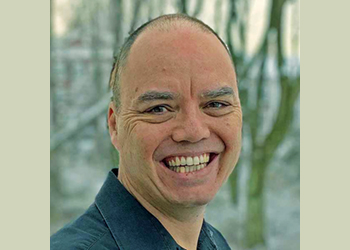

Nasser ... oil demand to grow for the rest of the decade

Nasser ... oil demand to grow for the rest of the decade

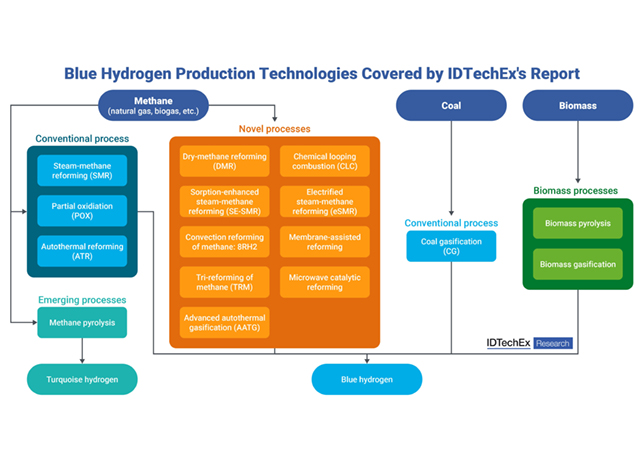

These record profits reflect increasing demand for oil, and while climate goals remain critical, Aramco is working to increase production from multiple energy sources, including oil and gas, renewables, and blue hydrogen, says CEO Amin Nasser

Saudi Aramco’s profitable H1 2022 financial results brings a breath of fresh air to the an industry, which has been challenged by under investment and environmental concerns.

The company earned $87.9 billion in H1 compared to $47.2 billion in 2021. Its Q1 net income rose 90 per cent over last year to $48.4 billion.

If we consider Aramco, the world’s largest crude oil producer, as the industry’s barometer, then there are strong signs of the demand for oil going up.

Other oil majors have also announced record profits, such as Chevron, ExxonMobil, and Royal Dutch Shell that saw profits more than double in Q2. But Aramco’s profits are the largest of any listed company.

What needs to be seen henceforth is whether the market responds with further investment – as the industry so desires – or if the naysayers have their way and stall further growth.

A report by the King Abdullah Petroleum Studies and Research Center (KAPSARC) has warned of challenges hindering investments in the industry (read report on page 62).

It says after investments significant dropped in 2016, they started to recover in 2017. 'However, the Covid-19 pandemic interrupted that recovery, driving investment levels in 2020 to the lowest in the last decade, and making it more evident how sensitive the market is to crises'.

But some strong voices in the industry are in to 'correct that'.

Last month, Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, said 'extreme' volatility and lack of liquidity mean the futures market is increasingly disconnected from fundamentals and OPEC+ may be forced to cut production, said a Bloomberg report.

'The paper and physical markets have become increasingly more disconnected,' he said.

Opec+ members have backed up the prince.

The report further said benchmark crude oil futures had fallen more than 20 per cent since early June on concern about the outlook for the global economy and the possibility of more Iranian oil coming onto the market.

Opec+ agreed last month to raise production quotas by another 100,000 bpd in September as it faced pressure from major consumers including the United States which are keen to cool prices.

Only Saudi Arabia and the UAE are believed to have spare capacity and the ability to increase production in a meaningful way.

INCREASE IN DEMAND & INVESTMENT

|

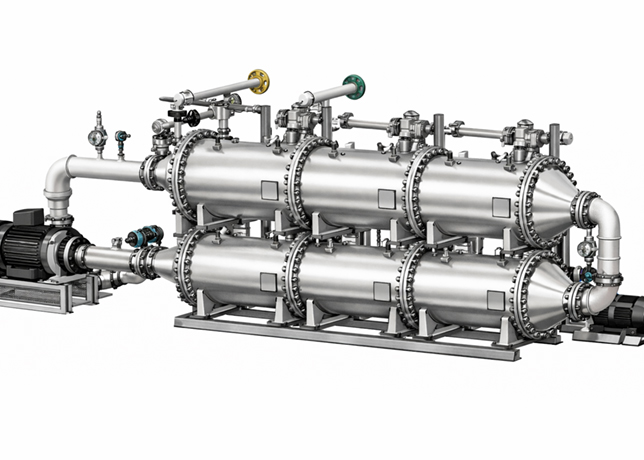

The Hawiyah Gas Plant ... the Hawiyah Unayzah Gas Reservoir Storage is in |

There is no denying the fact that the world increasingly needs energy, and Aramco’s financial results are proof.

