Aramco ... investing in expansion

Aramco ... investing in expansion

SAUDI Aramco is committed to playing a leadership role in creating new job opportunities for the kingdom’s citizens that will harness the talent and potential of coming generations, the oil giant says in its 2012 Annual Review.

As part of the effort to shape tomorrow, in 2012 Aramco continued the expansion of the company’s business portfolio further downstream into chemicals, which is important for the development of conversion industries and for attracting investment to the kingdom.

New manufacturing plants and projects will create opportunities for the kingdom’s youth. Aramco is leading the development of a globally competitive energy services sector in the country that will create hundreds of thousands of direct and indirect jobs.

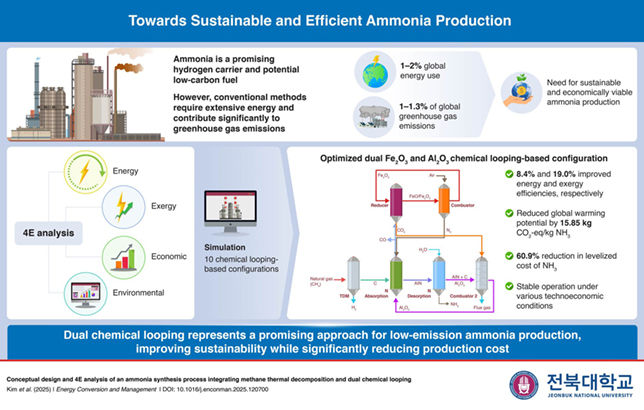

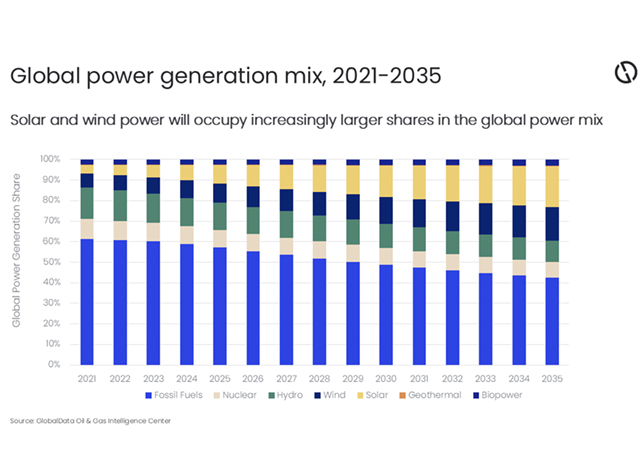

It is exploring renewable and alternative energies, including wind and solar, which will help create even more opportunities for the company and the kingdom.

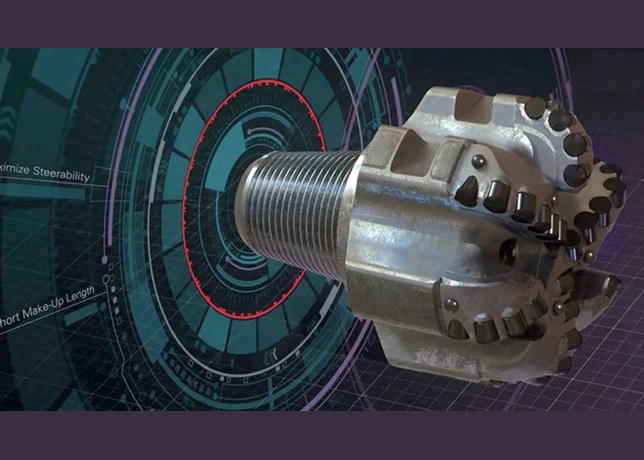

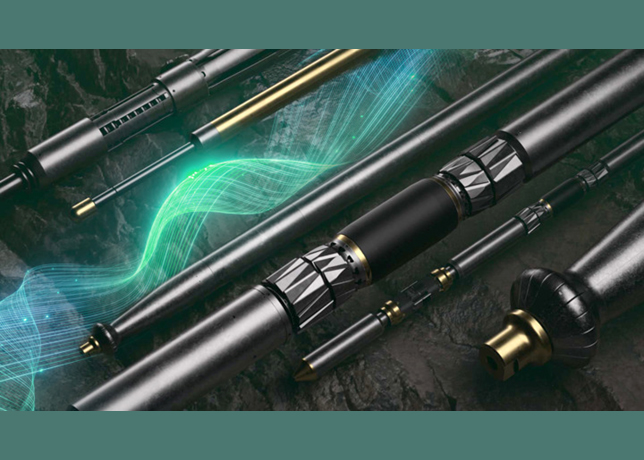

In 2012, as it continued to pursue new energy sources, Aramco made its first foray into the unconventional gas arena, proving that substantial shale and tight gas deposits exist in Saudi Arabia.

