Katschinski ... giving traders confidence through technology

Katschinski ... giving traders confidence through technology

The platform creates one unified virtualised view of the market encompassing all available liquidity and data pools, and where all liquidity is discovered, analysed and traded easily and reliably, Ami Katschinski, CEO & Founder of Sphere, tells OGN

For traders, nothing matters more than managing risk, optimising assets and generating trading profits. Although this is the same for all traders, the oil and gas industry in particular has seen volatility and hyperactive moves in recent times.

THE CONFIDENCE CHALLENGE

In the current market turbulence, what matters most to traders is confidence in reliable and fast price discovery, as well as efficient quick execution when opportunities are spotted.

Those of us who have spent decades developing trading tech know all too well the inherent role confidence plays. It spreads across a community of trading competitors when liquidity is revealed and, unsurprisingly, it dwindles when liquidity is opaque. But how can technology help?

Success in oil trading requires getting multiple factors right, all at once. It relies on solving three key challenges simultaneously with each being difficult to perfect on its own, let alone all at once.

• The availability of external high-quality market information.

• The quality of trader analysis, which drives instinctive and informed decision making.

• The ability to commit capital quickly, precisely and confidently.

Until recently, voice and electronic liquidity pools were isolated from each other, denying oil traders a clear and holistic overview of the markets they cover.

Many traders favoured voice, with its immediacy and human feel. Others may have liked the ability to trade anonymously on electronic screens, interacting from anywhere in the world in the same way, many markets do today.

These differing takes on trading have long been at odds with each other, competing for traders’ attention and as a result, liquidity has been fractured and splintered.

Now, however, a new platform has emerged, enabling traders to fluidly and seamlessly traverse across traditional voice trading and electronic trading workflows.

By collecting all actionable liquidity in one platform traders are able to boost their confidence in the increasingly complex, volatile, and fragmented trading environments of today.

A category of software has been created to define this new option - The Liquidity Lake. It enables traders and brokers to trade and see liquidity from all liquidity pools and across any trading workflows altogether, in a single interface.

The Liquidity Lake distils prices from unstructured audio and/or text-based communications, merging together electronic trading and digital data streams on one screen for the first time.

A single Liquidity Lake now unites trading and data from global trading venues and that very act of unification helps liquidity formation and promotes efficient price discovery.

For Liquidity Lake users, the world is now one big actionable pool of liquidity for them to dive into.

ARCHAIC DATA COLLECTION

Today’s oil traders are subjected to a daily barrage of structured and unstructured information from audio and text to digital inputs, making it extremely hard to separate the signal from the noise.

|

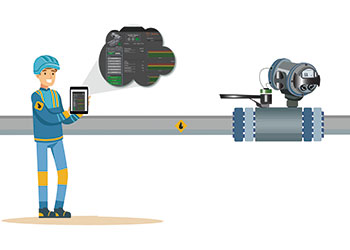

Liquidity Lake ... creating a unified virtualised view of the market |

Over 90 per cent of the refined oil financial derivatives market is still traded via voice and IM communications. This means traders may need to process up to 5,000 shout-downs from around 50 brokers in an average trading day, while simultaneously having to deal with more than 20 digitised information sources.

All of this ‘noise’ is then mentally consolidated by traders into a proprietary spreadsheet, containing each trader’s view of their markets, constantly aiming to capture where "fair price" is for every contract in the markets they cover - the traders’ ‘North Star’.

It is fundamental that the quality of data captured is entirely correct and up to date, be this via automation of inputs or simply by improving visibility of available actionable liquidity at any given moment.

A trader’s ‘gut feel’ and experience cannot be built upon false or unreliable data, all traders benefit from a tool which frees them up to focus on other tasks.

ADVANCED TRADING WITH INTELLIGENT TECHNOLOGY

The most valuable trading information comes from the richest external data, drawn from both analogue and digital sources, displayed in the most relevant and digestible format possible.

Regrettably, a constant wall of noise can compromise a trader’s performance. Additionally, traders are forced to rely on the manual consolidation of this data.

Given this intense trading activity is made up of a mix of audio, textual and visual signals, bringing these data sources together adds significant value to traders.

Traders could do better - if only they had more help to distinguish the signals from the noise, thousands of times a day, every trading day. If only they had help to feed and deploy their experience and instincts more efficiently and with greater control - when making decisions and when executing trades.

The industry has been crying out for a platform, which can maximise the benefits of the digital trading infrastructure whilst complementing traditional voice workflows in markets where liquidity is fragmented and challenged.

For this reason, Sphere is building the world’s first Liquidity Lake - creating one unified virtualised view of the market encompassing all available liquidity and data pools, and where all liquidity is discovered, analysed and traded easily and reliably.

PUTTING INTELLIGENT TRADING INTO PRACTISE

Uncertainty and volatility have always existed in the energy markets. Today’s conditions, however, are uniquely wild. But now, oil traders have a new alternative – to lean on the market’s most innovative and powerful technology developed by Sphere.

The platform enables traders to react quickly, gain deeper insights, track all available liquidity, and respond to price shifts more efficiently and decisively than ever before.

Current market circumstances create an environment that favours those who choose to leverage technology to help them win against the competition even in volatile and unpredictable times.

Take for example the impact on oil and gas trading following the latest Opec + meeting.

Opec and partners agreed to cut oil production by 2 million barrels per day to shore up prices. This follows a much larger cut of 10 million barrels a day in 2020 due to the Covid-19 pandemic and resulting in travel and social distancing restrictions imposed worldwide.

Output increased gradually since 2020 but a looming global recession and rapidly dropping oil prices pushed Opec+ to make these cuts, members explained.

The medium- and long-term impact of the reduction in output on prices of crude and refined oil products will clarify in time but any change in supply has, as one would expect, a ripple effect throughout the energy markets.

The difference now is that traders in the know can deploy Sphere’s intelligent Liquidity Lake technology to quickly and efficiently consolidate and trade on their views in response to events as they unfold.

Despite the choppy conditions, oil traders now have a secret weapon to help them perform and trade better than ever before.