Lukoil ... seeing prospects in Saudi Arabia

Lukoil ... seeing prospects in Saudi Arabia

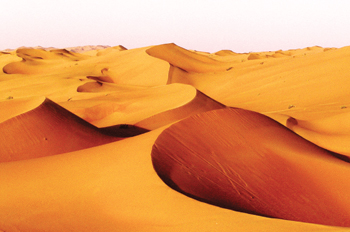

RUSSIA’S Lukoil is set to drill deep for unconventional gas in Saudi Arabia’s challenging ‘Empty Quarter’ desert region early next year after a decade-long hunt for conventional deposits that has proved futile. The world’s top oil exporting nation invited international oil companies (IOCs) – such as Lukoil, Royal Dutch Shell and Sinopec – to find and pump gas in its southeast Empty Quarter, known as Rub Al Khali, more than 10 years ago. Saudi wants natural gas to help it cover subsidised domestic power demand so it can save oil for more lucrative exports.

The IOCs, which formed joint ventures with state oil firm Saudi Aramco, failed to find commercially viable deposits and while the others have abandoned the search, Lukoil has not. It plans, with Saudi Aramco, to drill two, very deep evaluation wells at depths of up to 19,000 ft in the Mushaib tight gas field in the Empty Quarter, two industry sources said.

A Lukoil Overseas official said the joint venture will drill the first well in the first quarter of 2015 and the second during the last six months. Saudi Aramco declined to comment. “The cost will be very high compared to unconventional reservoirs in the US,” said one source.

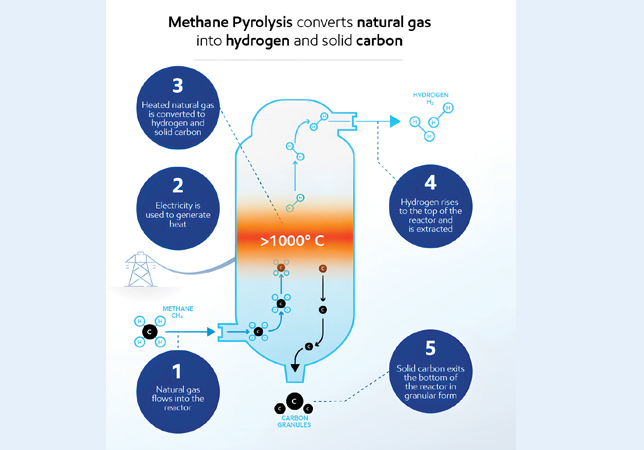

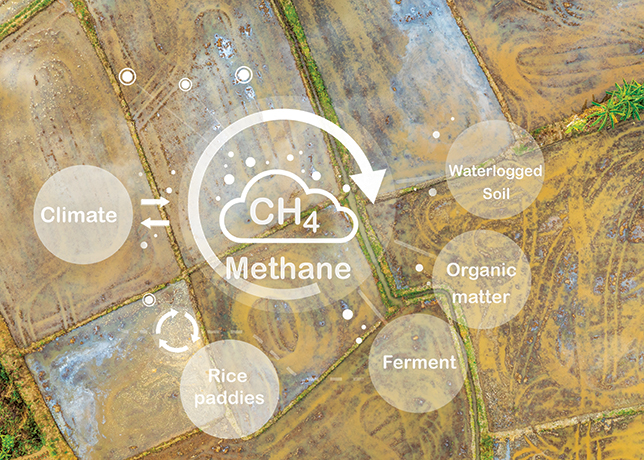

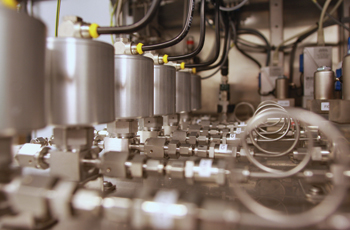

Tight gas is found in reservoirs formed by rocks of low permeability and low porosity typically at depths ranging between 8,000 to 10,000 ft and thus needs to be fracked. Another and more commonly known type of unconventional gas is shale, which is trapped within sedimentary rock.

“Drilling two wells shows that they are serious and positive about the region – and most importantly, that they are more committed than the other IOCs who already left,” said Sadad Al Husseini, a former top executive at Saudi Aramco. ‘But they will have to find some Natural Gas Liquids and condensate to increase their profits and spread their costs.’

Inspired by a shale gas surge in the US, which has transformed it from the world’s largest gas importer to an exporter, the kingdom has begun investigating its large unconventional deposits and their potential for fuelling long-term growth for its booming population. Aramco’s CEO Khalid Al Falih has said Riyadh will spend $3 billion on shale gas development in the kingdom, but has given no details on the investment.

The biggest obstacle for Saudi Arabia is probably the lack of water, because fracking entails pumping huge amounts of fresh water to pressure gas out of rock, shale or compacted sands. Saudi Aramco said in its 2013 annual review released on Thursday that it was developing new hydraulic fracturing technologies to increase recovery rates and improve cost efficiency. It cited “a CO2-based fracturing fluid as one of the techniques that may meet the water supply challenge”.

“Aramco is in the evaluation phase of shale gas and it’s an evaluation that requires large capital spending. Further development will happen based on results,” said Husseini. “It seems that Lukoil wants to be a partner in the evaluation process.”

For now, the most concrete initiative by Aramco is a plan to produce 200 million cubic feet per day (mmcfd) of unconventional natural gas by 2018 to supply a new phosphate project and power plant in the north of the country. Aramco is also drilling offshore in the Red Sea and has made gas discoveries there.

Oilfield service companies such as Baker Hughes, Schlumberger, Weatherford and Halliburton have all set up operations and bases in Saudi Arabia to help Aramco develop technology for unconventional gas.

-(3).jpg)