Saudi Arabia is already pursuing alternative energy forms

Saudi Arabia is already pursuing alternative energy forms

SAUDI ARABIA’S surging domestic oil consumption – coupled with its inadequate supply growth – could turn the kingdom into a net oil importer by 2038, according to a Chatham House report.

Guzzling more than a quarter of its 11.1 million barrels per day (mbpd) production in 2011, Saudi Arabia is the fifth-largest oil consumer in the world. The kingdom even recently surpassed Germany’s consumption level, despite having less than one-third of Germany’s population and one-fifth of its economic output. Continued consumption growth, if left unchecked, could devastate the country’s economy in the coming years.

Demography partly explains this growing use of oil. The population has doubled since 1985 and demand has risen accordingly, but the main culprit is the kingdom’s growing economic prosperity tied with its reliance on oil-fired power generation.

Almost all of Saudi Arabia’s energy needs are met by oil and gas – and burning crude oil to overcome gas shortages has increasingly become the norm. Given that oil in particular accounts for nearly 90 percent of the country’s exports and state budget, it is no wonder that Saudi officials hope to rein in consumption as the kingdom continues to eat up more and more of its own export wares.

Rising consumption will have other impacts beyond the country’s energy-led economy. Although close to half of the Saudi economy is derived from the oil and gas sectors, less than 1 per cent of the workforce is employed in these industries.

To increase employment, the kingdom has become a very bureaucratic nation with over 80 per cent of its workforce in the public sector, analysts say. Similar to other Gulf countries, Saudi Arabia has responded to the Arab Spring with generous public-sector pay increases, highlighting how the country relies on oil revenues to deter political unrest. But diminishing oil revenues in the future could hinder Saudi Arabia’s ability to use its elaborate public sector and welfare system to combat political turmoil.

Saudi Arabia must therefore reduce its oil consumption so it can maintain large state revenues. The first step will require subsidy reform. The price of oil ranges from $5 to $15 per barrel, compared to a global market rate averaging over $110 since 2011.

The kingdom’s decision to set the price of oil far below export price is a significant opportunity cost in foregone state revenue – one that also encourages a culture of overconsumption and waste. Saudi Arabia’s poor or unemployed mostly do not benefit from subsidies as the biggest consumers of oil tend to be high-income groups and heavy industries (including the petrochemicals sector) – both of whom are paying unnecessarily bargain rates for oil and gas.

|

|

Aramco sucks up nearly 10 per cent of the |

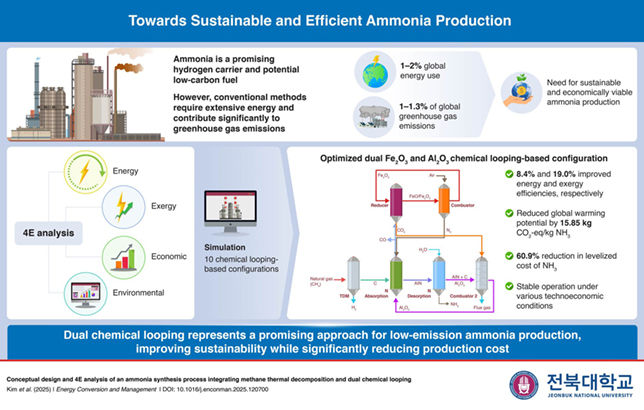

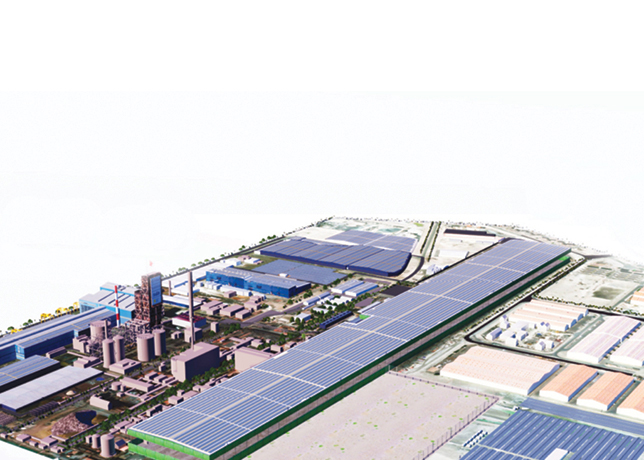

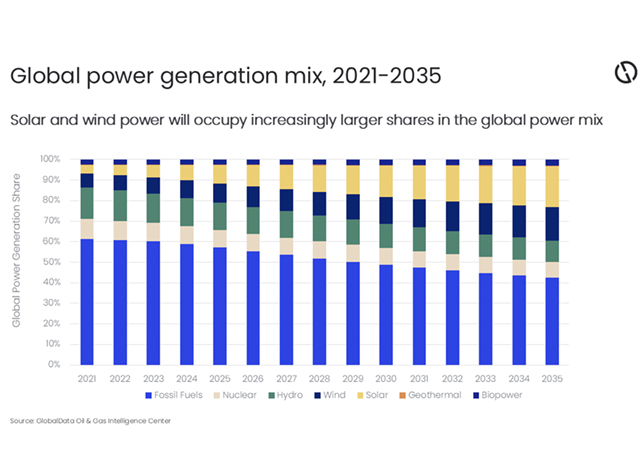

The second step will require diversifying the kingdom’s energy sources. Saudi Arabia is already pursuing alternative energy forms including nuclear and solar power. Plans are currently under way to construct 16 nuclear plants which are expected to meet one-sixth of the kingdom’s electricity needs by 2032 ($80 billion estimate), but these are limited and expensive ventures to be completed just six years before Saudi Arabia could (theoretically) become a net oil importer.

