Aramco ... on the cusp of far-reaching changes

Aramco ... on the cusp of far-reaching changes

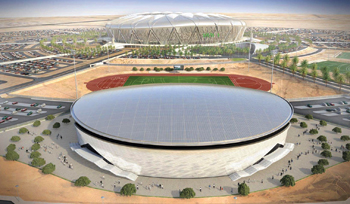

SAUDI Aramco, the state-owned mega enterprise of the world’s largest oil exporter, says it has designed and deployed a top-to-bottom, side-to-side re-examination of its businesses – and even of the way it conducts business itself – while pledging investments worth $400 billion over a 10-year period to keep oil production capacity steady and double gas production.

The national oil company (NOC) of Saudi Arabia will invest $40 billion a year over the next decade, says Saudi Aramco president and CEO, Khalid Al Falih, adding that the company expected an increase in capital spending for offshore projects.

“To meet forecast demand growth and offset global output decline, our industry will need to add close to 40 million barrels per day (mbpd) of new capacity in the next two decades,” Al Falih says.

“Although our investments will span the value chain, the bulk will be in upstream, and increasingly from offshore, with the aim of maintaining our maximum sustained oil production capacity at 12 mbpd, while also doubling our gas production.”

He warned that rising costs and global turmoil could lead to a lack of oil supplies in the future if companies did not make sufficient investments.

“We must put our money where our mouth is by making prudent and timely investments, balancing long-term objectives and short-term interests and meeting the energy needs of the future, while providing attractive investment options and delivering value to shareholders,” Al Falih says.

“At Saudi Aramco, as we solidify our upstream leadership while also diversifying our business portfolio, our investments will exceed $40 billion a year during the next decade.

“This will ensure that we efficiently meet the kingdom’s rising energy demand with gas for power and industry and refined products for transport, while also meeting the global call on our crude oil.”

However, he says costs are soaring. “At Saudi Aramco, project costs have roughly doubled over the last decade despite deploying cutting-edge technologies and applying our robust project management systems to mitigate cost escalation,” Al Falih says.

“These project challenges are driven in part by shortages and bottlenecks in our supply chain, including drilling contractors, shipyards, engineering, procurement and construction (EPC) firms, and materials and equipment suppliers, which have led to growing quality, schedule and cost pressures.”

Al Falih says fundamental problems within the industry, including rising costs, increasing technical challenges and the falling size of reserves at new locations would determine the price of oil, and the Organization of the Petroleum Exporting Countries (Opec) or the International Energy Agency (IEA) should not interfere in the market.

|

Naimi ... Aramco positioned for long-term growth |

On the downstream side, the company has earmarked investments exceeding $100 billion over the next decade.

“Globally, these investments will exceed $100 billion over the next decade alone and that is premised on our belief in the long term sustainability of oil demand,” Al Falih says.

“As a result of both global demographic growth and rising standards of living in the developing world we see global demand for oil growing by a quarter over the next 25 years,” he says.

Al Falih says Aramco’s refining capacity would be between 8 and 10 mbpd in the coming years, a figure exceeding the goal cited by Aramco in 2012 of 8 mbpd.

“In the years to come Saudi Aramco will have 8 to 10 mbpd of participate refining capacity primarily in the high demand growth markets of the Far East and of course here at home in the Middle East that will make us one of the largest downstream players on the planet by volume,” Al Falih says.

Mirroring the changes Al Falih indicated was the company’s Annual Review 2013, which says: “Successful organisations must keep pace with change, however, and with the whole world changing, the global community is calling on leading companies to find solutions to the grand challenges facing everyone.”

“We are expanding our business portfolio and asset base, re-engineering our processes and re-calibrating our behaviour, and becoming more engaged in some of the kingdom’s most pressing issues, including energy intensity, economic diversification, and the creation of new business opportunities for the private sector. All of these efforts are ultimately just means to an end,” the review says.

Saudi Aramco’s true goal is the realisation of its fullest potential while enabling the kingdom’s development in the broadest terms – energy is opportunity for all.

That means developing into a company that will not only change with the global energy landscape, but will lead that evolution.

According to the review, Aramco and its subsidiaries own or have equity interest in domestic and international refineries with a total worldwide refining capacity of 4.9 mbpd, of which its equity share is 2.6 mbpd, making it the world’s sixth-largest refiner.

Aramco is also looking to grow within the petrochemicals sector with two major projects.

