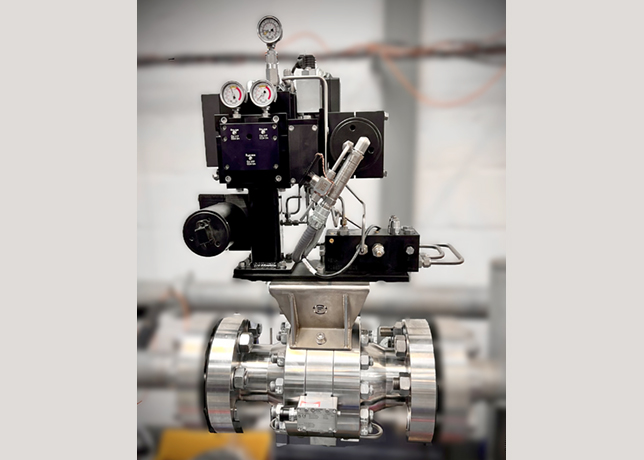

The signing of the financial deal

The signing of the financial deal

A polypropylene companY under construction in Oman will help meet local demand, leaving a major portion to be exported.

Oman Polypropylene LLC (OPP) will produce various grades of polypropylene used in a range of products from non-woven bags to household furniture and diapers.

The $320-million plant, which will produce 340,000 tonnes of polypropylene in the first full year, is being built in the Special Economic Zone in Sohar, northern Oman. The facility, first of its kind in the Sultanate, will be ready in mid-2006 but commercial production begins in September of the year, said chief executive officer Mohammed Benayoune.

The plant is using technology from Novolen Technology Holdings, Germany, while GS E&C, formerly known as LG Engineering & Construction, is building the plant. The major stockholder in OPP is state-owned Oman Oil Company with 60 per cent of the shares. LG International of South Korea holds 20 per cent with Kuwait-headquartered Gulf Investment Corporation (GIC) also holding 20 per cent.

"Demand is very high and prices are currently good at between $900 and $1,100 per tonne," said Benayoune. "Oman's demand from the production will be 40,000 tpy. The purpose of this plant is to support domestic industries," the official said.

"Demand is going up 5 to 6 per cent per year in Oman. We'll be the driving force. We'll be advising people and helping them to do things with polypropylene."

Among the major Omani buyers of polypropylene will be Khaleej Polyropylene which makes biaxial oriented polypropylene (BOPP) film.

OPP has signed an offtake deal with LG International to lift the entire volume, but OPP has the right to bring down the volume to 200,000 tonnes per year. "OPP territory spans over the Indian Subcontinent, the Middle East including Iran and East and South Africa," said Benayoune.

Feedstock for the plant will come from the next-door Sohar Refinery, which is under construction and expected to be ready around the same time as OPP.

Propylene as feedstock will also be available from another plant, Oman Petrochemical Industries Company, which is also under construction.

A financing deal for the OPP project was signed by the lead arrangers Apicorp, Arab Banking Corporation, BNP Paribas and HSBC in May 2004.

The financing was the fastest as it took just three weeks from mandating the lead arrangers to signing the finance and project documents. OPP got the Middle East Petrochemical Deal of the Year 2004 award under the title "fast and unfettered."

-is-one-of-the-world.jpg)

-(4)-caption-in-text.jpg)

.jpg)

.jpg)