S-Oil ... significant stakes owned by Aramco

S-Oil ... significant stakes owned by Aramco

SAUDI Aramco is more than an oil company; it is the steward of Saudi Arabia’s vast hydrocarbon resources.

While in the past the company focused primarily on crude oil and gas, now it is rapidly progressing toward becoming the world’s leading integrated energy and chemicals company.

The firm expects its work to further strengthen the economy by creating, either directly or indirectly, approximately half a million jobs throughout the kingdom over the next several years.

As it solidifies its leadership in its core business, two imperatives must be met, says Aramco’s Annual Review 2013.

First is an emphasis on profitable growth through the diversification of its business portfolio.

The second is a focus on the kingdom’s economic agenda, particularly its support for local economic development.

In 2013, Saudi Aramco’s downstream operations achieved success on both these fronts.

In refining, it continued to supply the domestic market with fuels and feedstock cost-effectively.

Increasing global demand for chemicals and fuel products, however, will require Saudi Aramco to widen its focus to grow its businesses accordingly.

Refineries such as the Saudi Aramco Mobil Refining Company (Samref) joint venture will strengthen its competitive position for years to come by producing world-class fuels.

The company’s partnerships such as Saudi Aramco Total Refining and Petrochemical Company (Satorp), Sadara Chemical Company and Yanbu Aramco Sinopec Refining Company (Yasref) strengthen its strategic position globally as well as serve domestic needs and enhance the broader competitiveness of the kingdom’s industries.

The localisation of the Saudi energy sector can help raise the kingdom’s gross domestic product (GDP) and standard of living by boosting regional economic development through employment and foreign direct investment.

It can also directly impact the company’s operations through improved efficiency and quality, allowing it to navigate an evolving industry with greater agility.

Saudi Arabia’s demographic profile also presents opportunities for supporting the further development of a knowledge economy.

The kingdom has a rapidly growing population, with half of the population under the age of 25, and it also enjoys a highly educated and talented female population, whose participation in the workforce has substantial room to grow.

Taking advantage of these human resources can help the company to realise its future vision.

Saudi Aramco therefore aspires to facilitate the development of an economic ecosystem that helps attract, establish and promote energy-related domestic industries that are globally competitive and create employment opportunities for Saudis.

Saudi Aramco has begun developing a series of major integrated industrial clusters that will help diversify its energy mix while also providing national benefits from economic diversification to the expansion of value-adding activities and the creation of high-quality jobs.

The Competitive Saudi Energy Sector initiative, for example, is designed to achieve the following key objectives:

• Increase Saudi Aramco’s proportion of in-kingdom spending in manufacturing industries from less than 30 per cent today to 70 per cent over the next decade;

• Increase the Saudisation of jobs in the sector from existing levels of around 20 per cent to 70 per cent;

• Promote a sustainable ecosystem that supports a thriving energy sector in Saudi Arabia;

• Develop Saudi energy sector industries that are globally competitive; and

• Contribute to the creation of 500,000 direct and indirect jobs in the kingdom.

The ripple effect of the company’s work can be seen throughout its communities. Large-scale initiatives like those outlined in this Annual Review encourage investment in Saudi manufacturing, help develop industrial “clusters” adjacent to its operations and provide training to local manufacturers and suppliers in areas ranging from safety to ethics.

The immediate impact of Saudi Aramco expanding downstream portfolio also helps stimulate broader opportunities inside the kingdom and globally.

EXPANDING THE LOCAL ECONOMY – SATORP

The Saudi Aramco Total Refining and Petrochemical Company, or Satorp, a joint venture with France’s Total, is a newly constructed 400,000-bpd full conversion refinery with integrated petrochemical production.

It will be among the most complex refineries in the world, converting Arabian Heavy crude oil into high-quality products including gasoline, kerosene and diesel, as well as petrochemical products such as benzene and propylene.

The Satorp refinery is also the first producer of petroleum coke and paraxylene in the kingdom.

Construction was completed in 2013, and all units are expected to be in full operation by the end of the first quarter of 2014.

