ExxonMobil

ExxonMobil

ExxonMobil has released a detailed investor presentation reiterating the company’s strategy to capitalise on its industry-leading resources to drive earnings and cash flow growth, maintain a strong dividend, reduce debt and invest in lower-emission technologies.

“ExxonMobil has laid a solid foundation for success,” said Darren Woods, chairman and chief executive officer. “Our board and management have developed and are executing a strategy which has positioned us for future outperformance relative to peers, including paying a reliable and growing dividend. We are uniquely placed to help society meet its net zero ambitions, while capturing enormous future opportunities and delivering value for shareholders for many decades to come.”

ExxonMobil’s presentation outlines how it is investing in lower-carbon technologies to expand business opportunities over the longer term, while driving structural improvements in existing businesses with a disciplined, value-driven approach.

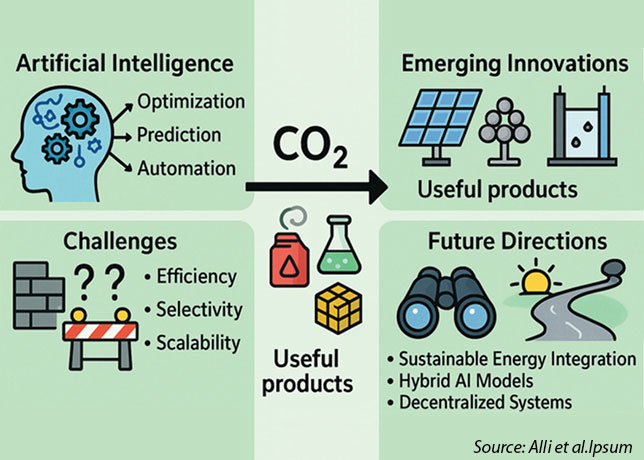

The presentation highlights the new ExxonMobil Low Carbon Solutions business, which is working to commercialise technologies to reduce emissions in hard-to-decarbonise sectors, such as power generation, commercial transportation and heavy industry. The technologies include carbon capture and storage (CCS), which will be the initial focus of Low Carbon Solutions, as well as hydrogen, and advanced biofuels. Demand for these lower-emission technologies could create multi-trillion dollar markets by 2040. ExxonMobil is the global leader in CCS, and has captured approximately 40 percent of all anthropogenic CO2 ever captured, the equivalent to planting approximately 2 billion trees.

ExxonMobil recently announced a multi-industry CCS concept that has the potential to significantly decarbonise heavy industries located near the Houston ship channel; early projections indicate that, with the appropriate enablers, it could remove approximately 100 million metric tons of CO2 per year by 2040. The lower-carbon business opportunities leverage decades of ExxonMobil experience in deploying technology at scale, and competitive advantages demonstrated in its existing businesses. In addition, the company’s 2025 emission-reduction plans are projected to be consistent with the goals of the Paris Agreement and a 2-degree pathway.

The company also details how it is investing in one of the most attractive, high-return portfolios in the industry to increase cash flow while maintaining existing production levels needed to responsibly meet society’s continued demand for oil and gas and high-value chemical products.

ExxonMobil’s plans are built to capture opportunities in a wide range of long-term energy-demand scenarios, consistent with those of the UN’s Intergovernmental Panel on Climate Change and the authoritative International Energy Agency, that show a continued use of fossil fuels well into the future. The company’s current plan assumes flat production volumes while still generating excess cash at $50 per barrel Brent.

Noting significant improvements to its portfolio since 2017, and the fact that the company continues to benefit from long-cycle actions approved by its board, ExxonMobil highlighted that total shareholder return (TSR) has outperformed the peer average over the past six-month, one-year, two-year and three-year periods, and had a 52% TSR over the past year.

The company also outperformed the peer average on long-term return on capital employed (ROCE) and dividend growth per share over the last five years. -- TradeArabia News Service