Rub Al Khali .. holding promise for unconventional gas

Rub Al Khali .. holding promise for unconventional gas

A SIGNIFICANT component of Saudi Aramco’s corporate strategy is to retain its preeminence as the world’s most reliable supplier of energy while entering new operational areas.

These new areas include large-scale expansion in exploration and development of unconventional gas resources. Unconventional gas refers to the deposits of natural gas trapped in shale and tight sands.

This gas was not commercially viable to produce until recently. Today, tapping this resource is an important strategic step for continued economic development in the kingdom for the following reasons: Unconventional gas will help meet Saudi Arabia’s own energy demand, and is the preferred fuel for power generation and water desalination due to its increased efficiency and cleaner burning qualities compared to other fossil fuels.

The resulting increase in the total gas share of the kingdom’s energy mix will increase the volumes of higher value diesel and crude oil available for export.

As a resource-intensive operation, estimates of direct jobs can be up to 10,000 (including contractors) for every 1–2 billion cubic feet of gas produced daily, with up to four times as many indirect jobs.

These jobs also require expert skills and training, and therefore stimulate demand for advanced support sectors and a knowledge economy.

The company’s unconventional gas programme became fully operational in 2013.

Only two years after launching its own unconventional gas programme in the frontier Northern Region, Saudi Aramco is ready to commit shale gas for the development of a 1,000 MW power plant that will feed a massive phosphate mining and manufacturing sector in the kingdom and drive that region’s development and prosperity. Saudi Arabia will be among the first countries outside North America to use shale gas for domestic power generation.

Saudi Aramco is actively exploring for unconventional gas resources in three areas of Saudi Arabia: the Northwest, South Ghawar and the Rub’ Al Khali.

Due to the large scale of these unconventional gas resources and the complexity and intensity of the activity associated with their development, significant investment opportunities and economic benefits lie in the full value chain of this emerging industry.

Furthermore, the full unconventional gas value chain such as site development, rig preparation, drilling, fracking, completion, well tie-in, production and maintenance are poised to grow rapidly between now and 2020.

The opportunity presently exists for unconventional gas sector manufacturers and service providers to serve Saudi Arabia and neighboring countries by targeting localisation within Saudi Arabia as their operational hub.

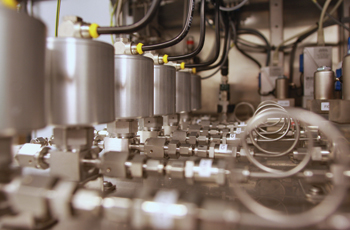

When it comes to extracting unconventional or tight natural gas, the best technique found so far is fracturing, also known as fracking. Saudi Aramco’s constant focus on environmental stewardship has led it to push for new and better ways to conduct fracturing operations with the least environmental impact possible.

New hydraulic fracturing technologies are being developed to significantly improve cost efficiency, increase recovery rates, reduce environmental impact and enhance well productivity across shale, deep sandstones, and carbonate formations in the kingdom: Pulsed gas fracturing improves well-to-reservoir connectivity by generating a fracture network near the wellbore by using a propellant.

|

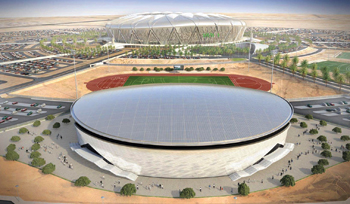

UPDC ... immersive learning environment |

Plasma technology uses high-electric discharge to generate supersonic stress waves to induce fracture in the reservoir.

CO2-based fracturing fluid may meet the water supply challenge in largescale fracturing jobs.

Staged fracturing is evolving into cost-effective techniques by creating multiple hydraulic fractures in horizontal wells without using mechanical isolation tools.

Research and development collaboration between Saudi Aramco and Schlumberger Limited has discovered methods to control simultaneous fracture initiation, marking the first multiple fracture initiation research in the oil and gas industry.

The use of microseismic fracturing proved to be a valuable tool in the first Northwest shale gas well to assess the efficiency of the fracture network generated through hydraulic fracture treatments.

This was the first time this technology was deployed in Saudi Aramco to assess four different fracturing technologies.

The technology provided a better understanding of the geometry and complexity of the fractures generated for each type of fracture design.

An innovative fracture propping concept is being developed by the Advanced Research Centre of Saudi Aramco’s Exploration and Petroleum Engineering Center (Expec Arc) to chemically convert fracturing fluid into solids in situ.

The fracturing fluid will be a system containing multiple liquid and/or gas components. Upon being catalysed by the reservoir temperature, the fluid is set into a porous medium to keep the fracture open while at the same time providing high conductivity.

Saudi Aramco is also exploring new methods for using fracturing fluid technology to get the maximum amount of natural gas out of the ground with minimum ecological impact. The recent development of environmentally friendly polymer-free fracturing fluids — with superior operational performance — represents a major technological advance in the petroleum industry.

UNCONVENTIONAL GAS

Unconventional gas plays a significant role in Saudi Aramco’s upstream production strategy and as a potential growth area to meet the kingdom’s energy demand. The mission of Saudi Aramco’s Upstream Professional Development Centre (UPDC) is to ensure a sustainable, capable upstream workforce by providing effective and efficient professional development for all petroleum engineers and geoscientists.

UPDC’s immersive learning environment accelerates learning through allowing participants to combine field experience with high-tech simulation.

UPDC has developed a training programme that leverages the North American shale gas experience of three major service companies to equip upstream professionals with the knowledge and skills required to successfully exploit this new growth area. Saudi Aramco’s Exploration, Petroleum Engineering, Drilling & Workover and Production Engineering organisations selected a total of 56 young professionals to participate in the programme.

The 18-month programmes consist of 30 per cent classroom training and 70 per cent on the job field training.

FLARING MINIMISATION

As a company dependent on natural resources, Saudi Aramco considers the environment to be a significant priority.

Saudi Aramco has made progress in many areas with respect to environmental excellence.

Its ongoing goal is to be globally competitive in terms of its social responsibility and environmental stewardship. The Saudi Aramco Engineering Standard asserts various goals with respect to air quality, source emission controls and the elimination of discharge of toxic substances.

Flare minimisation plans are meant to eliminate hydrocarbon flaring to lighten the environmental footprint of facilities while generating additional revenues from the captured hydrocarbons.

In 2013, Saudi Aramco completed the development of Flare Minimisation Plans at all its facilities to provide a consistent and focused approach to measure, monitor and control gas flaring.

As a result of this programme, flared gases across its gas operations have been reduced 31 per cent compared to 2010.

In 2013 alone, flaring at all Saudi Aramco facilities was reduced by over 17 per cent, translating to annualised cost avoidance in flaring of $29 million per year.

LOOKING FORWARD

Saudi Aramco’s strategic, long-term outlook on research and technology development is consistent with its development plans for its oil and gas fields—allowing us to maximise reservoir performance, and add further value to its integrated energy value chain.

Saudi Aramco’s Exploration and Petroleum Engineering Advanced Research Centre, also known as Expec Arc, is the upstream research arm that tackles the challenges of maximising oil and gas recovery while reducing the associated developmental cost through innovative technologies and better understanding of its reservoirs.

-(3).jpg)