The Unconventional Gas Initiative will contribute to the company’s strategic intent in many ways. Saudi Arabia’s supplies of unconventional gas will supplement its supplies of conventional gas resources and help meet the kingdom’s energy demand.

|

|

Sadara ... the focus shifts to petrochemicals |

In addition, the unconventional gas resources Aramco identified in 2012 will increase the total gas share in the kingdom’s energy mix and save substantial volumes of oil for future export and further extending Saudi Aramco’s position as a leading supplier of energy to world markets for generations to come.

Although the cost of delivered unconventional gas is higher than most conventional gas, it is an important strategic and economic choice for the company.

Unconventional gas will serve as a substitute for higher value liquid fuels such as diesel, residual fuel oil and crude oil that would otherwise be used to fuel the electric power and water-desalination needs of the kingdom.

Saudi Aramco is investing in innovative technologies to reduce the higher cost of producing unconventional gas, which offers opportunities to more efficiently manage domestic demand. Following on the company’s success in discovering these resources, in 2012 Aramco continued to explore and apprise programmes in three prospective areas for unconventional gas in the kingdom: in the Northwest, South Ghawar and condensate-rich shale gas in the Rub Al Khali.

These efforts were aimed at acquiring the data needed to help the company make the right decisions as to where and how to invest in order to accelerate the delivery of commercial production of unconventional gas. These projects are part of the company’s wider Unconventional Gas Initiative, which became fully operational in 2012 when multidisciplinary teams, made up of Saudi Aramco professionals and industry experts with extensive experience, began appraisal drillings.

In 2012, Aramco made another major step toward further optimising the company’s crude oil mix portfolio. Aramco developed a strategy that will reinforce the long-term sustainability of the company’s crude oil production into the next century.

This crude oil mix strategy is designed to help the company maximise the value it creates upstream, while taking into account, and making the most of, the opportunities it has downstream.

During 2012, Aramco reviewed all of the company’s reservoirs, meticulously identifying the crude oil mix they will be able to deliver in the short and long term. Going forward, Aramco will rely on this information to help the company continue to introduce new best-in-class reservoir management principles for optimal development and production. This, in turn, will help the company maximise the company’s hydrocarbon recovery, maintain the highest safety standards and ensure reliable operations – while operating in an environmentally responsible manner.

Optimum stewardship of the kingdom’s endowment of oil reserves will anchor the company’s success and will continue to contribute to the economic wellbeing of Saudi Aramco and Saudi Arabia for many decades to come.

|

|

Aramco ... creating value |

In addition to undertakings in unconventional gas and optimising the company’s crude oil mix production, Aramco has embarked on a number of new programmes and joint ventures.

These projects are contributing to the company’s goal of becoming a leading world-class integrated energy firm and to create value for it and the kingdom through asset and business integration and the application of leading technologies.

In 2012, Saudi Aramco and the China Petrochemical Corporation (Sinopec) formed Yanbu Aramco Sinopec Refining Company Limited (Yasref), a joint venture that will construct, own and operate a full conversion refinery in Yanbu Industrial City.

Saudi Aramco and Sinopec have a long and successful history of joint initiatives that develop and execute world-class mega-projects. Yasref is Sinopec’s first international downstream investment and ushers in a new chapter of partnership with Saudi Aramco.

The joint venture refinery will be a world-class, full-conversion refinery using 400,000 bpd of Arabian Heavy crude oil. It will produce over 13.5 million gallons per day of ultra-clean transportation fuels for international and domestic markets as well as other high-value refined products.

Yasref is expected to deliver, within a few years of operation, significant annual revenues and generate about 6,000 direct and indirect jobs for Saudis. In addition to direct hires, hundreds of Saudis have already joined the company’s apprentice programme, with the majority assigned to future jobs in operations and maintenance.

Yasref’s primary contractors will hire and train many Saudi engineers and technicians in various technical and administrative fields during the project’s construction phase, contributing to the kingdom’s Saudisation programme. It is expected that approximately 60 per cent of the total project value will be spent in Saudi Arabia through detailed engineering executed in local design offices, material procurement from local manufacturers and suppliers, and utilisation of Saudi construction companies.

