A rendition of Stratos, the world’s largest commercial scale DAC plant. Source, 1PointFive

A rendition of Stratos, the world’s largest commercial scale DAC plant. Source, 1PointFive

CCS could reduce emissions but it faces challenges including high scale-up cost, leakage of sequestered carbon, seismic activity and accidents during transportation

The ability to scale up carbon capture technology could play a role in helping keep global warming below 1.5 deg C.

Two significant projects coming online – and insured by Allianz Commercial – show the potential of what may be an important transition technology towards net-zero.

In the foreground, five spades are rammed into a stark, barren plain. In the distance, but framed in the center of the image, is earth-moving equipment to reinforce that this occasion is a groundbreaking ceremony.

The photograph and accompanying article in The Economist in May this year, describes Notrees, an aptly named place in a remote, dusty corner of Texas, the US. Stratos, the world’s largest commercial scale ‘direct air capture’ (DAC) plant is being constructed near there.

Owned by 1PointFive, a subsidiary of Occidental, Stratos will use technology developed by Carbon Engineering, a Canadian startup backed by Bill Gates, to suck carbon dioxide from the air, concentrate it and inject it into geologic formations deep below ground.

When fully operational in 2025, it is expected to capture up to 500,000 metric tons of CO2 annually, sequestering it permanently.

1PointFive is selling carbon dioxide removal (CDR) credits to companies wanting to remove their emissions on a per-ton basis.

Apart from sequestering, the captured carbon can also be used in plastics, concrete, net-zero fuels or biofuels, adding fizz to drinks and spurring plant growth in greenhouses.

BURNING THROUGH THE CLIMATE BUDGET

Carbon dioxide removal (CDR) technologies have long been seen as a tool to tackle climate chaos, but the potential was largely theoretical.

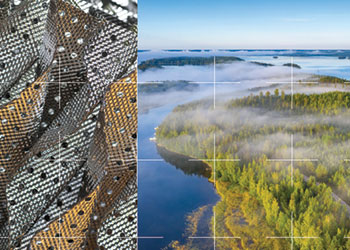

Two projects at Sleipner and Snohvit off the coast of Norway have been capturing and safely storing millions of tons of CO2 for 27 years and 15 years, respectively, but overall deployment has been slow to take off.

However, this has changed as the urgency of climate action has gathered pace.

In 2021, Orca, a large-scale DAC and storage plant in Hellisheidi, Iceland, entered operations, becoming the first of a new generation of facilities based on newer, cheaper technologies.

Although small (Orca only currently captures about 4,000 tons of CO2 annually), the Icelandic plant showed the potential. Since then, there has been a rush of planned CDR projects.

'Let’s be clear – CDR alone will not save the planet. It remains more effective never to emit CO2 than to try to suck the particles out of the atmosphere after the fact,' says Steffen Halscheidt, Global Practice Group Leader, Oil & Gas at Allianz Commercial.

'However, this is not always practical in a world where we need steel and concrete and where people still want to fly and build and heat their homes. CO2 is unlikely to be dislodged from industrial processes any time soon, so carbon mitigation is essential if we are to reign in climate change.'

The knife edge upon which the world is poised is captured in the ‘carbon budget’. This refers to the maximum amount of CO2 that can still be emitted while having a chance to limit warming to 1.5 deg C by the end of the century compared to pre-industrial levels.

If average global temperatures rise above 1.5 deg C, it is expected that the natural systems that sustain us will push past a dangerous turning point.

According to one estimate in the UN-backed Intergovernmental Panel on Climate Change’s (IPCC) recent review of climate science (AR6), the world can only emit 300 gigatons (Gt) more from January 1, 2020, for a high likelihood of limiting warming to 1.5 deg C. As we currently emit about 40 Gt CO2 annually, the remaining budget could be burnt by about 2027.

HELPING TO CREATE BREATHING SPACE

Enter CDR: In the Sixth Assessment Report (AR6), the IPCC found that capturing and storing CO2, though expensive, might play a role in keeping global temperatures within safe bounds.

The hope is that removing carbon from the atmosphere will provide breathing space to decarbonise heavy-polluting sectors.

Carbon capture has also been ranked as one of the top-10 transformative technologies to come by broker Aon.

'Reducing emissions is fundamental, but we need carbon removal to help get to net-zero and then to net negative emissions,' explains Halscheidt.

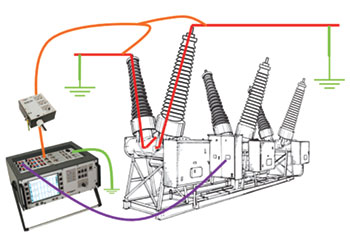

Apart from Stratos, where Allianz Commercial is co-leading the insurance programme for the construction phase, Allianz Commercial is also involved with Northern Lights, a first-of-its kind carbon capture and storage (CCS) project in Norway.

