Shell ... finding Kidan unviable

Shell ... finding Kidan unviable

ROYAL Dutch Shell has quit Saudi Arabia’s Kidan sour gas project just ahead of the previously expected launch of front-engineering and design tenders for the long-awaited development, the company says.

“Shell has decided to end further investment in the Kidan development,” a company spokesman says.

Industry sources familiar with the project had previously predicted Shell would issue Feed tenders for Kidan in mid-2014, preparing the ground for the $4 billion first phase of the field’s development.

Shell says it had been in “regular dialogue” over the project with officials at the Ministry of Petroleum Mineral Resources and national oil company Saudi Aramco, its partner in the South Rub Al Khali, or Srak, field development joint venture formed more than 10 years ago.

“This was a difficult decision but Shell remains committed to the kingdom and we are keen to grow our investments, both in upstream and downstream,” the company adds.

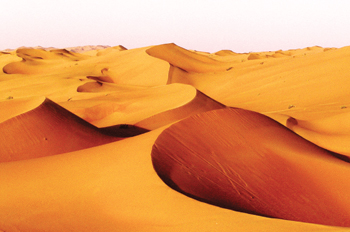

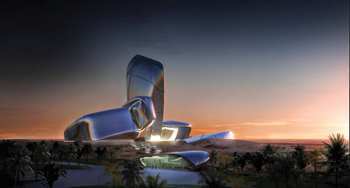

Kidan is in the heart of the harsh Rub Al Khali (Empty Quarter) desert, which covers a large swath of territory in the south of the Arabian Peninsula, and its proposed development posed severe technical, logistic and economic challenges for Srak.

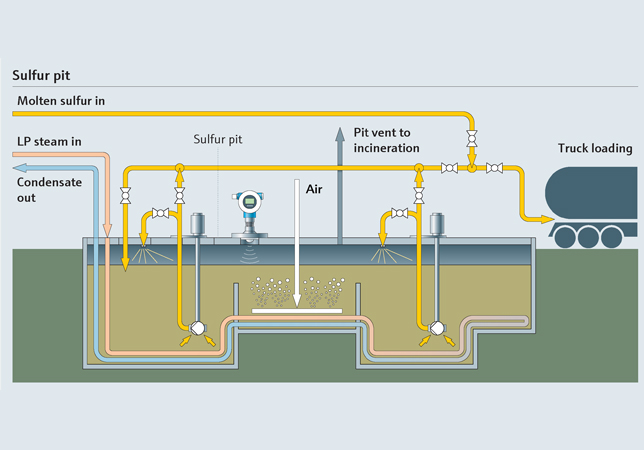

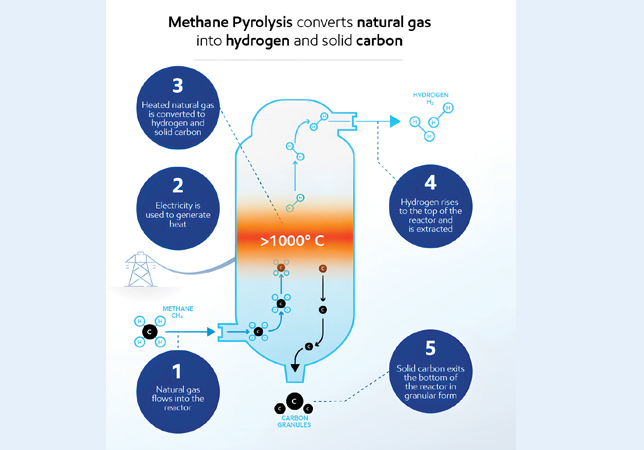

Large amounts of hydrogen sulphide, which is highly toxic and corrosive, would need to be removed from the raw gas and associated liquids to make them usable, generating elemental sulphur as a major byproduct in the process that Shell has previously used at large sour gas projects in Canada, the Caspian region and elsewhere. There is an international market for sulphur, which is used mainly to make fertilisers, sulphuric acid and sulphurised rubber, but to get the commodity to tidewater from such a remote Saudi location would entail building a long-distance rail link or heated pipeline to the Saudi east coast. The cost of the former could be prohibitive, while the latter would present an extreme technical challenge.

Moreover, with Saudi domestic gas prices held artificially low by entrenched government subsidies, the economic feasibility of developing Kidan would hinge on the outlook for sales of byproducts including sulphur.

Analysts doubt that Saudi Arabia and the neighboring UAE emirate of Abu Dhabi, which is pressing ahead with its own $10 billion Shah gas development in the UAE sector of the Rub Al Khali desert, would cooperate on sulphur transportation by rail to Gulf coast. A UAE spur from Shah to the Gulf Coast is planned as the first link in a UAE national railway system, and it could theoretically be extended across the Saudi border to Kidan, but adding to the already ample sulphur supply that Shah is expected to generate would put downward pressure on prices, to the detriment of Shah’s project economics.

Saudi Arabia and the UAE are desperate to step up production of non-associated gas to satisfy fast growing domestic demand for gas to fuel power generation and industry, and for re-injection into mature oil fields to improve crude recovery. The two Opec members both have substantial additional reserves of gas associated with oil fields, but associated gas output can only be ramped up in conjunction with higher crude production, which in turn is subject to Opec ministerial agreements.

International oil companies were for the first time in decades invited to participate in Saudi domestic upstream oil and gas projects when the petroleum ministry decided to seek technologically competent partners for Rub Al Khali gas exploration

-(3).jpg)