Aramco is determined to reach its 13 mbpd sustainable production target by 2030

Aramco is determined to reach its 13 mbpd sustainable production target by 2030

Although Aramco’s profits in H1 2023 declined 29.5 per cent, from $87.9 billion to $61.9 billion, that hasn’t deterred it from further upstream and downstream investments, which increased by 14.3 per cent and 12.9 per cent respectively

Aramco's Q2/H1 2023 results showed that it is making every effort to increase its gas production capacity by up to 60 per cent to meet domestic demand growth and play a key role in the country’s energy transition.

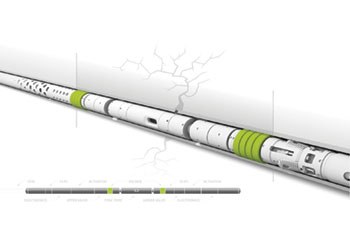

The company is progressing with multiple projects in this regard, including the 17,000-sq-m Jafurah unconventional gas field and Marjan development programme.

Containing an estimated 200 trillion standard cubic feet (scf) of natural gas, the Jafurah Gas Field is the largest liquid-rich shale gas field in the Middle East.

The gas projects will be supported by 4,000 km of pipelines for extensive delivery to the industries and power generation.

Aramco has increased the pace of oil and gas development projects and has set a target until 2030, by which it aims to reach 13 million barrels per day of sustainable production capacity.

According to the H1 report, the world’s largest producer has total hydrocarbon reserves of nearly 259 billion barrels of oil equivalent (boe). It produced 13.5 million boe per day of hydrocarbons in Q2.

|

Key Aramco Figures |

Aramco expects to achieve 1 million barrels per day (bpd) of additional crude capacity from its ongoing capacity enhancement programme by 2027, and another 1 million bpd from replacing oil with gas in the utilities sector. This will allow Aramco to free more oil for exports.

The report showed a 38 per cent decrease in Aramco’s profits in Q2, amounting to $30.1 billion compared to $48.3 billion last year in the same period. The overall profits in H1 2023 were $61.9 billion compared to $87.9 billion in H1 2022, a decrease of 29.5 per cent.

This was majorly attributed it to low crude oil prices and weakening refining and chemicals margins.

The cash flow generated was $33.6 billion in Q2 and $73.3 billion in H1 from operating activities.

Overall, the company delivered strong profitability and cash flows, enabled by low-cost production and high supply reliability.

Accordingly, it announced approximately $9.9 billion of performance-linked dividends in Q3 2023 based on combined full-year 2022 results and half-year 2023 results.

There was a 4 per cent year-on-year (YoY) increase in dividend in Q1 2023 base to the tune of $19.5 billion (paid in Q2). Meanwhile, the Q2 2023 dividend of $19.5 billion will paid in the third quarter (Q3).

|

The Abqaiq Oil Plant ... key upstream projects are undertaken by Aramco |

Amin Nasser, the President and CEO of Aramco, said regarding the results: 'Our strong results reflect our resilience and ability to adapt through market cycles. We continue to demonstrate our long-standing ability to meet the needs of customers around the world with high levels of reliability.'

Nasser said Aramco is under way with the largest capital spending programme in its history, with the aim of increasing oil and gas production capacity and expanding the downstream business, which included petrochemicals projects, such as the $11-billion expansion of the SATORP refinery with TotalEnergies to meet future demand.

All of Aramco’s projects are being executed keeping in view sustainability measures and its net-zero targets.

Nasser said he remained optimistic about the potential for new technologies to reduce the company’s operational emissions.

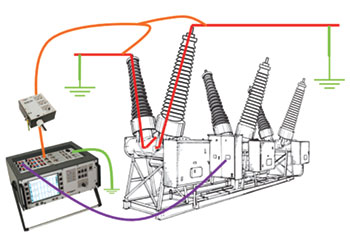

UPSTREAM PROJECTS ON TRACK

Aramco said its expansion developments in the upstream, both oil and gas, were progressing. These included the Marjan, Berri, Dammam, and Zuluf crude oil increments.

|

The Fadhili Gas Plant ... Aramco aims to increase gas production by 60 per cent |

Aramco’s spent (capital expenditure) $8.352 billion in upstream development in Q2 of 2023, an increase of 13 per cent compared to $7.394 billion for the same period in 2022. Overall capex in the first half of 2023 was up by 14.3 per cent, from 13.2 billion to 15.1 billion.

This increase came as result of additional development activity for crude oil increments to expand the maximum sustainable capacity, and for progress associated with gas projects to increase gas production capacity.

These developments include:

• The Marjan and Berri crude oil increments, which are expected to add production capacity of 300 mbpd and 250 mbpd, respectively, by 2025.

• The Dammam development project, which is expected to add 25,000 bpd and 50,000 bpd of crude oil by 2024 and 2027, respectively.

• The Zuluf crude oil increment, which is expected to provide a central facility to process a total of 600,000 bpd of crude oil from the Zuluf field by 2026.

In gas, Aramco made progress on several projects, including:

• Jafurah Gas Plant, part of the Jafurah unconventional gas field. The plant is expected to start production in 2025 and will gradually increase natural gas deliveries to reach a sustainable rate of 2.0 bscfd by 2030. The plant is currently undergoing design and construction activities.

