Oman Arab Bank, Commercial Bank of Qatar, National Bank of Dubai and Bank Dhofar.

In February, Oman awarded an $86.8 million contract to Athens-based firm Consolidated Contractors Company (CCC) to upgrade its 85,000 barrels per day refinery and build a new isomarisation plant.

Oman is building a second refinery in the northeast port city of Sohar which is expected to produce 75,000 bpd from April 2006.

Meanwhile, an agreement to create a joint venture company for developing a modern industrial gas production unit was signed.

ORC has joined hands with industrial gases giant Air Liquide of France, among other investors, to create Air Liquide Sohar Industrial Gases LLC (Alsig) in which Omani business houses Mohsin Haider Darwish LLC and Omar Zawawi Establishment (Omzest) are also taking part.

Alsig is envisaged as a state-of-the-art unit with an initial capacity to manufacture 200 tonnes per day of nitrogen.

In later phases, the plant will be upgraded to produce oxygen and other industrial gases, depending upon demand by industries located within the Sohar Industrial Port complex.

Air Liquide, which has a majority 50.1 per cent stake in the Sohar venture, is a world leader in industrial and medical gases and related services.

Oman Refinery has 29.9 per cent of the equity in Air Liquide Sohar, while MHD and Omzest have a 10 per cent stake each.

Alsig has obtained a concession from Sohar Industrial Port Company (SIPC), which manages the port and industrial zone, to exclusively supply industrial gases to companies operating within the zone.

Oman Refinery is developing the $1 billion refinery at Sohar jointly with the Omani Government, and is the main provider of feedstock and utilities to the new refinery.

At the signing ceremony, Oman Refinery also inked an agreement to lift the new plant's initial output of nitrogen, which is destined for the Sohar Refinery and associated Oman Polypropylene projects.

Further offtake agreements are also expected to be signed in the future as new industrial gas-dependent industries progressively come on stream at Sohar.

According to Wilfried Manet, general manager of Air Liquide Sohar Industrial Gases, work on the facility will commence in the fourth quarter of this year.

The plant is expected to be operational by March 2006, with deliveries of nitrogen due to commence on April 1, 2006, he said.

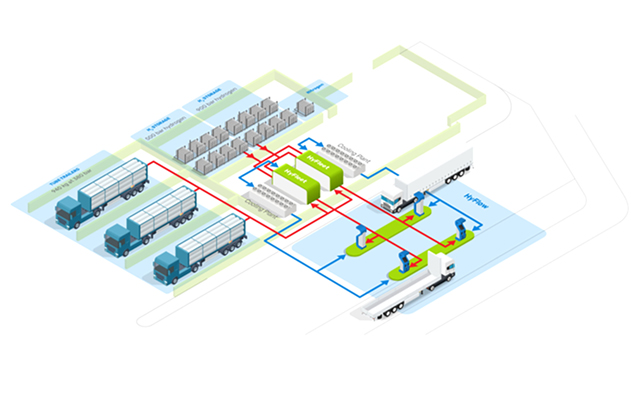

The gas will be supplied by pipeline to the consumers, he said, adding that a total investment of around $10 million is envisaged in the first phase, Manet added.

-is-one-of-the-world.jpg)

-(4)-caption-in-text.jpg)

.jpg)

.jpg)