It has a joint venture with Dow Chemical Co to build the $20 billion Sadara petrochemical complex in Jubail that is due to come on stream in the second half of 2015 is also expanding its petrochemical complex called PetroRabigh that it jointly owns with Sumitomo Chemical.

“That will take our total chemicals participate production capacity to more than 15 million tonnes per year,” Al Falih says.

However, Saudi Aramco is facing some big shifts in the world oil industry.

There is enough indication in the review to suggest that the fully integrated, global petroleum and chemicals enterprise is on the cusp of far-reaching changes.

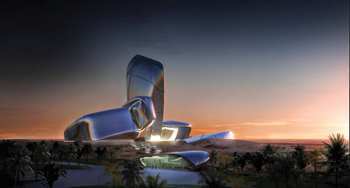

“We have embarked on ambitious corporate transformation guided by our Strategic Intent, our overall vision for Saudi Aramco through 2020,” the review states.

“These advancements will not only ensure that Saudi Aramco remains a global leader in crude oil and natural gas liquids (NGL) production and exports, but will also propel us into the top tier of chemicals companies worldwide and reaffirm our commitment to the kingdom’s future in a rapidly changing world.”

For Saudi Aramco, which is a world leader in hydrocarbons’ exploration, production, refining, distribution, shipping and marketing, to suggest there could be any question about remaining “a global leader” in crude oil production and exports is significant. The reference to rapid global changes is also noteworthy, indicating high levels of Saudi government concern with such developments as US shale oil and gas production, the emergence of complex integrated refining and petrochemicals projects in Asia and the unprecedented surge in Saudi domestic fuel and power consumption.

“Our business portfolio is being reshaped to meet evolving requirements in our upstream and downstream activities as well as across the kingdom as a whole. It is also expanding in scope and technological prowess to be become more integrated, global and diversified,” Aramco says.

|

Wa’ed ... helping a new generation of entrepreneurs |

The planned portfolio overhaul stands on three legs: expanding the kingdom’s resource base through a major step-out into unconventional oil and gas development, especially shale gas; further downstream expansion into petrochemicals – an area of state enterprise previously dominated by non-oil entities; and curbing domestic oil and gas consumption.

“Unconventional gas has become a game changer in our upstream production strategy and a potential fuel for the kingdom’s energy demand growth. While maintaining a continued focus on renewables and alternative energy, we have also begun our journey toward becoming a global leader in chemicals,” Aramco says.

Aramco also notes the 2013 discovery of oil in deep waters of the Red Sea, a frontier region for the company, as well as two other oil and conventional gas discoveries in its eastern core operating area.

It especially plays up the gas discoveries, describing them as “integral to supporting our critical gas business, which is geared toward meeting the kingdom’s domestic energy needs and powering industrial development.”

The company further notes that its unconventional gas programme became “fully operational” in 2013.

Saudi Aramco continues to innovate and make progress on its strategic transformation into a fully integrated energy enterprise, says Saudi Oil Minister and Aramco board chairman Ali Al Naimi in the review.

The company made exciting new oil and gas discoveries through its continued implementation of the largest exploration programme in its history. More importantly, it is also well positioned for long-term growth and success, says Naimi.

It provided energy to the world and also served the communities where it operates and strengthened the kingdom’s development through job creation and capacity building, he says.

“Whether drilling in the deep waters of the Red Sea for the first time or selling new products to China, we embraced our transformation and enabled new opportunities along our full value chain from upstream to downstream and new businesses,” says Al Falih in his forward to the review.

“We maintained our position as an upstream powerhouse and expanded our capabilities with respect to conventional and unconventional resources. Saudi Aramco combines its resources, leading know-how and pioneering mindset so that we continue to be a catalyst for innovation. In this spirit, we established new global research centres to develop our technical innovation pipeline for the future,” he says.

“In 2013, we also continued helping a new generation of entrepreneurs through our Wa’ed initiative and placed a renewed emphasis on engaging and developing our young employees.

“We are also dedicated to building the capacity of our diverse workforce of men and women while engaging in a major transformation of our business and our corporate culture. This transformation builds upon the same corporate values that have brought the company so much success to date.

“It will also enable us to achieve our Strategic Intent to become the world’s leading integrated energy and chemicals company within this decade,” he says.

“Today, we are the top exporter of crude oil and natural gas liquids, and the world’s largest oil company based on reserves, production and refining capacity,” the review says.

-(3).jpg)