During 2012, significant progress was also made on the design and execution of Saudi Aramco’s Jazan Refinery Project, which will be the nucleus for industrialisation in the southwestern region.

When the refinery begins operations in 2016, it will process 400,000 bpd of Arabian Heavy and Arabian Medium crude oil to produce gasoline, ultralow sulfur diesel, benzene and paraxylene.

The refinery will be integrated with the world’s largest Integrated Gasification Combined Cycle (IGCC) complex, which will economically and efficiently generate 3,000 MW of electricity to cover the refinery’s needs and enable creation of small industries nearby as well as provide power for cities in the area.

An adjacent marine terminal on the Red Sea coast will accommodate Very Large Crude Carriers (VLCCs) for the supply of crude oil to the new refinery.

|

|

Pertamina ... looking at a new joint venture |

Only three other refinery projects on the same scale as the Jazan, Yasref and Satorp refineries have been commissioned worldwide in the past 20 years. The Jazan Refinery and Terminal will be wholly owned by Saudi Aramco and will become an integral part of the company’s refining network to meet the kingdom’s energy demand and to export surplus fuels to international markets. The project will provide more than 1,000 direct and 4,000 indirect jobs.

The Saudi Aramco Total Refining and Petrochemical Company (Satorp) is a joint venture with France’s Total, which will construct a 400,000-bpd full-conversion refinery with integrated petrochemical production in Jubail.

Following pre-commissioning at the end of 2012, a gradual start-up of process facilities for the refinery is planned for 2013. Satorp has already hired more than 700 employees and has 350 apprentices in training at Saudi Aramco facilities and refineries.

When completed, it will be the seventh-most complex refinery in the world, converting Arabian Heavy crude oil into high quality products. The Satorp refinery will also be the first producer of petroleum coke and paraxylene in the kingdom.

The refinery will produce significant quantities of primary petrochemicals directed both to downstream conversion and exports. These petrochemicals will include 700,000 metric tonnes per annum (mtpa) of paraxylene and 200,000 mtpa of polymer-grade propylene, among others. Studies were also initiated in 2012 to explore further petrochemical integration opportunities around Satorp.

PetroRabigh is a joint stock company initially founded by Saudi Aramco and Sumitomo Chemical Co as a joint venture. The new Rabigh II initiative will further expand and complement the Rabigh I petroleum refining and petrochemical production complex and facilities.

In 2012, the Rabigh Phase II Project received a positive final investment decision from Saudi Aramco and Sumitomo Chemicals, based on the outcome of a joint feasibility study. The project will have great synergies with the existing PetroRabigh complex and produce a variety of value-added petrochemical products, most of which are newly introduced in the kingdom.

Rabigh Phase II will create more than 1,200 direct jobs and thousands more indirect jobs in the Plus Tech Value Park. Rabigh Phase II is an integral part of Saudi Aramco’s refining-petrochemical integration strategy.

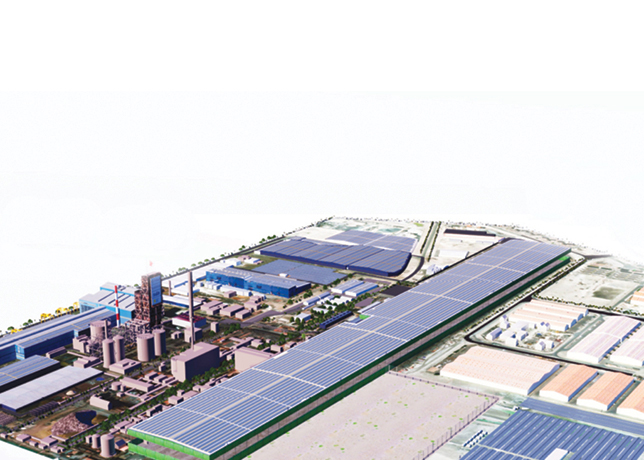

Saudi Aramco and The Dow Chemical Company, the leading speciality materials company in the world, have formed the Sadara Chemical Company (Sadara), a joint venture that will construct, own and operate a world-scale integrated chemicals complex in Jubail Industrial City II in Saudi Arabia.

Work on Sadara made significant progress during 2012. Engineering work reached 49 per cent completion and construction activities geared up, with almost 7,000 workers already on the site by year-end. Sadara continues to build its staffing levels and has created job opportunities by hiring more than 1,000 Saudi employees. Once complete, the chemicals complex will be the largest petrochemical facility ever built in one single phase.

