SAUDI ARAMCO is in the midst of a $15 billion, five year investment programme which will focus on a number of massive projects to boost oil and gas production capacities.

The company is pressing on with plans to implement the latest technologies to maximise its abundant resources.

It has already identified the value of gas for future development, with president and CEO Abdallah S Jum'ah saying: ''Our own assessment indicates that vast reserves of gas remain to be discovered in many parts of the Kingdom.

''The Kingdom's strategy is to encourage a rapid expansion of the use of gas across the country in order to accelerate the pace of industrialisation and achieve a speedier expansion and diversification of the economic base,'' he said.

Thus, Saudi Aramco is increasing the scope of its gas infrastructure, building on more than three decades of successful utilisation of this vital resource.

Expansions continue in the Master Gas System (MGS) - which captures, processes and transports associated gas for use as feedstock for downstream industries.

Three existing gas processing plants in the MGS will become four by the end of this year, when the Hawiyah plant comes onstream.

With a capacity to process 1.4 billion cu ft per day of associated gas, Hawiyah will go some way to helping the MGS meet burgeoning gas demand growth.

Estimates suggest that gas demand in Saudi Arabia is scheduled to grow by seven per cent per year in the coming decade, growth that Saudi Aramco believes will offer a 'wealth of opportunities'.

Further capacity will come towards the end of 2003 when a fifth gas processing plant - at Haradh - starts up. With this, MGS processing capacity will top seven billion cu ft per day.

Saudi Aramco has stepped up its search for associated gas - a programme which has resulted in the discovery of more than 30 trillion cu ft in the last three to four years.

Exploration for more gas is now focused on the South Ghawar, Berri and Qatif fields in the Eastern Province.

The company says that, in addition to its gas industry, it is also committed to the development of more basic petrochemical and downstream projects.

These pledges by Saudi Aramco come at a time when international oil majors are preparing for major gas and downstream development plans of their own in the Kingdom.

Under the three so-called Core Ventures, the majors have formed consortia to further develop the Kingdom's gas in upstream and downstream plans including power, water and petrochemical components.

Preliminary estimates have put the value of the three Core Ventures at between $25 billion and $30 billion. And Saudi Aramco will, according to Minister of Petroleum and Mineral Resources Ali Al Naimi, play a crucial role in this process.

It is perhaps testimony to its corporate and operational flexibility that Saudi Aramco can work with the international companies in the Kingdom's gas sector. Cooperation and partnership will be the key, according to observers, but then Saudi Aramco already has a long and successful history of cooperation with foreign oil companies in the form of domestic and overseas joint venture refineries and marketing/retail companies.

''We welcome outside involvement in the construction of Saudi Aramco mega projects,'' said Jum'ah.

''We encourage international firms to partner with domestic companies in carrying out the varied elements of complex integrated projects,'' he added.

Saudi Aramco has already conducted preliminary studies on some of the gas tracts which are to be developed by the majors, while these same companies will rely on Saudi Aramco to provide the initial gas feedstock for power and water plants.

Knowledge and expertise are tremendous assets at Saudi Aramco, and the company continues to strengthen these aspects of its business to prepare for future global energy demand.

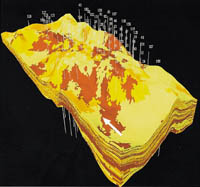

The vast amounts of seismic and reservoir data generated and processed for interpretation has required the installation of new supercomputers, giving the company unprecedented information and knowledge about the country's subsurface in an enhanced 3D environment.

This technology empowers Saudi Aramco, as it embarks on a programme to boost crude oil and natural gas production capacities, by providing more accurate and, therefore, cost effective drilling information.

Crude oil capacity expansions are already under way at Qatif and Khurais, projects which are expected to raise production capacity in the Kingdom by a further one million barrels per day (bpd).

Crude oil output last year increased 7.2 per cent to approximately 7.8 million bpd, according to statistics.

This makes Saudi Arabia by far the world's largest producer and exporter of crude oil to the global market.

As the leading Opec oil producer, the Kingdom has played a major role in ensuring market stability. Its international status was enhanced further at the end of last year when Riyadh hosted the Saudi Aramco-organised Seventh International Energy Forum, a gathering of energy ministers from both producing and consumer countries.

Estimates from the Saudi American Bank (Samba) suggest that Saudi crude will average $23 per barrel for the remainder of this year, from $24 per barrel in the first half of the year. Saudi crude fetched $27 per barrel last year.

The Far East continues to be the main export market for Saudi crude oil and refined products. Last year, its share of crude exports totalled 40.7 per cent against 38.8 per cent in 1999. The Kingdom has also consistently remained the leading supplier of crude oil to the US.

In addition, Saudi Aramco has established a strong foothold in the growing Chinese domestic market.

The company renewed a crude supply agreement with the Chinese International Petroleum and Chemicals Company earlier this year. The Chinese firm operates 24 refineries in China with a combined refining capacity of 2.5 million bpd.

In addition to gas, Saudi Aramco anticipates demand growth of 2.5 per cent per year in the domestic refining sector.

The sector has reaped the fruits of joint venture partnerships for many years, at the state-of-the-art Saudi Aramco Shell Refinery (Sasref) in Jubail and Saudi Aramco Mobil Refinery (Samref) in Yanbu.

Saudi Aramco's policy of overseas investments in the downstream sector continues.

The company is said to have completed a joint feasibility study - with Chinese major Sinopec and ExxonMobil of the US - for a $3 billion petrochemical complex in southern China.

Saudi Aramco, Sinopec subsidiary Fujian Refining and Chemical Co and ExxonMobil will build the integrated plant in Fujian province, which will include an eight million tonnes per year (tpy) refinery, a 600,000 tpy ethylene facility, a 450,000 tpy polyethylene plant and a 300,000 tpy polypropylene plant. Saudi Aramco will hold a 25 per cent stake in the project.

When completed, the Chinese facility will complement Saudi Aramco's downstream assets in the Philippines, South Korea, Greece and the US as it continues to seek new export outlets for its crude.

Saudi Aramco will, according to Al Naimi, also regain its 50 per cent stake in US downstream venture Motiva following the planned takeover of Texaco by Chevron.

Saudi Aramco refining sector could also benefit from new e-commerce initiatives launched by the company.

By harnessing and deploying the latest technologies, the company is now adding value in production processes, managing and delivering information more efficiently and controlling costs.

Saudi Aramco has, for nearly a decade, been developing state-of-the-art infrastructure to support Internet and Intranet capabilities.

And development is also an ongoing process among Saudi Aramco's high calibre staff. This year has been the 'Year of Self Development' at the company, under which employees are encouraged to take responsibility to improve expertise.

As a pillar of the Saudi economy, Saudi Aramco takes its corporate responsibilities seriously, and is now developing the next generation of decision-makers and innovators to ensure the company's leading position in an increasingly competitive and challenging world.