Less movement has been made so far on solar energy, and the kingdom is expected to release its first tenders for 500 to 800 megawatts of power generation capacity, just over 1 percent of its current consumption. Although plans are in place to have solar power generate 54 gigawatts by 2032 at a cost of $109 billion, there is no guarantee the projects will succeed.

Contrary to popular belief, the Arabian Desert is hardly an ideal spot for solar energy, as overheating and excess dust decrease the efficiency of solar panels.

Meanwhile, Saudi Arabia’s many oil-powered stations are expected to keep burning for year – even as five more are being built this year alone – further contributing to the issue at hand.

In the event that Saudi consumption cannot be contained, the kingdom will need to boost its production capacity to maintain its large and prized exporter status. Saudi Arabia already has most of the world’s spare capacity – it is currently pumping 9.3 million of its 12 mbpd potential. Yet, with oil consumption projected to rise above 4 mbpd by 2030 despite no expected growth in production capacity, more and more of Saudi Arabia’s subsidised oil will eventually be wasted on domestic needs.

Many analysts, however, are asking whether Saudi Arabia can increase its production capacity at all. According to WikiLeaks cables released last year, senior US and Saudi officials doubted this possibility in 2007.

Sadad Al Husseini, the former head of exploration at Saudi’s oil conglomerate Aramco, told US policymakers that his country’s production capacity would plateau at 12 mbpd within the next decade. The Saudi Oil Minister Ali Al Naimi said the kingdom did not plan to boost oil capacity from 12 to 15 mbpd by 2020, contradicting an earlier statement by Prince Turki Al Faisal, a member of the Saud royal family and a former head of intelligence.

That Saudi Arabia may be unable to increase its production capacity makes the need for slashing domestic consumption more paramount. However, if the kingdom is able to halt its current consumption, the sale of oil will remain quite lucrative in the long run as studies suggest that the demand for Gulf oil will outpace any future supply growth. China will increase its oil use by as much as two-thirds and India by more than double between now and 2030.

Even in the US, talk of a natural gas and “fracking” revolution masks some reports that cast doubt on claims that it will become more energy independent in the long run.

Furthermore, heightened demand for oil will place upward pressure on prices. The price has already risen from just over $60 per barrel in 2009 to over $110 today, and this has been quite profitable for Saudi Arabia as the world has few other options outside of Gulf oil.

Last year, for instance, the kingdom had state revenues that exceeded its forecast by over 80 per cent – driven entirely by higher-than-planned for oil prices.

Yet the region’s troubled politics, coupled with a global economic downturn, is delaying the grander, more comprehensive approach required to successfully diversify Saudi energy sources.

Considering that the kingdom’s appetite for its own oil also shows few signs of slowing down, it may not be long before Saudi Arabia’s role as the world’s principal source of oil is threatened. What this means for energy markets and the region’s political and economic life is hard to predict, but one thing is certain: it would fundamentally alter the Saudi state.

Saudi power-generating capacity has doubled in the past decade. Partly this is to mitigate the fearful heat: according to a report from Chatham House, a think-tank, air-conditioning units soak up half of all power generated at peak consumption periods.

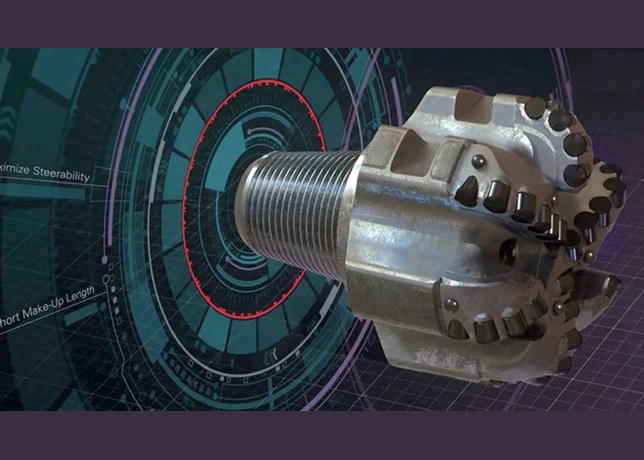

The second relates to economic structure. It takes energy to produce energy: pumps must be powered and vast quantities of seawater desalinated. Aramco, the Saudi state oil company, sucks up nearly 10 per cent of the country’s energy output. Attempts to diversify the Saudi economy beyond oil, gas and petrochemicals have not gone far.

The third reason for rising Gulf consumption is the inefficiency of domestic energy markets. Some 65 per cent of Saudi electricity is generated using black gold, even as successive price shocks and the relative inefficiency of oil generation have seen it all but phased out in rich countries. Oil is used with such profligacy because domestic consumption is massively subsidised.

According to the International Energy Agency, global oil subsidies added up to $192 billion in 2010. Opec countries accounted for $121 billion of the total.

.jpg)