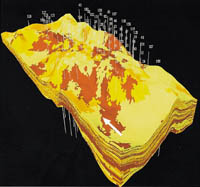

Saudi AramcoÕs operations and infrastructure are flexible and provide a cutting edge

Saudi AramcoÕs operations and infrastructure are flexible and provide a cutting edge

SAUDI ARABIA's burgeoning gas industry is likely to see increased foreign investment and joint ventures, over and above the landmark investment agreements signed with eight foreign oil majors.

Saudi Aramco will play a pivotal role in the future development of the Kingdom's gas resources, working with the international oil companies as part of a long term strategy to provide expertise and knowledge in this unique working environment.

Additional foreign firms and the Saudi private sector will be wooed to invest in the Kingdom's gas projects and further downstream, according to the Saudi Arabian General Investment Authority (Sagia), a government body charged with attracting private investment in several aspects of Saudi Arabia's industrial sector.

Central to the development of the gas sector is the establishment of an integrated industry, from exploration and production to supply lines and pipelines for primary industries, desalination and power plants, and for exports.

On June 3 this year BP, Conoco, ExxonMobil, Marathon Oil, Occidental, Phillips, Royal Dutch/Shell and TotalFinaElf signed three agreements - called 'Core Ventures' - to spend at least $25 billion on gas exploration, production, transportation and processing, in addition to petrochemical projects, power stations and desalination plants.

These core projects are expected to stimulate the private sector into providing further downstream services, increasing localisation, providing new jobs and transferring technology and training Saudi nationals.

However, Riyadh realises that, in order to mobilise the private sector in this way, certain regulatory reforms must take place.

Change is already taking place, a new foreign investment law now allowing 100 per cent foreign ownership of companies, tax reductions and other lending benefits.

Sagia will help potential investors by setting up 'one-stop-shops' called Comprehensive Service Centres, where investors will be able to gain access to representatives from Saudi Arabia's various government departments, with whom they need to deal with to set up their businesses. The aim, according to officials, is to decentralise the process.

The Core Ventures are therefore ultimately expected to stimulate an already growing private petrochemical sector, which will use increasing quantities of feedstock gas.

One private venture, the Saudi International Petrochemicals Company, was set up at the end of 1999 to focus on major petrochemical projects in the Kingdom, and is developing an $800 million facility in the eastern city of Jubail. The National Petrochemical Industrialisation Company, meanwhile, is spending $133 million on a polypropylene plant in Yanbu.

Increasing numbers of investors are indeed beginning to realise the full potential and size of a Saudi market whose Gross Domestic Product (GDP) is already approximately one fifth of the entire Middle East total. A rising population and good links with the world's developed economies augur well for the future, according to investment officials.

Far from threatening the Saudi domestic private sector, foreign investment in the Kingdom is expected to provide trickle-down opportunities to Saudi contractors and distributors as foreign firms aim to find Saudi partners.

Some financial experts also say that a new capital law, currently with the Supreme Economic Council, could ease liquidity and regulation concerning disclosure, minority shareholder rights, independent directors and accounting standards.

Saudi Arabia is no stranger to direct foreign investment. Some $50 billion has been spent on joint venture refineries and petrochemical plants in the country. The Kingdom's drive for gas will be the new focus for this investment.

For Saudi Aramco, both the Core Venture issue and that of private investors (domestic or foreign) will require a vital role to be played.

The company, for instance, has already explored many of the tracts of gas on offer to the international oil majors on a preliminary basis, and also has a mammoth infrastructure already in place to launch industrial projects. By working with the foreign majors, Saudi Aramco is, some officials believe, simply demonstrating its flexibility.