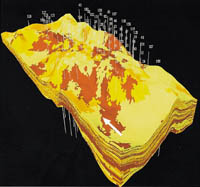

Drilling rig at Shaybah

Drilling rig at Shaybah

BE IT oil, gas or petrochemicals, these are certainly exciting times in the dynamic world of Saudi hydrocarbons.

More good news is on the way for some of the contractors and rig operators operating in the Kingdom's oil exploration and production sector.

Saudi Aramco will embark on a massive programme of oil and development projects worth more than $15 billion over the next five years as it hikes production capacity from 10.5 million barrels per day (bpd) at present up to 12.5 million bpd.

The plan is for the company to expand its crude oil production potential with a host of new projects in the biggest expansion programme since the development of the giant Shaybah field at the end of the last decade.

At Qatif, Foster Wheeler is providing overall management, basic and detailed engineering, essential procurement, construction management and other services to a $1.5 billion project to increase crude production capacity by 500,000 bpd.

The development of the Qatif North and South fields and the offshore Abu Safah field will involve the construction of three gas oil separation plants (GOSPs), pipelines, expansion of Berri gas plant to process associated gas and the construction of four cogeneration plants, which will generate 180 MW power and 600 lb per hour of high pressure superheated steam. The project is expected to come onstream by 2003 or 2004.

A selection of the lump sum turnkey contractor for the projects is expected shortly. The tendering process is said to be under consideration by Saudi Aramco. One possibility would be to have four packages covering Qatif North and South and Abu Safah GOSPs; the Qatif South GOSP; the Berri gas plant expansion, and the cogeneration plants.

The alternative, according to reports in the Kingdom, would be to tender just three packages. If this were the case, the Qatif North and Abu Safah GOSPs would be combined with the cogeneration works into one package.

An even bigger project is taking shape in the Khurais region, some 100km West of the Ghawar field.

Estimates suggest that the Khurais scheme will cost some $3 billion when it comes onstream in mid-2005. Details of the project are said to be still under consideration, but will involve the addition of 800,000 bpd of crude oil capacity, as well as a number of GOSPs.

It is a revamp and full development of a field which is one of four - along with Abu Hadriya, Abu Jifan, Harmaliyah and Khursaniyah - which were mothballed in the 1990s.

Oil production will get a further lift by a development at Haradh, where Italy's Snamprogetti has an engineering, procurement and construction (EPC) contract for a 300,000 bpd GOSP.

In addition to oil production incremental projects, the Core Venture gas projects could also provide Saudi Aramco with more oil.

Under the agreements with international majors, if any oil is struck while gas exploration is taking place, then the oil must be handed to Saudi Aramco.

Saudi Aramco is also constantly looking for ways to enhance crude oil production from existing wells.

At the Ghawar field, for instance, the aplication last year of a lateral reentry system - self locating (LRS-SL) is enabling the company to speed up remedial well production tasks without using expensive rigs, according to officials.

LRS-SL technology allows an operator to enter a dual lateral horizontal well selectively and easily to carry out remedial jobs such as well stimulation or zonal isolation in a highly cost effective manner.

Installation of LRS-SL across the start of each lateral section enables oil to be produced from two wellbores - the vertical and the two laterals - simultaneously.

Saudi Aramco has drilled numerous lateral sections from existing wells to capture the maximum amount of crude oil in its reservoirs.

Along with Ghawar, Saudi Aramco says that the fields in which this technology is particularly appropriate include Qatif, Berri, Marjan and Safaniya.