Sadara and the adjoining conversion parks, administered by the Royal Commission of Jubail and Yanbu, will establish a world-scale manufacturing footprint that delivers a full range of value-added, performance products destined for the emerging markets of Asia, the Middle East and Africa.

Sadara is a strategic investment for Saudi Aramco as well as an opportunity to support the kingdom in terms of economic development and diversification and job creation. The Sadara project and its conversion park will provide more than 20,000 direct and indirect job opportunities and produce approximately 3.2 million tonnes of chemical and plastic products per year.

Sadara will utilise commercially proven, advanced technologies licensed by the Dow group entities and third parties to produce an extensive and diversified slate of chemicals and plastics that will introduce new value chains and performance products to the kingdom.

|

|

Aramco is investing in process optimisation |

Sadara will also facilitate the development of conversion industries in Jubail and in the kingdom in general. Sadara and PetroRabigh I and II epitomise the company’s vision of becoming a leading global player in chemicals and are expected to remain the cornerstone for the company’s chemicals business for many years.

The establishment of Saudi Aramco Asia Company Ltd (Aramco Asia) underscores the strategic importance of Asia to Saudi Aramco, and deepens the company’s presence in one of the world’s fastest growing regions. In 2012, the new Aramco Asia regional headquarters was officially opened in Beijing, with supporting branches in Shanghai and Xiamen.

The company’s international refining portfolio with partners in China, Indonesia and India while leveraging the company’s domestic and other international joint ventures.

Aramco Asia will provide a wide range of services, including marketing crude oil, NGL and chemicals products, joint venture coordination, procurement, inspection, research and development, project management, human resources development, government and public relations, and communications in the region.

Aramco Asia will bring together business operations in this vibrant fast-growing region under one entity and be unified in carrying out Saudi Aramco’s vision and strategy for all of Asia. Further, Aramco Asia will play an important role and be part of the building blocks that will contribute to Saudi Aramco’s corporate transformation to become a global leader in energy and chemicals by 2020. Aramco Asia also signed in 2012 a joint development agreement with PetroChina Company to consider Saudi Aramco’s participation in the 200,000-260,000 bpd grass-roots Yunnan Refinery Project. The project is expected to be completed in the second half of 2014.

In 2012, Aramco Asia and PT Pertamina (Persero) signed a Memorandum of Understanding to evaluate the economic feasibility of building an integrated refining and petrochemical project in Tuban, East Java, in the Republic of Indonesia.

The proposed refinery and petrochemicals project would process 200,000-300,000 bpd of crude oil and produce high-quality refined petroleum and petrochemical products to meet rising demand in Indonesia and elsewhere in Southeast Asia.

The project represents a bold opportunity for Saudi Aramco to invest and capitalise on opportunities in Indonesia and the broader Asian markets.

In 2012, Saudi Aramco supported the Fujian Refining and Petrochemical Company Limited’s (FRPC) Steam Cracker Debottlenecking Project. This project will revamp and expand the existing crude oil refining facilities from 240,000 bpd to 280,000 bpd and expand the petrochemical complex capacity from 800 kta (kilo tonnes per annum) to 1,100 kta.

The incremental volumes will primarily serve the Fujian market, where fuels and petrochemical demand is growing due to the development of the local and provincial economy.

As Aramco went into 2013, it began marketing from the company’s Aramco Asia offices the company’s share of the polyolefins produced by FRPC.

Sales of Saudi Aramco crude oil from Okinawa storage gained more traction in 2012 with a total volume of 3.97 million barrels. This forward logistical location allowed Saudi Aramco to better serve the company’s customer base in Japan, Korea and China with spot short-haul cargos and ensure that Aramco continues to grow the company’s global portfolio.

During 2012, as part of Saudi Aramco’s strategy to continue expanding internationally, Vela Marine (the wholly owned shipping subsidiary of Saudi Aramco), merged with the National Shipping Company of Saudi Arabia (Bahri) to create a formidable global shipping company. The merger, besides serving as an example of cooperation between national companies, is expected to provide leverage for development of a maritime industry in the kingdom and make a major contribution to the domestic economy.

Under this agreement, Saudi Aramco will sell and transfer its entire Vela fleet – consisting of 14 double-hull VLCCs; one single-hull VLCC used as a floating storage for fuel oil; five refined products carriers; and all Vela’s ship-based cadres and its land-based personnel – to Bahri, which will then have a 77-vessel fleet.

Under the long-term shipping contract, Bahri will become the exclusive transporter of crude oil sold by Saudi Aramco on a delivery basis.