At year’s end, the crude oil throughput was 56,000 bpd and the refinery had shipped seven fuel cargoes, including a naphtha shipment.

In an auspicious coincidence, the first cargo from Satorp was loaded on Saudi National Day.

Joint ventures such as Satorp are a powerful expression of its corporate strategy.

They not only incubate Saudi-owned small and medium-sized manufacturers and service providers but also reinforce Saudi Aramco’s commitment to foster a knowledge-based economy in which thousands of Saudi technicians, engineers and operators can find exciting job opportunities.

The refinery is creating over 1,200 direct jobs in the kingdom, each of which in turn helps create a further five indirect employment opportunities.

SADARA

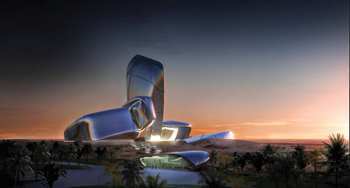

The Sadara Chemical Company, a joint venture with the Dow Chemical Company, represents the synergy between one of the world’s leading energy suppliers and one of the world’s leading science and technology companies.

Sadara will operate a world-scale, integrated chemicals complex in Jubail Industrial City II.

Jubail Industrial City is an established petrochemicals centre in the Eastern Province of the kingdom complete with an industrial port, pipeline corridors, utilities and supporting industries.

In addition to supporting local demand, the complex’s strategic location makes it ideally suited to drive economic growth in fast-paced, emerging markets in Asia, the Middle East, Africa and Eastern Europe. Full commercial operations are expected to begin in 2016.

Sadara’s complex will consist of a hydrocarbon and chlorine-based production facility capable of producing up to 3.2 million tonnes per year of diversified chemicals and plastic products.

This level of productivity will allow Sadara to introduce new value chains and high-performance products throughout the kingdom.

Sadara and the adjoining value park will deliver a full range of value-added, performance products destined for the emerging markets of Asia Pacific, the Middle East, Eastern Europe and Africa.

By the second half of 2015, Sadara will already have begun producing plastic and chemical products that Saudi-owned companies can use to produce plastic bags, detergents and foam materials for domestic and international markets.

Ultimately, Sadara will be an active contributor to Saudi Arabia’s strategy to become a hub for future downstream industrialisation of chemicals and plastics.

Sadara and related investments are expected to generate substantial income for the region and thousands of direct and indirect employment opportunities.

Output from Sadara’s 26 chemical processing plants will generate an estimated $10 billion in revenues within a decade of commencing operations.

Sadara currently has over 475 apprentices and 235 on-the-job trainees undergoing comprehensive manufacturing and engineering training programmes in state-of-the-art centres both inside and outside Saudi Arabia.

Already with an estimated 1,500 currently on staff, Sadara will ultimately employ more than 3,000 people and contribute to an additional 15,000 non-direct employment opportunities.

The value park will create more than 20,000 quality jobs, directly or indirectly, for Saudi nationals.

YASREF

In 2013, Aramco’s Yanbu Aramco Sinopec Refining Company refinery project made significant progress toward its start-up in 2014. As a joint venture, Yasref also stands as a model of foreign direct investment in the kingdom and another positive phase in Saudi Aramco’s relationship with China’s Sinopec.

Yasref, when completed, will be the kingdom’s most advanced refinery.

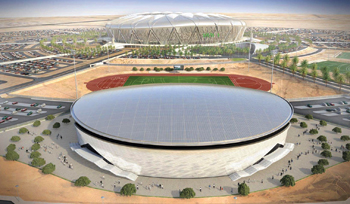

The project involves the construction and operation of a 400,000 bpd integrated petroleum refinery in the Yanbu Industrial City located on the west coast of Saudi Arabia along the Red Sea.

The refinery will process 100 per cent Arabian Heavy crude oil and produce gasoline, high-quality diesel and liquefied petroleum gases (LPG) as well as by-product sulphur and petroleum coke for export.

Yasref will include process units for the separation and conversion of the feed crude oil into finished products, for utility and offsite systems to support the refinery operation, and for associated feed, intermediate and product storage facilities.

