Aramco is operating 212 oil and gas rigs

Aramco is operating 212 oil and gas rigs

Saudi Aramco appears to have succeeded in its drive to cut drilling costs by negotiating lower rates with rig contractors operating in the region

Drilling rates in the shallow waters of the Arabian Gulf off eastern Saudi Arabia have come off as much as 20 per cent recently, according to a report by US-based investment bank group Cowen and Company.

Those are part of a broader push by Aramco to reduce project and operating costs across the board, with contractors on major projects coming under pressure to increase the scope of their work with little or no price adjustment.

The Cowen report highlighted Aramco’s rate reductions on jackup rigs for London-based rig provider Ensco International. The company says in its April fleet status report that it had agreed to lower day rates for its seven offshore jackup rigs in the kingdom. The reductions range from 10 per cent to 20 per cent, with effect from April 2015 to January 2016.

'We expect further rate negotiations are ongoing, and could affect other operators with units contracted to Aramco,' Cowen says.

Since the New Year, Aramco has been pushing for markdowns of up to 25 per cent with rig providers and other oilfield services as the price of oil remains around $50/barrel.

'We continue to believe this will be an industry-wide trend as NOCs and IOCs seek to renegotiate current contract rates in light of lower commodity prices,' the report says.

According to an executive at an oilfield services provider, Aramco is looking at new contracts linked to oil prices to reflect the volatile conditions, but there has been no decision yet if this will be the method used.

'This would be a compromise, with discounts while the price is low, but also higher rates as conditions improve,' the source says.

Saudi Aramco declined to comment on its rig status or talks with contractors.

RBC Capital Markets described Middle East rig activity as the hardest hit globally in March, with the region dropping eight rigs to 407, according to RBC estimates.

'However, service companies have mentioned the Middle East as an area of relative strength and the data backs this up so far,' RBC says in a report dated April 8.

According to RBC, the Middle East’s rig count has dropped 6 per cent since July 2014, compared with 9 per cent in Africa, 8 per cent in Asia Pacific, 12 per cent in Europe and 14 per cent in Latin America. Significant drops in Iraq of 40 per cent and Egypt of 20 per cent have partially offset increased rig counts in Saudi Arabia, up 19 per cent, and Kuwait, RBC says.

Other analysts have predicted that Aramco’s 2015 drilling activity would remain about the same as last year as the state petroleum company moves to implement Riyadh’s new policy of protecting Saudi Arabia’s share of the global oil market. But sharply lower oil export revenue due to the recent price slide puts Aramco under pressure to do more for less, meaning it can only achieve its production targets if drilling costs fall.

Aramco’s former chief executive Khalid Al Falih said in late January that the company had sufficient cash to fund its 2015 capital programme but would have to re-examine its approach to a number of projects as a result of the price crash.

Since then, Aramco has increased crude output.

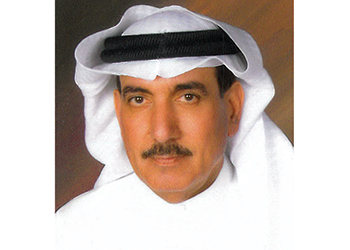

Aramco acting CEO Amin Al Nasser says that Aramco was operating 212 oil and gas rigs across the country and had not decided either to increase or cut its drilling fleet.

The kingdom’s rig count is not expected to fall significantly in 2015, Aramco’s cash flow is being managed carefully across all of its operations.

.jpg)