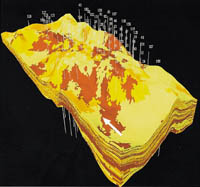

Ras Tanura refinery ... revamped to process lighter value products

Ras Tanura refinery ... revamped to process lighter value products

Saudi Arabia's vast refining sector could get a further boost if plans to attract foreign investments into the sector come to fruition.

Saudi Aramco's existing refining assets can be viewed as significant pre-investment platforms supporting appropriate refinery-based petrochemical and fuels facilities, according to company president and CEO Abdallah Jum'ah.

Many of Saudi Aramco's refineries and gas plants will be building power and steam cogeneration facilities to optimise fuel consumption, thus offering further investment opportunities.

Saudi Aramco has invested heavily on upgrading a refining sector whose capacity is currently at around two million barrels per day (bpd). In doing so, the company is aiming to meet growing domestic and export demands for high quality refined products.

The bulk of the products manufactured by Saudi Aramco's plants are already destined for domestic markets, and some industry sources now estimate that domestic consumption is now running at close to one million bpd.

Such investment in the sector has allowed Saudi Arabia to lighten its crude oil throughput to refineries by supplementing a stream of Arab Light with Arab Super Light and Arab Extra Light crudes.

The Ras Tanura refinery, for instance, has undergone a major revamp and expansion project, extending Saudi Aramco's drive to increase profit by configuring the plant to process higher value refined products from the crude stream and reducing the amount of lower-value heavy fuel oil products of earlier configurations.

Capacity at the refinery has been expanded to 540,000 bpd.

Italy's Snamprogetti was recently awarded an estimated $110 million contract from Saudi Aramco to carry out the so-called Khuff gas fractionation project, adjacent to the Ras Tanura refinery.

The Khuff contract calls for the construction of a new fractionation unit at the refinery.

The unit will have the capacity to process 200,000 bpd. The main units will be a 200,000 bpd fractionator, a 100,000 bpd naphtha stabilisation unit, a 150,000 distillate blender, and offsites and utilities. The plant will produce naphtha and distillates for export and processing in the refinery.

Snamprogetti will, according to reports, undertake the two year project with a local affiliate.

Ras Tanura is the oldest and biggest of Saudi Aramco's domestic refineries, coming onstream in 1945 with a capacity of 50,000 bpd.

Additional units were then added to the plant in following decades to raise capacity to 530,000 bpd. A decision was taken in 1983 to modernise the plant, with a new crude distillation unit (CDU) and vacuum unit installed to replace two ageing CDUs and two vacuum units. A sulphur plant was also built with the capacity to process 10.1 million cu ft per day of acid gas.

Sulphur recovery units came onstream in May 1986, followed by a new 265,000 bpd distillation unit in October of that year. The second distillation unit's output included light and heavy diesel (30 per cent), fuel oil (30 per cent), naphtha (20 per cent) and kerosene (15 per cent).

In October/November 1990, Ras Tanura stepped up its crude throughput to 510,000 bpd, although in December 1990 a fire badly damaged one of the distillation units, cutting the plant's capacity to 265,000 bpd.

The Red Sea-based Rabigh refinery has also witnessed a recent capacity expansion and upgrade.

The crude distillation tower at the refinery has been modified to create one of the world's largest CDUs in the world at 425,000 bpd.

The crude distillation tower was designed to process 325,000 bpd of both Arabian Light and Arabian Medium crudes with an extra 10 per cent over design limits.

Major upgrade changes were made in the light fractionation section of the distillation tower.

By upgrading tower internals, Rabigh is now benefitting from both improved yields and a debottlenecking of internal hydraulics.

Based on the success of the tower upgrade, Saudi Aramco is said to be considering further upgrades at Rabigh in future, including expanding capacity to up to 500,000 bpd.

Such an upgrade will require major investment and will be judged on economic incentives, but officials say that such a move is being considered in the next operating plan.

Saudi Aramco operates seven refineries in the Kingdom, two as joint ventures, and supplies the refineries with every drop of their crude oil requirements.

The approximately 225,000 barrels per day (bpd) Yanbu facility, the 110,000 bpd Riyadh facility and a 60,000 bpd Jeddah plant operate principally to meet domestic demand for gasoline, diesel fuel, kerosene and asphalt.

The Ras Tanura refinery also meets domestic needs while the 400,000 bpd Rabigh, 320,000 bpd Saudi Aramco Mobil Refinery Company (Samref) - a joint venture with ExxonMobil - and Saudi Aramco Shell Refinery Company (Sasref) refineries produce goods primarily for export.