In addition to the enormous direct impact Yasref will have, the refinery will provide significant annual revenues and approximately 6,000 direct and indirect job opportunities for Saudis.

As part of Saudi Aramco’s efforts to develop a quality local workforce, Yasref is working with Riyadh Refinery to train new apprentices to operate the Yasref facility. By the end of 2013, 24 apprentices had completed the six-month training programme.

JAZAN REFINERY AND TERMINAL PROJECT

The Custodian of the Two Holy Mosques, King Abdullah, launched the Jazan Economic City Project as part of a strategy to nurture non-oil based industries, expand the kingdom’s existing industries to serve domestic needs and rejuvenate the Jazan region by providing an additional source of employment opportunities.

The refinery and terminal will help enable the development of industrial clusters.

Construction will start in 2014, and when completed in late 2016, the refinery will have the capacity to process 400,000 bpd of Arabian Heavy and Arabian Medium crude oil as well as produce 80,000 bpd of gasoline, 250,000 bpd of ultra-low sulphur diesel and over 1 million tonnes per year of benzene and paraxylene products.

The Houston, Texas office of Aramco’s subsidiary company, Aramco Services Company, is supporting 65 employees during the front-end engineering and design (Feed) phase of the project’s Integrated Gasification Combined Cycle complex, which will use the refinery’s by-product to economically and efficiently generate 2,400 MW of electricity to cover the refinery’s needs, enable the development of small industries nearby and provide power for cities in the area.

FURTHERMORE, THE WORKFORCE TO BUILD THE JAZAN

Programme is expected to exceed 40,000 over the next four years. Saudi Aramco adopted a new Human Resources strategy with its business partners that, rather than setting Saudisation targets, created a consortium from among the contractors and public sector entities to train a local workforce for the programme.

Through the Jazan Contractors Consortium for Training and Employment, or “Maharat,” 550 young Saudis from Jazan commenced their training in October 2013.

The total intake will reach 5,000 over a four-year period.

The objective is to qualify these young Saudis for jobs required for the construction phase of the project, participate in advancing national development and contribute to the economic development of Jazan.

PETRORABIGH

An integral part of Saudi Aramco’s strategy to integrate petrochemical production with refining, this joint stock company was initially founded as a joint venture with Japan’s Sumitomo Chemical Company.

The development of Phase II of PetroRabigh includes a new aromatics complex and an expanded facility to process 30 million standard cubic feet per day (scfd) of ethane, and approximately 3 million tonnes per year of naphtha as feedstock, to produce a variety of high value-added petrochemical products.

Progress is rapidly being made to expand the product slate of PetroRabigh, and the company will begin marketing products in 2014.

By the end of 2013, agreements had been reached with tenants for 25 of the 30 sites in the adjacent value park and potential tenants have been identified for the remaining sites.

SAMREF

The Saudi Aramco Mobil Refining Company is a joint venture with ExxonMobil in Yanbu that supplies high-value products at a competitive cost while maintaining world-class safety, reliability and environmental protection.

In 2013, Samref completed the first two phases of the $2.2 billion Clean Fuels Project, a major environmental project to serve the needs of the kingdom.

The project will reduce the sulphur levels in gasoline and diesel by more than 98 per cent, to 10 parts per million (ppm).

Ultra-low sulphur fuels allow the use of improved pollution control devices that reduce diesel emissions more effectively but can be damaged by sulphur.

When powering the latest technology engines on tractor-trailers, buses, marine vessels and off-road equipment, these fuels will meet upcoming fuels specification regulations in the kingdom and reflect its ongoing efforts toward producing environment-friendly products. Overall project construction progress was 93 per cent at year-end, with the third remaining phase to be completed by mid-2014.

The refined products produced by Samref support the kingdom in general and the Western Province specifically by contributing to the development of Yanbu Industrial City.

In addition to its excellent safety record and mechanical reliability, Samref provides training and career development for its workforce, 94 per cent of which are Saudi nationals.