'These record profits are a testament to the resilience of the oil industry. Despite concerns about climate change and the rise of renewable energy, the oil industry continues to thrive thanks to high energy prices,' says Tradingplatforms’s Edith Reads.

Amin Nasser, President and CEO, and Aramco, said in the H1 report that the company’s record second-quarter results reflect increasing demand for its products.

'In fact, we expect oil demand to continue to grow for the rest of the decade, despite downward economic pressures on short-term global forecasts,'

He said events during the first half of this year supported their view that ongoing investment in the industry was essential — 'both to help ensure markets remain well supplied and to facilitate an orderly energy transition', despite the global market volatility and economic uncertainty.

Aramco is using windfall to pay down debt and expand its production capacity. The company believes demand for its oil and chemicals will continue to be strong even as the world seeks to reduce reliance on fossil fuels.

Aramco intends to increase its production capacity by investing in new projects, which would help meet growing energy needs while diversifying Saudi Arabia’s economy.

The company is looking to increase its crude oil maximum sustainable capacity from 12 million bpd to 13 million bpd by 2027.

It demonstrated a reliable upstream performance, with average total hydrocarbon production of 13.6 million barrels of oil equivalent per day in the second quarter of 2022.

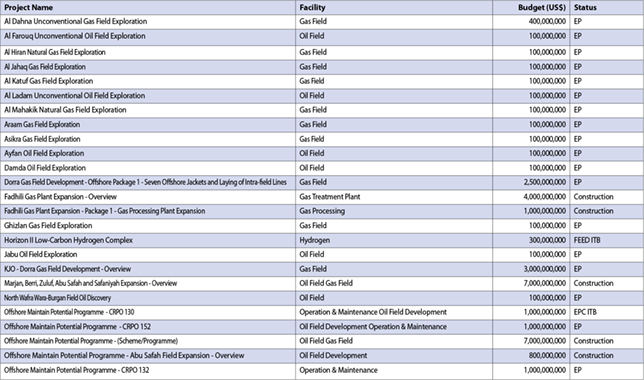

Aramco is going ahead with the largest capital programme in its history.

'Our approach is to invest in the reliable energy and petrochemicals that the world needs, while developing lower carbon solutions that can contribute to the broader energy transition,' says Nasser.

Aramco is looking for partners to invest in carbon capture, renewable energy, and hydrogen production. This is all part of the goal to reach net-zero carbon emissions from operations by 2050.

The company will see an increase in capex in 2022 in the range of SR150 to SR187.5 billion ($40-$50 billion), compared to 2021 capex $31.9 billion. This level of investment demonstrates Aramco’s growth ambitions.

• Upstream: Aramco will be doing a phased development at its $100 billion-plus Jafurah unconventional onshore gas project, which is expected to produce up to 2 billion cu ft per day (bscfd) of gas by 2030.

Jafurah is one of the largest shale gas fields outside the US with an estimated reserve of 200 trillion cu ft of gas.

This project will start initially with the construction and design of the Jafurah Gas Plant, which has a planned processing capacity of 3.1 bscfd of raw gas, expected to be completed in two phases by 2027.

In July, Worley announced that it had been awarded a three-year project management contract by Aramco for Jafurah, with an option for a two year extension. The firm will provide front-end engineering design, detailed design support, project management and construction management services.

Last November, Aramco announced the award of 16 subsurface and engineering, procurement and construction contracts worth $10 billion for the Jafurah gas plant and gas compression facilities, as well as infrastructure and related surface facilities.

Italy’s Saipem said it will build a system to transport water associated with separation of treated gas in a $750-million contract, which includes engineering, supply of materials, construction and commissioning of about 835 km of pipeline to transport gas, condensate and production water.

Other contract awards are believed to have gone to India’s Larson & Toubro, South Korea’s Samsung Engineering and Hyundai Engineering and Hyundai E&C.

The Jafurah field is expected to commence production in 2025 and will gradually reach a sustainable rate of 2 bscfd by 2030.

