Facilities in the Master Gas System

Facilities in the Master Gas System

RECENT MOVES to expand Saudi Arabia's gas infrastructure to meet increasing industrial demand are the latest in a long line of initiatives carried out by Saudi Aramco to maximise this vital source of fuel.

The Kingdom has identified three specific targets with regards to its gas reserves: firstly, to meet domestic gas demand and optimise ethane and natural gas liquids (NGL) utilisation up to 2025 and beyond; secondly, to identify the ultimate economically-recoverable gas reserves of the country and, thirdly, to identify the appropriate near-term actions which allow the ongoing development of the gas sector.

Saudi Arabia uses more gas per capita than leading high income Organisation for Economic Cooperation and Development (OECD) countries such as Germany, Japan and the UK.

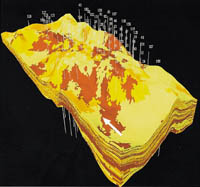

Saudi Aramco has been proactive in utilising its associated gas through the so-called Master Gas System (MGS), which is now being extensively expanded.

Since the 1970s, the MGS has offered substantial economic benefits by gathering and utilising the associated gas to diversify the country's sources of income, stimulating industries such as petrochemicals and providing more affordable utilities.

Gas is also acknowledged as an environmentally-friendly alternative to oil, while also freeing up hydrocarbon liquids for export.

But associated gas production is inflexible in that, in order to increase production, oil production must also be increased. Thus, Saudi Aramco began to develop non-associated gas in the early 1980s to provide fuel and feedstock to domestic industries during periodic shortfalls of associated gas supplies.

Processing

Today, major processing facilities at Berri, Shedgum, 'Uthmaniyah and, later this year Hawiyah, treat the gas and recover NGLs.

Gas from the plants is then supplied to the sales gas distribution grid, with the NGLs being supplied to downstream fractionation plants at Ju'aymah and Yanbu. It is these downstream facilities which supply petrochemical feedstock and liquid petroleum gas (LPG) for export and industrial consumption.

However, meeting demand for sales gas from industrial and power generation sectors has required several major expansions to MGS infrastructure in recent years.

Projects

The Shedgum Gas Plant has recently increased its processing capacity by 20 per cent to 2.4 billion cu ft per day following a major debottlenecking project, following debottlenecking projects at Berri and 'Uthmaniyah.

The project, according to Saudi Aramco, included expansion of a high-pressure gas-treating unit, a sweet gas moisture removal unit and high-pressure flare systems, and the addition of a new 535,000 tonnes per day (tpd) sulphur recovery unit at Shedgum.

The $1.4 billion Hawiyah Gas Plant has been under construction since 1999 and is expected to be completed by this December, according to reports. The company is hoping to process first gas by this month.

Products

The facility, which will be the largest gas plant in the MGS, will produce 1.4 billion cu ft per day of non-associated gas. It will receive sweet gas from the Jauf reservoir and sour Khuff gas from wells in the Hawiyah and Haradh fields. It will be the first MGS plant to process only non-associated gas.

With its commissioning, the Hawiyah plant will boost total supply to the MGS by some 35 per cent to around 5.6 billion cu ft per day. The plant is also expected to provide some 170,000 barrels of condensate and 1,000 tonnes of elemental sulphur per day.

Japan's JGC Corporation is carrying out the engineering, procurement and construction (EPC) for the facility, with Argentina's Techint carrying out the inlets part of the plant, where incoming gas will be stabilised and condensate separated out. Italy's Technip is working on sulphur recovery and utilities.

Site preparation also started earlier this year for the 1.4 billion cu ft per day capacity Haradh Gas Plant, which is scheduled to begin production in December 2003.

JGC will build the estimated $410 million plant under a turnkey contract, with Consolidated Contractors International Company (CCC) Saudi Arabia as a subcontractor.

Technip France is undertaking a lump sum turnkey contract to install a new compression train for Saudi Aramco at Abqaiq gas plant.

The project involves the installation of a 100 million cu ft per day NGL compression train with associated facilities in the existing Abqaiq complex, according to reports. A new heat recovery system and primary flare will also be added, while the control system will be expanded and upgraded with new technology. Completion of the project is expected in mid-2003.

The capacity will be sufficient to process low pressure gases to comply with current environmental regulations, Technip said.

Technip is also involved in a project to build two gas pipelines to distribute gas from Haradh to the Abqaiq terminal, which is expected to be completed in 2003.

Earlier this year Saudi Aramco set a record by carrying out a high quality test and inspection of a giant propane storage tank at Ju'aymah Gas Plant in a record time of two months, at minimum cost and with no accidents, according to the company. Five to six months are normally required to complete such a project, which included complete shell insulation replacement.

The 650,000 barrel tank, 29 m high and 66 m in diameter, stores propane produced at the gas plant at -45 deg Fahrenheit and atmospheric pressure.

Saudi Arabia's proven reserves of associates and non-associated gas are estimated at approximately 213 trillion cu ft, with new discoveries likely to increase that figure significantly. Estimates also suggest that domestic demand in the Kingdom for gas will rise to 6.8 billion cu ft per day in 2005, and up to 8.2 billion cu ft per day by 2012.

Saudi Aramco's efforts to find new associated gas reserves has, according to officials, resulted in the discovery of about 30 trillion cu ft of gas in the last three to four years. Exploration is now focused on the South Ghawar, Berri and Qatif fields in the Eastern Province.

Petrochemicals

The Kingdom's petrochemical sector will be a leading consumer of Saudi Arabia's gas.

State petrochemical giant Saudi Basic Industries Corporation (Sabic) is in the middle of a major programme of expansion which will see current production of 35 million tonnes per year (tpy) rise to 48 million tpy by 2010.

A number of private petrochemical projects are also being set up to take advantage of the plentiful supplies of gas.