LUBEREF

The Saudi Aramco Lubricating Oil Refining Company, or Luberef, created in cooperation with Jadwa Industrial Investment, is another successful joint venture project that helps drive the economic growth of the kingdom. Luberef is currently the sole producer of virgin base oils in the Gulf Cooperation Council (GCC).

It has two solvent extraction base oil refineries: one in Jeddah and the other in Yanbu, with a total capacity of 4 million barrels per year.

About 70 per cent of Luberef’s production is sold to the kingdom’s domestic market; the balance is exported internationally, mainly to the UAE.

Luberef is in the midst of a $1.45 billion expansion project to increase its operations in Yanbu Industrial City to cover new base oil products.

RAS TANURA REFINERY

Ras Tanura Refinery is the largest complex of its type in the Middle East and one of the largest in the world.

The greater Ras Tanura area is home to a vast array of operations from refining to aviation and roughly one in every eight Saudi Aramco employees works in Ras Tanura.

The Port of Ras Tanura, which includes Sea Island, North Pier and Ju’aymah offshore terminals, is the largest crude oil export terminal in the world.

The refinery can stabilise 1.2 mbpd of crude oil for shipping to international customers, and it generates 178 megawatts of power using four steam turbines and two third-party cogeneration units.

The excess power generated by these units is delivered into the Saudi Electricity Company’s Eastern Province power grid.

Ras Tanura meets 31 per cent of domestic demand for refined and natural gas liquids (NGL) products, making it an integral refinery in the kingdom’s economy.

In 2013, Ras Tanura received ISO 14001:2004 certification, which focuses on environmental management systems and other standards related to specific environmental aspects such as life cycle analysis, communication and awareness and auditing.

This certification provides assurance for the current operations while also providing practical tools to help Saudi Aramco constantly improve its environmental performance by identifying and controlling the environmental impact of its businesses.

BAHRI

In November 2012, as part of Saudi Aramco’s strategy to continue expanding internationally, Vela International Marine Limited (the wholly owned shipping subsidiary of Saudi Aramco) agreed to merge its fleet and operations with the National Shipping Company of Saudi Arabia (Bahri) to create a world-scale diversified global shipping company.

Under a long-term shipping agreement signed in connection with the transaction, Bahri will become the exclusive provider of very large crude carrier (VLCC) shipping services for crude oil sold by Saudi Aramco on a delivered basis and will take responsibility for maintaining a reliable fleet. Following the receipt of necessary approvals Vela will transfer to Bahri ownership of its entire fleet, consisting of 14 VLCCs, a floating storage VLCC and five product tankers.

MARITIME SECTOR EXPANSION

Saudi Arabia’s maritime sector has been identified as an industry with high development potential.

The development of an integrated Maritime Yard at Ras Al Khair, a joint venture between Saudi Aramco, SembCorp Marine of Singapore and Bahri, is a key anchor initiative to fast track the development and localisation of the maritime industry and the related value chain.

Saudi Aramco expects the project to create additional export capability, raise domestic GDP and provide significant numbers of jobs for Saudis.

Maritime Yard revenues are expected to grow to $2.5 billion annually by 2023, with $250 million being generated from vessel maintenance, repair and overhaul activities and $2.25 billion from marine construction activities, including oil and gas offshore rigs and platforms as well as selective segments of shipbuilding.

At full capacity, the Maritime Yard will employ a workforce of approximately 13,600, of which approximately 7,000 will be Saudi nationals.

The Saudi Aramco Products Trading Company, known as Aramco Trading, grew its refined products business with estimated year-end export volumes at 403,000 bpd.

In March 2013, it obtained new storage and blending capabilities with a 10-month lease on 800,000 barrel tank facilities in Fujairah, UAE, enabling improved product handling, sourcing and upgrading.

In addition, the company showed sustained growth in ship chartering and logistics, risk identification and management and data capture and reporting.

EXPANDING ITS GLOBAL REACH

Saudi Aramco’s global affiliates provide a wide range of services, including marketing crude oil, NGL and chemicals products, joint venture coordination, procurement, inspection, research and development, project management, human resources development, government and public relations, and communications.

