KJO ... performing below expectations

KJO ... performing below expectations

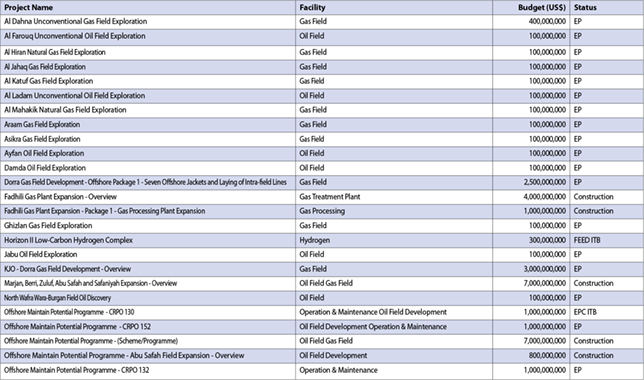

KUWAIT and Saudi Arabia are looking at ways to boost output from the Neutral Zone to make up for an extended maintenance period earlier this year, but will struggle to get the area’s offshore fields to pump the 350,000 barrels per day (bdp) that they hit in 2012, a top Kuwaiti official says.

The Neutral Zone, evenly split between the two Opec nations, is producing 300,000 bpd offshore and 220,000 bpd onshore, says the official. But the Khafji field, which makes up nearly all offshore production, produced far under its potential in the first quarter of this year due to 50 days of maintenance.

“The plan is to try to make up for the lost production during the maintenance period during the rest of the year,” the official says. But the official noted that it will be “very difficult,” as Khafji would need to produce flat-out at its design capacity of 350,000 bpd, which currently isn’t logistically possible. Khafji was producing near that rate late last year, but returning to those levels depends on debottlenecking infrastructure, says the official.

The official expects Khafji to average 270,000 bpd for 2013, meaning that combined output from the partitioned zone will likely fall below 500,000 bpd. Last year, production touched 570,000 bpd.

A more realistic timeline for Khafji to achieve the target of 350,000 bpd would be “next year, or the year after,” the official says. “Our operational plan is to see how to achieve this production level, and what debottlenecks we have to deal with to reach that,” the official adds.

The Neutral Zone is a 50-50 partnership of Kuwait Gulf Oil Co (KGOC), a subsidiary of state-owned Kuwait Petroleum Corp (KPC) and Aramco Gulf Operations Co (AGOC), a subsidiary of state giant Saudi Aramco. US major Chevron operates the Saudi share of the onshore partitioned zone, which includes the Wafra field.

Kuwaiti officials say Wafra could potentially add an additional 500,000 bpd if Chevron decides to move forward with development of the field’s heavy oil reservoirs.

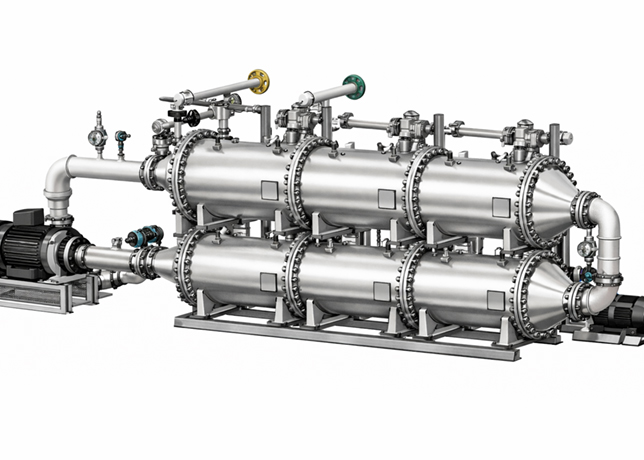

Chevron delayed a final investment decision on a massive steamflooding project at Wafra. The US major extended its ongoing large-scale pilot (LSP) in order to gain a better understanding of the complicated nature of injecting steam into the field’s carbonate reservoir to extract the heavy 18° API crude.

A significant output hike at Wafra could help compensate for other delayed upstream projects inside Kuwait, which are likely to jeopardise the Opec country’s ability to boost overall production capacity to 4 mbpd by 2020, up from around 3.2 mbpd.

The partners are continuing with the LSP in order to collect data, better understand the nature of the reservoir and evaluate how responsive the field will be to large-scale steamflooding. “We are making conceptual designs of the facilities and the full field development. When we are comfortable with results of the LSP, then we can start the Feed [front-end engineering design],” the official says.

Chevron says it expects to commence with the Feed phase for Stage 1 of the Wafra steamflood project in 2014. Stage 1 is expected to produce a maximum of 80,000 bpd, but it is not yet clear when Chevron plans to reach this target.

.jpg)