Shaybah ... undergoing major maintenance

Shaybah ... undergoing major maintenance

SAUDI Aramco has awarded a $54 million contract to Indian engineering company Essar Projects to upgrade a crude stabilisation unit at the Shaybah oil field in Saudi Arabia’s Empty Quarter, Essar says.

The scope of work includes the engineering, procurement and construction of a crude tank, replacing crude pumps and civil works at the Abqaiq plant. The scheme is expected to be completed in 29 months.

The Shaybah oilfield, which came on stream in 1998, has the capacity to produce around 750,000 barrels per day (bpd) of Arab Extra Light crude.

Aramco awarded a major $400 million contract in January to South Korea’s Samsung to boost production capacity at the field to 1 mbpd by April 2016, with new oil and gas separators and a wet crude processing train.

Meanwhile, Saudi Aramco had alerted its crude buyers in February that it imminently plans to carry out major maintenance on the giant Shaybah oil field that will reduce supply of Arab Extra Light.

The remote Shaybah field has a production capacity of 750,000 barrels per day (bpd) of Arab Extra Light (AXL), making up about 50 per cent of the kingdom’s output of the high-value light, sour grade.

The other main AXL producers are the aging Berri and Abqaiq fields, which can pump around 800,000 bpd combined.

Japan buys over 400,000 bpd of AXL, while the US takes some 150,000 bpd. China imports less than 100,000 bpd.

Aramco has not officially said how much crude it will take off line, but the state oil giant has communicated the maintenance should not have a major impact on the AXL market, says a source.

Trading sources understand that the maintenance will be extensive, given the multiple months of work required.

There is evidence that Aramco has been stockpiling AXL storage volumes during the last few months to minimise the impact on customers. Exports in December and January were below total capacity, which stands around 1.6 mbpd, industry sources say.

“I think they are building up inventories,” says one Saudi-based source.

Shaybah, which started production in 1998 at 500,000 bpd and was expanded to its current capacity in 2009, is due for routine maintenance, but given the duration of the outage, industry sources expect that the field will be undergoing additional work.

Aramco plans to bring on stream its multibillion-dollar natural gas liquids (NGL) project at Shaybah in 2014. The project intends to expand the associated gas handling capabilities to strip 264,000 bpd of NGLs out of the 2.4 billion cubic feet per day of gas which is reinjected into the reservoir to maintain pressure.

The project includes debottlenecking Shaybah’s four gas-oil separation plants (Gosps) to handle the additional gas and liquids flows. The final tie-in process will almost certainly impact production, and Aramco may have opted to perform this work with regular maintenance during the late winter months when demand for Saudi crude dips, says industry sources.

The kingdom’s production of 9.1 mbpd in February-March 2013 was some 1 mbpd less than August 2013 – the month each year when Saudi domestic demand soars. Aramco awarded engineering contracts in late December to expand Shaybah to 1 mbpd by April 2016.

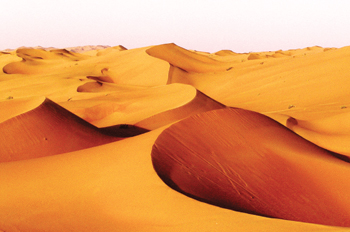

The Shaybah oilfield in the Empty Quarter desert can pump 750,000 bpd for the next 70 years because of the innovative management of the site by Saudi Aramco.

The oilfield 800 km southeast of Dhahran is one of the most prominent landmarks in the Rub Al Khali desert and is surrounded by a series of giant semicircular sand dunes some of which are 300 m high. The field is average in size compared to the giant Ghawar field that pumps millions of barrels a day.

However, Shaybah’s management makes it stand out from other fields in the Organization of the Petroleum Exporting Countries (Opec).

The expertise and hard work of Aramco technicians have paid off in 15.7 billion barrels of initial reserves according to reports.

-(3).jpg)