Through the regional offices of Saudi Aramco Asia Company (Aramco Asia), the firm continues to deepen its presence in one of the world’s fastest growing regions.

These international ventures will continue to play an important role in Saudi Aramco’s corporate transformation to become a global leader in energy and chemicals by 2020.

Japan Saudi Aramco, through one of its affiliates, has a 14.96 per cent interest in Showa Shell, one of the largest refiners in Japan. Showa Shell’s shares increased in value by 115 per cent in 2013.

This compares against a 52 per cent gain in the benchmark Nikkei for the same period and confirms the market’s upbeat assessment of Showa Shell’s stellar business outlook.

Showa Shell also outperformed its peers, such as Tonen General and Cosmo, primarily due to its solar energy business.

In 2012, Solar Frontier, a subsidiary of Showa Shell, successfully installed a 10.5 MW solar power system at Saudi Aramco’s Al Midra office tower. More than 120,000 photovoltaic panels were installed on the parking shade structures to produce clean power for the building.

CHINA

One element of Saudi Aramco’s chemicals strategy is to encourage and create new businesses that use its products. Aramco Asia continued to actively pursue potential refining and petrochemicals opportunities in Asia, including a refinery/marketing venture with PetroChina to develop a 260,000 bpd grass roots full-conversion refinery in Yunnan province.

Definitive agreements are expected to be initialised in the first quarter of 2014.

PetroChina commenced construction of the refinery in 2013, which was 18 per cent complete by year’s end.

In a historic development, 2013 also saw Saudi Aramco’s first polymer sale go directly to a customer in Xiamen, China, who immediately converted it into stretch film that will be used by other companies for packaging.

The products sold were produced by Fujian Refining and Petrochemical Company Ltd (FRPC), Saudi Aramco’s equity venture.

China is the primary focus for Aramco Asia’s polyolefin marketing business. From this initial transaction, the annual sales of FRPC are expected to grow to 200,000 metric tonnes (mt) of polyethylene and 130,000 mt of polypropylene, with Aramco Asia’s Xiamen office targeting both direct customers and distributors.

Aramco Asia will market aromatics from other Saudi Aramco facilities in addition to polyolefin, with both representing major growth businesses for the company’s downstream operations.

FRPC’s ongoing Steam Cracker Debottlenecking Project achieved 8.8 million work-hours without a lost-time injury by the end of 2013.

When fully operational in 2015, the project will increase refining capacity from 240,000 to 280,000 bpd, ethylene capacity from 800 to 1,100 kilo tonnes per annum (kta), polyethylene production from 800 to 960 kta and polypropylene production from 400 to 550 kta.

It will also add a new ethylene oxide/ethylene glycols production capacity of 180/400 kta.

The project will capitalise on demand growth and efficiency enhancements to increase sales revenue in the Fujian market.

KOREA

The Republic of Korea is Saudi Arabia’s fourth largest trading partner.

Saudi Aramco owns a significant stake in S-Oil, a petroleum and refinery company based in Seoul.

In November, S-Oil won the highest award in the Korea Brand Awards: the Presidential Award.

Hosted by the Ministry of Trade, Industry and Energy and organised by the Institute for Industrial Policy Studies, the Korea Brand Awards is the only national award programme related to brands, and S-Oil is the first refiner to receive the Presidential Award.

REPUBLIC OF INDONESIA

In 2012, Aramco Asia and PT Pertamina signed a Memorandum of Understanding (MoU) to evaluate the economic feasibility of building an integrated refining and petrochemical project in Tuban, East Java, in the Republic of Indonesia.

The proposed project would process 200,000-300,000 bpd of crude oil and produce high-quality refined petroleum and petrochemical products to meet rising demand in Indonesia and elsewhere in Southeast Asia.

In 2013, the MoU was extended for one more year until February 2014.

UNITED STATES

Motiva Enterprises, a Houston-based refining and marketing joint venture between Saudi Refining, Inc (SRI), a Saudi Aramco subsidiary, and a Shell Oil affiliate, completed its expansion project in 2012, but startup activities were interrupted by an operational incident that required repairs to the crude oil distillation unit.