These are two of around 200 carbon-sequestration projects now in operation or in development around the world, according to the Global CCS Institute, a think tank that promotes carbon capture.

A joint venture of Shell, Total Energies and Equinor, supported by the Norwegian government, Northern Lights is the first cross-border project to offer European industrial companies a solution for safely and permanently storing their CO2 emissions.

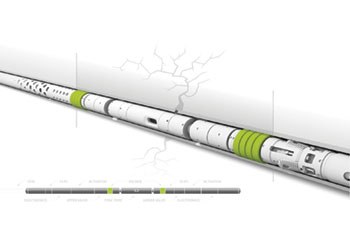

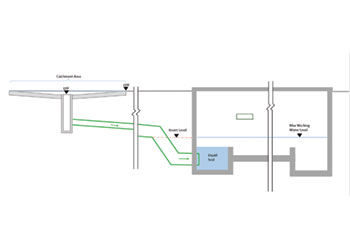

Whereas Stratos sucks CO2 from the air, Northern Lights collects it from industrial processes.

Northern Lights will transport liquefied CO2 from European industrial companies and bury it about 2,600 m below the seabed, off Oygarden in the North Sea.

Allianz Commercial is the lead insurer of the construction of the carbon-receiving terminal and the offshore storage solution.

Commercial contracts that have already been signed include with Yara Sluiskil, a Dutch producer of nitrogen fertilisers and industrial chemicals.

From 2025, 800,000 metric tons of CO2 per year will be shipped from the Netherlands alone. Northern Lights believes the annual capacity could be five million tons by 2026.

CHALLENGES AND RISKS

The boom in carbon removal cannot come fast enough. It is estimated that the world needs to remove up to 1,000 gigatons of CO2 from the atmosphere by the end of the century to keep the world livable.

'Growing carbon removal in line with current estimates requires an urgent, massive scale-up in the next decade,' says Halscheidt.

'Government policy must be met with private capital to unlock the full potential of CCS and limit global warming to 1.5 deg C to avoid the most catastrophic impacts of climate change.'

As well as insurance coverage, Allianz currently provides finance to such projects.

There are reasons to be optimistic; the infant industry is growing fast. In 2019, the capacity of CCS facilities worldwide was 85 million metric tons per year.

By 2022, it had already reached over 240 million metric tons, with a growing crop of new projects in the pipeline around the world.

Government support is also helping get the industry off the ground. Some $251 billion of the dollars earmarked recently by the Biden administration in the US for climate action is targeted at carbon capture. The EU’s response, the NextGenerationEU, is also likely to promote carbon removal, too.

'This is a rapidly developing industry,' Halscheidt comments. 'The underpinning technology has been around since the 1970s, but factors are combining now to see growth accelerate, and it is being driven by smart, young, dedicated people who understand the future our planet faces and are determined to make a difference.'

'Of course, as with any nascent industry, alongside the benefits that CCS could bring in reducing the amount of CO2 emitted into the atmosphere, there are also a number of challenges that will need addressing as this sector develops,' explains Funke Adeosun, Global Transition Solutions Director at Allianz Commercial.

Adeosun adds: 'These include the high cost of scaling-up facilities and implementation, uncertainty about the long-term ability of some countries and sites to sequester carbon without significant leakage and the potential for seismic activity caused by underground injection of CO2. In addition, while the risk of accident during transportation is relatively low, leaks could still occur. There is also the potential that some companies’ enthusiasm for carbon removal may be a tool for improving their reputations in the eyes of increasingly-climate conscious consumers while continuing with their emissions.'

From a risk consulting and underwriting perspective, the potential risks are well known, even if the industry is relatively new, explains Nicholas Pilz, a Senior Energy and Construction Risk Consultant with Allianz Commercial in North America.

For a construction insurance project, such as Allianz Commercial’s involvement, this would typically involve the risk of damage during erection/installation of heavy plant and equipment, potentially also resulting in delays to the project.

Then there is also structure/collapse risk (for example, collapse of a building frame/structure which could occur during erection for a number of reasons), as well as equipment accident during delivery risk (for example, specialist processing skids must be transported to project sites and can be damaged during delivery and offloading). Not forgetting, the testing and commissioning of various systems including gas fire boilers for fire/explosion risk.

Pilz, who has been deeply involved in the Stratos project, explains that the technology to be deployed in the DAC plant is a combination of proven industrial processes and equipment, commonly used at large scale in other industries, such as the pulp and paper industry, mitigating risks associated with scaling up the technology (a pilot plant, albeit on a smaller scale, has been in operation for years).

'Many learnings from the pilot plant have been incorporated into the design of this project,' says Pilz.

'For me, what is exciting is that they are developing a project that is scalable and repeatable, so this project and others can ramp up quickly.'

'For us, as Allianz Commercial, it is great for us to develop a long-term partnership with companies involved in such projects as they help our world transition from one of fossil fuels to one with a very low use of carbon fossil fuels compensated by CCS,' Halscheidt concludes.