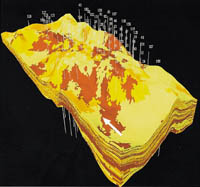

Overseas asset ... a Motiva plant in the US

Overseas asset ... a Motiva plant in the US

In addition to an impressive line up of domestic refining assets, Saudi Aramco has, for many years, been proactive in acquiring stakes in refinery projects overseas.

Thus, the company has invested heavily in plant and distribution networks in the US, Europe and Asia Pacific regions, becoming a partner in development and providing uninterrupted supplies of crude oil to refineries in key areas of the world.

In developing overseas assets, Saudi Aramco is aiming to guard against the worst effects of crude oil price fluctuations, which have a major effect on upstream earnings. Overseas assets therefore provide alternative sources of income for the company.

The search for overseas opportunities goes on. Reports earlier this summer suggested that 'serious' negotiations were taking place between Saudi Aramco, ExxonMobil and China's Sinopec (owned by the Chinese government) for a 220,000 barrels per day (bpd) joint venture oil refinery project in Shandong Province.

The plan also calls for the construction of a petrochemical plant and expansion and repair of a refinery in Fujian Province.

Reliable sources in China are reported to have estimated total project costs at $3.5 billion.

China is seen as an ideal location for potential joint ventures. The country is witnessing steady economic growth and therefore needs new sources of energy. For Saudi Aramco's part, with the largest oil reserves in the world, it is capable of meeting both short and long term market needs in China, as well as adding value to its crude through transportation and refining. If implemented, the project would be the company's fifth international refining and marketing venture.

Saudi Aramco already has a strong presence in China, with an office in Beijing helping develop key international refining and marketing links.

The company also has affiliates offices in New York, London, Tokyo and Singapore, providing a strong base for the sale of crude oil, natural gas liquids (NGLs) and petroleum products.

Saudi Arabia's overseas refining policy was forged in the mid-1980s, when it was decided to refine half of the Kingdom's crude in its own system, while establishing secure export outlets.

Saudi Aramco's refining assets are currently in the US (Motiva Enterprises), South Korea (S-Oil Corporation), the Philippines (Petron Corporation) and Greece.

However, recent reports on a possible merger between Chevron and Texaco could have implications for Saudi Aramco investments in the US.

The US Securities Exchange Commission (SEC) has, according to the reports, ordered Texaco to divest its holdings in refining and distribution venture Motiva and marketing company Equilon.

The SEC has argued that, post-merger, ChevronTexaco would hold too strong a grip on downstream activities in parts of the US if it continued to hold interests in Motiva and Equilon. Saudi Aramco and Texaco each control 35 per cent stakes in Motiva, and the Royal Dutch/Shell Group holds the remaining 30 per cent. The company owns four refineries and 14,000 petrol stations, and had gross revenues of $19.4 billion last year. Shell holds 56 per cent of Equilon, with Texaco holding 44 per cent.

Saudi Aramco and Shell are said to be in negotiations about buying the Texaco stakes. However, the Federal Trade Commission has effectively enabled those talks to extend beyond the October 9 merger deadline by allowing the shares to be placed in a trust if a deal cannot be concluded in time. The trust would be compelled to sell the stakes within eight months, with no floor on the price, according to reports.