In 2013, the joint venture was able to meet its target of a January restart, and was able to ramp up production and achieve design capacity on the crude oil unit.

Additionally, all of the other new units were operating at or near design capacity at the end of 2013.

In 2014, SRI will continue to work with Motiva to maximise throughputs and raise volumes where possible.

EXPANDING STRATEGICALLY – RETAILCO

Saudi Aramco’s Retail Team developed a number of strategic options for the company’s participation in the domestic retail market and secured company approval to launch RetailCo as a wholly owned subsidiary of Saudi Aramco.

RetailCo’s objective is to build and operate service stations in select areas of the kingdom using a Company-Owned, Company-Operated business model for the fuel component of the business, while potentially outsourcing the majority of the nonfuel component to partners who would add value to the business and its brand. By the end of 2013, the project was in the early implementation phase.

NEW PIPELINES

In 2013, Saudi Aramco commissioned 11 additional pipelines to its network with a total length of 935 km and an additional capacity of 1.45 mbpd for Arabian Heavy crude oil, 83,000 bpd for Arabian Light, 65 million scfd of sales gas, 90 million scfd of sour gas and 65,000 bpd of condensate.

The additional length represents an increase of about 3 per cent in the network from 2012, reaching 20,419 km of pipelines operated, maintained and mothballed.

ENHANCING OPERATIONAL EXCELLENCE

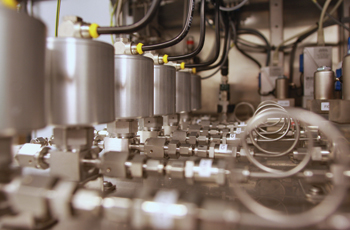

Over the past 10 years, Saudi Aramco has embarked on a corporate initiative to deploy advanced process control solutions company-wide to maximise high-value products, improve process controls and minimise energy usage in process plants.

Saudi Aramco will continue to identify opportunities for improving refinery availability and utilisation, and increasing white products’ yields to help position company refineries within the first quartile of the Solomon Fuel Refinery Performance Ranking.

Efforts to optimise the refining process performance are expected to result in a total improvement of 2 per cent on benchmarking factors and an increase in white products by 13,000 bpd of gasoline.

ENERGY EFFICIENCY

Saudi Aramco is a leader in efforts to improve energy efficiency and has developed cost-effective, innovative solutions and efficient resource management practices.

On average, since the year 2000, the company has been able to achieve a 2 per cent annual reduction in energy intensity in industrial facilities, which has resulted in a savings of around 150,000 barrels per day of oil equivalent (bpdoe).

This was realised through various initiatives such as cogeneration, retrofitting industrial equipment and process enhancements.

In recent years, the national demand for energy has increased dramatically to the point where the volumes meant for export may decline to unacceptably low levels in the coming two decades.

For example, the national demand for electricity has increased by about 7 to 8 per cent annually for the past five years. Therefore, improved energy efficiency is a national goal and concern.

In 2013, the company launched energy conservation policies to improve levels of energy efficiency in all operating facilities, whether industrial or nonindustrial, to support energy efficiency efforts in the kingdom.

The company achieved energy savings of roughly 9,000 bpdoe in support of the kingdom’s Energy Initiatives under the Saudi Aramco Energy Management Programme.

The Zero Discharge Technology was implemented in more than 400 well-site operations in 2013, which reduced hydrocarbon waste generated from each well site to a few kilograms and enabled the recovery of more than 260,000 barrels of oil and 70 million scf of natural gas.

In addition, through its Lead by Example initiative, Saudi Aramco identified opportunities to achieve a minimum of 35 per cent reduction in energy consumption through energy efficiency measures in transportation as well as in new and existing houses and buildings.

At the same time, Saudi Aramco’s Energy to the kingdom initiative focuses on growing and diversifying its energy supply, saving energy across all sectors, and creating opportunities for sustainable economic growth.

Efficiency, renewable energies (solar energy in particular) and hydrocarbon allocation strategies are major contributors that are expected to manage growing domestic energy demand in the mid- and long term.