• Construction and procurement activities continued at the Tanajib Gas Plant, part of the Marjan development program. The plant is expected to be on-stream by 2025 and add 2.6 bscfd of additional processing capacity from the Marjan, Safaniyah, and Zuluf fields;

• Hawiyah Unayzah Gas Reservoir Storage, the first underground natural gas storage in the Kingdom, achieved its maximum injection target of 1.5 bscfd. This programme will provide up to 2.0 bscfd of natural gas for reintroduction into the Master Gas System by 2024.

• Gas compression projects at the Haradh and Hawiyah fields continued commissioning activities, and are expected to be fully on-stream in 2023.

• Hawiyah Gas Plant expansion, which is part of the Haradh gas increment program, continued commissioning activities and is expected to be on-stream in 2023.

DOWNSTREAM GROWTH ADVANCING

Profits in the downstream were down substantially: 93.8 per cent, from $12.737 billion in Q2 2022 to $788 million in Q2 2023; and 81.6 per cent, from $22.9 billion in H1 2022 to $4.2 billion in H1 2023.

The reason given was weakening refining and chemicals margins and inventory valuation movement.

However, that didn’t deter Aramco from further investments. The company spent 10.4 per cent more on downstream activities in Q2 2023 compared to the same period in 2022, from $1.831 billion to $2.021 billion. Its capex for H1 202 was $3.927 billion, an increase of 12.9 per cent compared to $3.477 billion in H1 2022. This increase was mainly due to an increase in international investments and expansion.

Aramco has continued to strategically expand and integrate across the hydrocarbon value chain, advancing its goal of building a world-class integrated downstream business centered on long-term value creation and crude placement security.

During Q2, the company continued to demonstrate its track record of dependable operations, achieving 99.8 per cent supply reliability. In H1 2023, downstream utilised approximately 44 per cent of Aramco’s crude oil production. The key downstream developments include:

• In June 2023, Aramco and TotalEnergies awarded contracts worth $11 billion for the Amiral complex, a world-scale petrochemicals facility expansion at the Saudi Aramco Total Refining and Petrochemical Company (SATORP) refinery in Jubail, Saudi Arabia.

The new complex, to be owned and operated by SATORP, will house one of the largest mixed-load steam crackers in the region, with a capacity to produce 1.65 million tonnes per annum of ethylene and other industrial gases. The project will enable SATORP to help advance Aramco’s liquids-to-chemicals strategy with expected commercial operation in 2027.

• Saudi Aramco Power Company (SAPCO), a wholly-owned subsidiary of Aramco, entered into a consortium with Water and Electricity Holding Company (Badeel), a wholly-owned company of the Public Investment Fund (PIF), and ACWA Power Company for the development of the Al Shuaibah 1 and Al Shuaibah 2 photovoltaic solar (PV) projects.

The $2.2-billion projects, located in the Makkah province, will have a combined capacity of 2.66 GW. These are part of Aramco’s intention to invest in 12 GW of solar and wind energy by 2030 in support of the Kingdom’s National Renewable Energy Program.

• Aramco completed its strategic acquisition of a 10 per cent interest in China’s Rongsheng Petrochemical Company for $3.4 billion.

Under a long-term sales agreement, Aramco will supply up to 480,000 bpd of crude oil to Rongsheng Petrochemical’s affiliate, Zhejiang Petroleum and Chemical Company, which operates one of the largest integrated refining and chemicals complex in China with a capacity to process 800,000 bpd of crude oil and to produce 4.2 million metric tonnes of ethylene per year.

The acquisition aligns with Aramco’s strategic goal to enhance its downstream business in high-growth geographies and advance its liquids-to-chemicals strategy;

• Aramco delivered three shipments of accredited, lower-carbon ammonia during Q2 through its affiliates Aramco Trading Company and SABIC Agri-Nutrients. These shipments align with the company’s strategy of developing lower-carbon products and solutions, and represent the supply of lower-carbon ammonia for fertiliser production and power generation in markets such as India, Japan and Taiwan.

SUSTAINABLE PRODUCTS

• Aramco, TotalEnergies, and SABIC successfully converted oil derived from plastic waste into ISCC+ certified circular polymers for the first time in the region. Through the process, end-of-life plastics including non-sorted plastics are converted into plastic waste derived oil, which is then used as feedstock to produce certified circular polymers.

SATORP, Aramco’s Ju’aymah NGL Fractionation facility, and PETROKEMYA, are the three industrial plants involved in the process, and each received ISCC+ certification to assure transparency and traceability of the recycled origin of the feedstock and products.

The project illustrates the importance of the petrochemical sector in creating more sustainable products and solutions, and aims to pave the way for the creation of a domestic value chain for the advanced recycling of plastics to circular polymers in the Kingdom.

Also, Aramco expects to derive a number of valuable feedstocks for the growing downstream petrochemicals industry from the Jafurah unconventional gas field. By 2030, the facility is predicted to generate over 420 million scfd of ethane and around 630,000 barrels of NGLs and condensates per day, Aramco said.

To help drive Aramco’s long-term strategy across its global portfolio and value chain, it has appointed Nasir Al Naimi as president of its upstream business and Mohammed Al Qahtani as President of its downstream business.

These newly created roles demonstrate Aramco’s emphasis on its upstream and downstream businesses, and will help drive operational and financial performance in support of the company’s upstream capacity growth and downstream expansion.

Aramco believes demand for oil, gas, and chemicals will remain strong over the medium- to long-term.

According to Nasser: 'At Aramco, our mid to long-term view remains unchanged. With a recovery anticipated in the broader global economy, along with increased activity in the aviation sector, ongoing investments in energy projects will be necessary to safeguard energy security.'