At Saudi Aramco, leadership is not only about what Aramco does, but also how Aramco performs. Aramco not only strives to achieve excellence, it also works hard to sustain it through a structured approach designed to ensure that operational excellence remains a way of life.

The end result will be a Saudi Aramco that has solidified its leadership and fulfilled its ambition of becoming a leading integrated energy and chemicals company recognised globally for its reliability, efficiency, profitability and stewardship.

In 2012, Saudi Aramco developed a high-level strategy for operational excellence across all of the company’s business lines. The framework and respective governance structure will address key business and operational issues including outsourcing vs. in-sourcing, reliability and lifecycle economics, and procedures to drive further improvements in health and safety performance.

Implementing the strategy will achieve its goal to remain the company with the most effective and efficient operations, execution capabilities and controls possible.

During the past 20 years, Saudi Aramco has transformed into a multi-business company, increasing its scale, scope and complexity to meet upstream, downstream and domestic requirements. In just the last five years, the company’s capital programme has quadrupled in size.

During 2012, Aramco further optimised Saudi Aramco’s project delivery system to ensure it continues to deploy capital most efficiently, increase accountability and establish benchmarks for costs per activity, all of which help the company to be a more agile organisation. The company’s goal is to achieve the most from the money it spends. It involves proper investment in the right places and then ensuring that Aramco execute its projects as efficiently as possible.

In 2012, Aramco started to streamline its business processes to help make the company more agile, flexible and efficient so that it can respond more quickly to the dynamic markets it will be entering, such as chemicals and alternative energy.

Aramco is investing in process optimisation because developing sustainable and responsive processes will help the company’s leaders and employees to further develop the capacity and knowledge required to capitalise on future opportunities.

The company’s leadership engine initiative cuts across all business lines and everything it does. It influences the ways Aramco addresses the people element of the company’s business and ensures Aramco is prepared with the right people and leadership skills to help the company transform and achieve the its strategic intent.

This is what helps the company do more, create more and become more. Managing support 2012 was a year of major change for the company’s engineering and project management business lines. Due in large part to the emphasis on greater efficiency and cost effectiveness, two of the company’s business lines merged to form one major support centre of Saudi Aramco called Engineering, Capital and Operations Support (EC&OS).

The primary goal of the new business line is to provide reliable, safe and cost-effective operations support, execute the corporate capital programme and help create a competitive Saudi energy sector to support the company’s strategic direction.

In 2012, EC&OS continued focusing on maximising the company’s competitive advantage through sourcing and supplying products. Standardisation in production components, low transportation costs and the revolution of information processing and communication technology make it possible for a company such as Saudi Aramco to globally source raw materials, parts and semi-finished products at required locations, reducing delivery time and the overall cost without interfering with product quality.

EC&OS was able to execute a massive portfolio of capital and noncapital projects in 2012, in addition to providing engineering and operations support companywide. This new organisation is better positioned now to support company ambitions toward an integrated energy company and the company’s 2020 goals.

In 2012, Saudi Aramco continued to demonstrate leadership in safety and protection of the environment in all areas of the business. Aramco again reduced its lost time injury rate, to 0.11 per 200,000 work-hours, through the strong commitment exhibited by its management and broadly supported by its employees, and further enhanced by contractor awareness campaigns.

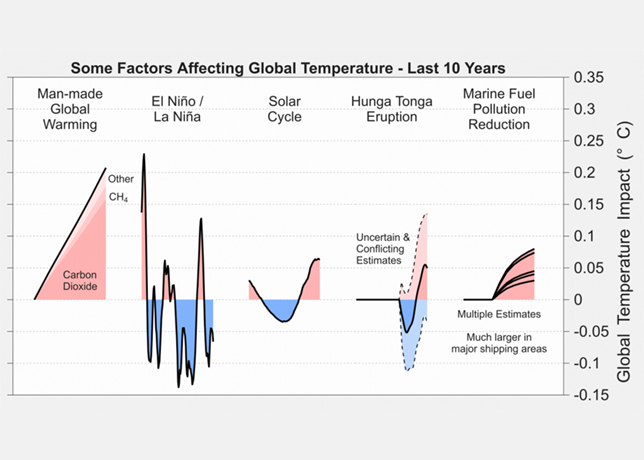

Saudi Aramco is also committed to its environmental targets. In the company’s role as one of the world’s leading suppliers of energy, Aramco continued in 2012 to proactively seek ways to address carbon dioxide (CO2) emissions.

.jpg)