The field will provide feedstock for hydrogen and ammonia production and will help meet expected growing local energy demand.

The unconventional gas project is part of the country’s long-term strategy to boost gas production and free up almost 1 million bpd of oil from domestic use, boosting export capacity.

Saudi Arabia’s dry natural gas production exceeded 4 trillion cu ft for the first time in 2020.

Aramco commissioned the Fadhili natural gas processing plant in 2019 and began processing natural gas from non-associated fields in the eastern region, scaling up gas-based infrastructure in the country.

Most of the incremental gas production in the country is likely to come from the Jafurah development, which is also the largest non-associated gas field in Saudi Arabia, with over 200 Tcf reserves.

Meanwhile, construction of the Hawiyah Unayzah Gas Reservoir Storage has reached an advanced stage, with the injection phase nearing completion.

This is expected to provide up to 2 bscfd of natural gas to be injected into the master gas system by 2024.

Hawiyah Unayzah is the first underground natural gas storage project in the Kingdom, which will help manage seasonal changes in demand and in turn improve asset utilisation and cost efficiency.

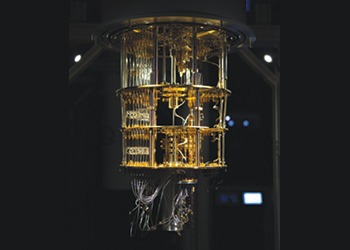

Also in upstream development, Aramco has successfully deployed the Ghawar-1 supercomputer for reservoir simulation.

The supercomputer is the second largest in the Mena region after Aramco’s Dammam-7, and it is expected to increase the number of completed simulation runs, enabling the company to exploit more opportunities from its existing resources.

• Downstream: Capturing additional value across the hydrocarbon chain and providing affordable, reliable, and sustainable energy to the world remains a priority for Aramco.

Since the inception of the programme in mid-2021, the downstream segment has embarked on a portfolio-wide transformation program that seeks to unlock incremental value through yield enhancements, stream integration, and cost reductions.

Aramco is well-positioned to achieve this objective and aims to capture growth opportunities, progress the strategic integration of its upstream and downstream segments, and expand its chemicals business.

The downstream segment continued to demonstrate its excellent operational track record and made important strides in enhancing its global downstream business in target geographies.

During H1 2022, the downstream segment consumed 44.4 per cent of Aramco’s crude oil production.

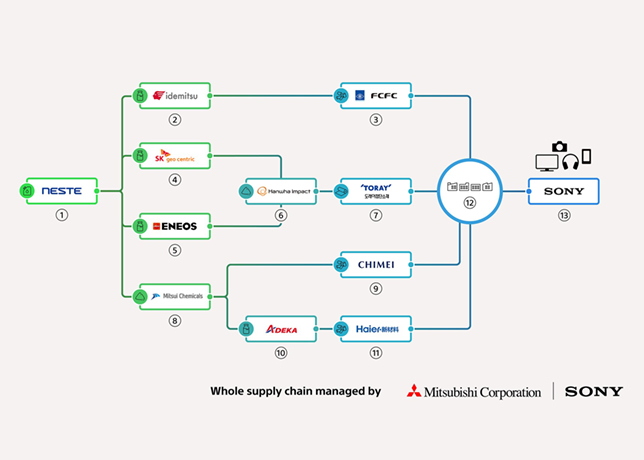

Aramco has undertaken a number of key downstream developments. In May, Aramco’s Malaysia-based investment in refining and petrochemical joint ventures with Petronas, PRefChem, started operations and is expected to reach full capacity of 300 mbpd by end of the year.

Aramco’s investment in PRefChem provides an expansion opportunity in an important high-growth market and offers new geographies for its crude oil production.

Marking yet another significant step in SABIC establishing itself as the primary chemicals arm and an integral member of the Aramco group, Aramco completed the transfer of its PRefChem polymers and monoethylene glycol offtake rights to SABIC.

In August, Aramco signed an equity purchase agreement to acquire Valvoline’s global products business (Valvoline Global Products) for $2.65 billion.

This strategic acquisition will complement Aramco’s line of premium branded lubricant products, optimise its global base oils production capabilities, and expand Aramco’s own R&D activities and partnerships with original equipment manufacturers.

By Abdulaziz Khattak

.jpg)