COGENERATION

Saudi Aramco signed three new energy conversion agreements in 2013 to build and operate efficient cogeneration plants at three major oil and gas complexes in the kingdom.

Cogeneration technology, which captures and utilises the heat produced in power generation, has a thermal efficiency of more than 80 per cent compared to conventional generation efficiency of 40 to 50 per cent.

It also uses less fuel and lowers emissions for better environmental performance. The agreements demonstrate Saudi Aramco’s commitment to pursue energy efficiency throughout its operations.

Upon completion, the new cogeneration power plants will efficiently provide electricity and steam needs at the company’s Abqaiq, Hawiyah and Ras Tanura facilities.

The cogeneration facilities will also serve as a benchmark for energy efficient power production and will further enhance the kingdom’s power sector.

The plants will generate a total of about 900 MW of power and 1,500 tonnes of steam per hour when they come on stream in 2016. Saudi Aramco’s partners will operate the cogeneration plants for 20 years, providing electric power and steam to all three Saudi Aramco facilities.

Saudi Aramco will hold a 50 per cent stake in the new cogeneration plants.

In addition, electricity generated by these plants is normally used locally, making losses due to long-distance transmission and distribution of power negligible.

WATER CONSERVATION

Protection of groundwater resources in Saudi Arabia is of vital importance as the kingdom’s aquifers supply over 90 per cent of the water used in the country.

As they are essentially non-renewable due to the arid climate, they can pose risks to human health and the environment if negatively impacted.

In this context, Saudi Aramco assigns a high priority to the responsible use of the kingdom’s precious water resources.

The majority of water utilised in Aramco’s operations is seawater, and while freshwater only represents a small part of its water use, its Water Conservation Strategy has an overall target of reducing the company’s projected freshwater consumption by 70 per cent by 2022.

All of the sanitary wastewater in Dhahran is treated and reused, with 70 per cent of water reused company-wide.

Saudi Aramco is also expanding its use of xeriscaping at Saudi Aramco facilities. Xeriscaping is characterised by the use of evergreen flora that is highly tolerant to poor soil conditions and hot arid climates and includes a wide variety of trees and shrubs.

This reduces water consumption by about 40 to 50 per cent as compared to conventional gardening.

LOOKING FORWARD

NAPHTHA-FUELLED VEHICLES

In 2013, after only two years of research and collaboration with leading German car engine design firm FEV, Saudi Aramco scientists successfully demonstrated the potential of naphtha, a gasoline-like fuel, in a modern diesel engine.

As Saudi Aramco expands its research and innovation portfolio through global partnerships and collaboration, the successful test drive has shown, for the first time, that a naphtha-fuelled vehicle is capable of meeting today’s European efficiency and emissions requirements while maintaining high comfort and drivability levels. More than a fifth of energy demand is consumed in transportation, mostly from oil.

As the world’s largest oil producer, Saudi Aramco has a key role in shaping future mobility and addressing upcoming fuel challenges.

Considered a complement to gasoline, diesel and jet fuel, naphtha requires less processing and upgrading in the refinery than modern diesel fuels and is therefore cheaper to produce.

Saudi Aramco’s research has shown that lighter, less processed fuels such as naphtha, when used in diesel engines, can also reduce environmental impact through lower emissions.

CRUDE OIL TO CHEMICALS

Aramco’s Chemicals organisation has a strategic objective to develop and deploy its own technologies and has been working on a number of key initiatives relating to technology development.

For example, a demonstration unit for crude oil-to-chemicals technology has proven successful in Teijin, China and the scaling up to an 80,000 bpd process plant is under consideration.

CO2 INTO POLYOLS

Novomer is a US-based chemical technology company engaged in the development of catalytic platforms to convert carbon dioxide (CO2) into useful products such as polyols, which are used to produce a range of polymers frequently found in foams, insulations and coatings.

Saudi Aramco has executed an option agreement with Novomer for the right to purchase Novomer’s polyols business, concurrent with the execution of an agreement between Saudi Aramco Energy Ventures (SAEV) and Novomer.

-(3).jpg)