Dow ... a potential target for Aramco

Dow ... a potential target for Aramco

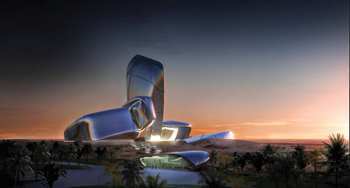

SAUDI Aramco is pursuing a potentially seismic purchase of a major chemical company that could transform it into one of the largest chemical producers in the world by 2020, Aramco and industry sources say.

Aramco set itself an aggressive target in 2011 to become a top five chemicals producer by the end of the decade, as part of a broader goal to become one of the world’s largest integrated energy companies.

In practice, that means achieving chemicals revenues of some $50 billion, the company says.

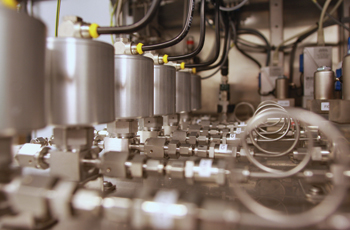

But despite some $40 billion of annual spending in the last few years, Aramco is set to produce only 15 million tonnes per year of chemicals by 2016, which will equate to roughly $20 billion-$30 billion worth of revenues, say sources familiar with the plans.

“The only way to get there is through merger and acquisition,” one source says.

To that end, Aramco is actively looking at buying a major player in the market, multiple sources say. The possible strategies involve an outright takeover or acquiring a part of a major player’s business, the sources say.

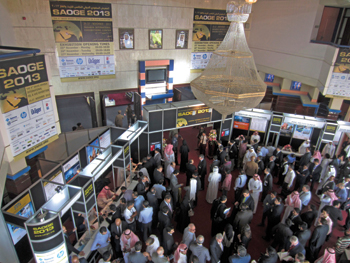

Aramco presentations at the Middle East Petrotech conference in Bahrain clearly flagged the strategy.

“We are looking to grow inorganically as well as organically and we are exploring attractive opportunities to enter into alliances or acquisitions wherever such opportunities exist,” said Warren Wilder, Aramco vice president of chemicals, at the conference.

The list of targets is not particularly long, given that some of the industry’s biggest players, like ExxonMobil and Sinopec, are not expected to be sellers. Nor is Aramco’s in-kingdom rival Sabic, which boasts some $50 billion in revenues.

Those inside and outside Aramco say that Dow Chemical, which is already a partner with Aramco on the 3 million tonnes per year Sadara plant, is a very good fit. The US chemical firm could benefit from a healthy injection of capital from cash-rich Aramco, and its top-tier portfolio has the scale that would push Aramco closer to its 2020 goals.

The decision to hire Wilder has also fuelled the M&A expectations.

Wilder, who joined Aramco last July, formerly headed a chemical division at Indian giant Reliance Industries, led Malaysia’s Titan Chemical Corp and worked for Exxon. He brings a track record of closing deals, said multiple sources. “That’s why they got him,” says one.

Aramco’s internal plans show the chemical business contributing $50 billion worth of revenues as soon as 2015, although insiders stress that a deal is not necessarily imminent.

The point of expanding its downstream footprint is to balance out its world-leading upstream sector, which can produce 12 million barrels per day (mbpd) of oil and 11 billion cubic feet per day of gas, Aramco says.

Conversely, its refining portfolio of 4.8 mbpd is only the world’s sixth-largest, and its chemicals division is in its infancy.

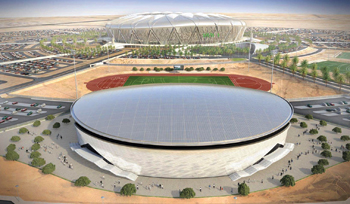

But the downstream push is also to help create jobs for the swelling number of young and unemployed Saudis, as well as to attract more research and development inside the kingdom.

A buyout that does not bring technology to the kingdom or create jobs, even if the scale is right, would not be the right fit, industry sources say.

-(3).jpg)