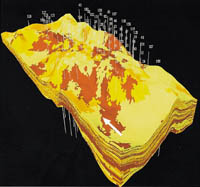

PetronÕs assets include retail outlets and a refinery at Bataan, which is currently being upgraded

PetronÕs assets include retail outlets and a refinery at Bataan, which is currently being upgraded

SAUDI ARAMCO has, since 1994, had a 40 per cent interest in the Philippines' largest refiner, Petron.

Petron operates a 180,000 barrels per day (bpd) refinery at Bataan and markets products through more than 1,000 retail outlets. The company is one of the top three oil retailers in the Philippines.

Saudi Aramco supplies the refinery with the majority of its crude oil needs, under a flexible crude purchase agreement with Petron.

The agreement gives Petron wider latitude in its crude purchas5 in aggressive environments. In practice to the 1970's, however, the only practical way that these low water to cement ratios could be achieved was to operate at relatively high cement contents.

During the 1970's however, all of this changed. A plethora of behavior-altering chemical admixtures were introduced. These technologies made it possible to produce very low water to cement ratio concretes at relatively low cement contents. This spawned further research by Clear [9] into empirical relationships for ation which has weathered Asian financial difficulties and low refining margins.

The company recorded a profit in the first half of this year after a loss in the same period a year ago, though officials say that prospects for the rest of the year depend upon global crude oil prices and the value of the Philippine peso.

Other officials have projected flat income growth for next year for Petron, as the expected commercialisation of the Malampaya natural gas project may affect oil demand. Malampaya gas is expected to start flowing by early next year.

Petron also aims to reduce operating expenses to remain competitive with the entry of natural gas into the market, he added. It will also review its assets to identify non-profit-making areas.

Petron made a net profit of 513 million pesos ($9.6 million) in the first six months of this year, reversing a net loss of 628 million pesos in the same period last year.

Petron said its sales jumped to 44.55 billion pesos in the first six months from 39.85 billion a year earlier despite an 8.6 per cent year-on-year decline in the volume of petroleum products sold in domestic and international markets.

Company officials said Petron sold 23.4 million barrels of refined products in the first half against 25.6 million in the same period last year.

Declining oil prices were cited as a reason for easing first half finances.

Petron is now keeping a watchful eye over the business environment before pursuing certain capital projects. One project in which the company has invested is a refinery upgrade to comply with the Philippines' Clean Air Act.

The Clean Air Act mandates the phasing out of leaded gasoline, a maximum 0.2 per cent sulphur content in gas oil compared with the present 0.5 per cent; two per cent benzene content and 35 per cent other aromatics in gasoline compared with corresponding levels of five per cent and 55 per cent.

Petron has been preparing for the more stringent specifications, commissioning a 17,000 bpd continuous catalytic reformer.

Construction of an Isomerisation Unit and Gas Oil Hydrotreater was expected to start this year for a targeted start-up of 2003, though this could be delayed.

While Petron is said to be evaluating its options to minimise the costs of the Act, the added cost component is likely to be reflected in the company's product pricing.

Petron is also said to be looking to diversify from its core business by expanding into the non-fuels market and the petrochemical sector.

The company is improving organisational efficiency by implementing advanced information technology and has also invested heavily in its product distribution network.